Fact: Volatility and uncertainty are unavoidable characteristics of Bitcoin, indeed of any market. No one can be certain or even confident.

What will happen tomorrow? Surprises happen. Shocks happen. Markets are sometimes dull. High and low volatility are unavoidable features of trading.

How do we cope with volatility if it is always a lurking danger?

When we are faced with high volatility, we must be ready for it. Not only must we be prepared for it, but we must also be ready for the challenges to our rationality that come with it.

How volatile is Bitcoin?

Volatility is a measure of how much the price of an asset loses over time. High volatility means that a security is risky to hold. Its value can go up or down substantially.

The more volatile a security, the more people want to limit their exposure to it, either simply by not holding it, deleveraging, or hedging the risk. If Bitcoin volatility decreases, the cost of converting into and out of Bitcoin will decrease as well.

But having no volatility is not a desirable circumstance. Without movement, there is no opportunity for profit. Traders avoid securities that are not moving. They head for risk because that is where opportunity lays.

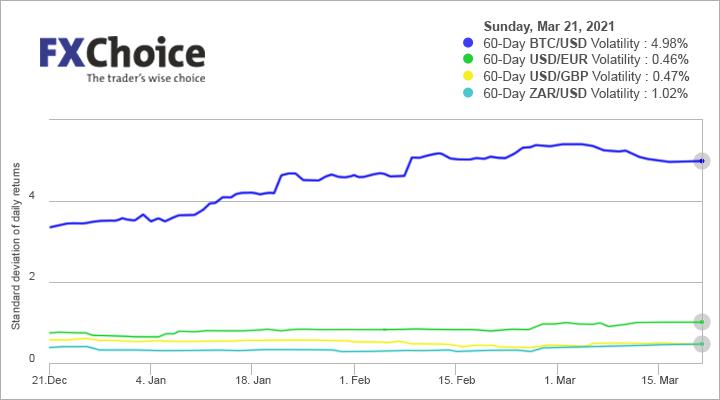

In the chart above, we can see that Bitcoin is substantially more volatile than currencies. Even the volatile Rand is comparatively quiet compared to noisy Bitcoin. Even Gold averages only around 1.2% compared to Bitcoin’s near 5%.

Coping with volatility

1. Your personal financial buffer and risk tolerance

Losses in trading and investing are inevitable. Before we start the journey, we need to ensure that we are not risking more than we can afford to lose or even leave us with no financial buffer. If you invest every penny you have and lose, you will have lost every penny you have.

We need a buffer of cash for real life emergencies. Everyone faces tough times, and everyone should prepare for them. But how much is enough of a buffer?

How big should your financial buffer be is a difficult question to answer clearly. It depends on your age and aspirations. If you are saving for the deposit to buy a house, you may need to put all your cash into that. If you are preparing for retirement, you will probably not want to risk your life savings at this point in your life.

The other question you should have answered before you start investing or trading is how comfortable are you with volatility itself? The US stock market’s inflation-adjusted return has been about 7% per annum, but it is volatile.

Seven percent sounds excellent, but do you have the stomach to sit through the 2007/8 Global Financial crisis or even the one-month sell-off seen in February last year? If you cannot take the heat, don’t go close to the fire.

2. Diversify Your Risk

Don’t become a Bitcoin specialist. Diversify your trading or investing as much as you can. Even Gold has offered some risk-reducing diversification. It holds up well whenever Bitcoin wobbles.

Gold has not returned as much as Bitcoin lately, but a portfolio containing Bitcoin and Gold has been less risky than a portfolio of Bitcoin alone. Consider other assets such as the stock market or commodities.

An announcement of a ban on trading cryptos in a country has no impact on the oil price. The shocking news will have a lot less impact on your holding if it is not made up only of cryptos. Your ideal portfolio would be made up of non-correlating assets.

3. Be Calm and Avoid Irrationality

Volatile markets, like Bitcoin, offer an opportunity for profits but also potential disaster. But maybe the swings have exaggerated your sensitivity?

Perhaps a look at the longer-term chart will show the trend is more important. Maybe, what you feel – racing pulse, your adrenaline pumping – is only the effect of the herd. The noise of the internet has made you deaf to a simple message.

Slow your breathing, take stock, avoid panic at all costs, recognize your irrationalities, control fear. Look for the opportunities and try to concentrate on your analysis skills.

Fear is the enemy of clear thinking.

4. Do not overtrade

A strong urge in times of high volatility is to react to each move. Diving in and out of the markets. It is, after all, as easy as clicking your mouse to take a profit or jump out of a position.

This is very destructive. It will chew up your money and put yourself under more psychological pressure – one of the profit’s strongest enemies.

5. You cannot control Bitcoin

Remember, you are a guest in this enormous marketplace. It owes you nothing. There will be news you that the market did not expect. You will, on occasion, be put into a state of shock.

You may become fixated by your P&L or may stick your head in the sand and deny your losses to yourself. You can become obsessed and fixated or frozen with fear. You cannot will Bitcoin to move the way you want.

Accept it. Be calm and avoid irrationality. The fear of being out of control is almost always caused by overtrading. Pay respect to Bitcoin’s volatility. Try to be aware of the market rather than emotionally obsessed.

Become a relaxed robot

Be a robot in the sense of using your skills to analyze coldly and to trade the market.

A relaxed robot tests its strategies first on a demo account.

You invest time and money learning how to plan and trade. Do this.Don’t react to the inevitable excitement of the fast swings. Ignore the shouting on the internet.

All this is highly destructive for your capital. Be cold and rational.

Summary

Volatility and uncertainty are unavoidable features of Bitcoin and other securities.

Before you trade, it is essential to put aside a buffer of cash for emergencies and to set the level of risk you are willing to tolerate.

Diversification is a good way of reducing Bitcoin’s risks but will not eliminate volatility.

Before panicking in the face of extreme volatility, you should have a heightened awareness of your psychology.

Resist the temptation to buy, sell, buy, sell and accept what we can and can’t control in Bitcoin or any other security.

Hot

No comment on record. Start new comment.