Renters vs. Homeowners

Introduction

The COVID-19 recession hit the lowest-paid sectors of the economy the hardest, resulting in lower-income Americans losing their jobs and income at higher rates.1,2,3 Renters, who tend to have lower incomes than homeowners, are more likely to have been impacted negatively by the economic shocks of the pandemic. While the Coronavirus Aid, Relief, and Economic Security (CARES) Act that passed in March 2020 provided one year of easily attainable mortgage forbearance for most homeowners4, renters did not receive any form of federally-provided rent relief until the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 passed on December 27, 2020. This Act provided $25 billion in rental assistance through the Emergency Rental Assistance Program to cover current or past due balances.5,6 In the interim, renters benefited from the same government supports that were available to all, such as expanded unemployment insurance (UI) benefits, and Economic Impact Payment (EIP) stimulus checks. There was also a complicated patchwork of eviction moratoria originating from federal, state, and local governments with various expiration dates that were often extended at the last minute as well as rental assistance in certain specific localities.7

With this backdrop, we examine income and savings patterns for renters and mortgages holders during the pandemic and ask: is there evidence that renters needed more assistance than they received?

We find evidence that renters indeed needed more of a financial safety net than was available during the pandemic. The renters we analyze are much more affluent than typical renters and even among this population, they were more likely than mortgage holders to have lost their job and suffered large swings in their labor income, including large drops. Even with unusually generous UI benefits and stimulus checks, more than one in five renters experienced a greater than 10 percent drop in their total income. These income swings were more negative relative to the pre-COVID period. Finally, renters not only had lower incomes than mortgage holders, they also had much less of a savings buffer entering the pandemic. While more generous UI benefits and stimulus checks dramatically boosted their savings, they had depleted most of the additional savings by the end of November, their position relative to mortgage holders did not improve significantly, and nearly one in four renters saw their savings decrease in 2020.

Data and Analytics

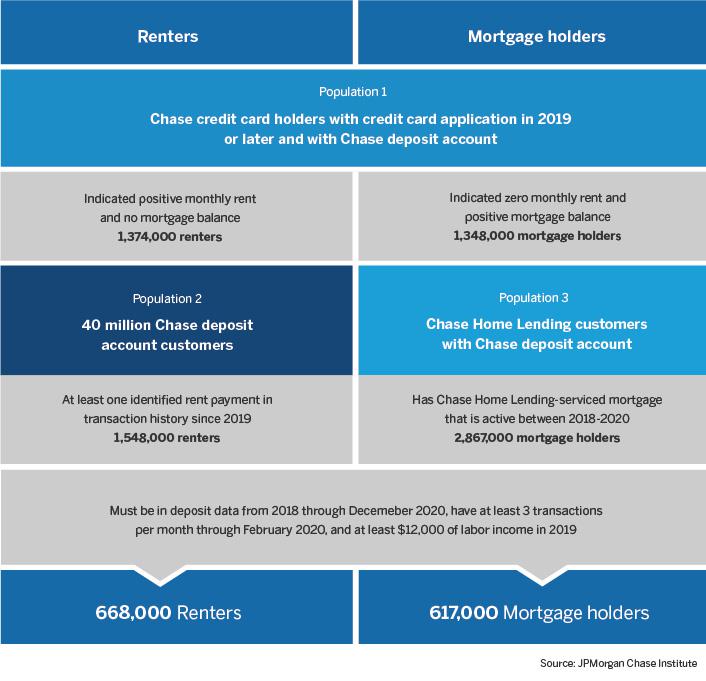

Using account and transaction-level administrative data on deposit accounts, credit cards, and mortgages, we find samples of households that we can confidently categorize as either renters or mortgage holders.8 The first population consists of credit card applicants from 2019 onwards with deposit accounts who indicated that they either had a positive monthly rent and no mortgage balance (renters) or no rent and a positive mortgage balance (mortgage holders).9 Our sample of renters also includes deposit account customers who we can see making as least one rent payment10 since January 2019. Finally, we use Chase mortgage customers from 2019 onwards who also have a deposit account to round out our sample of mortgage holders.

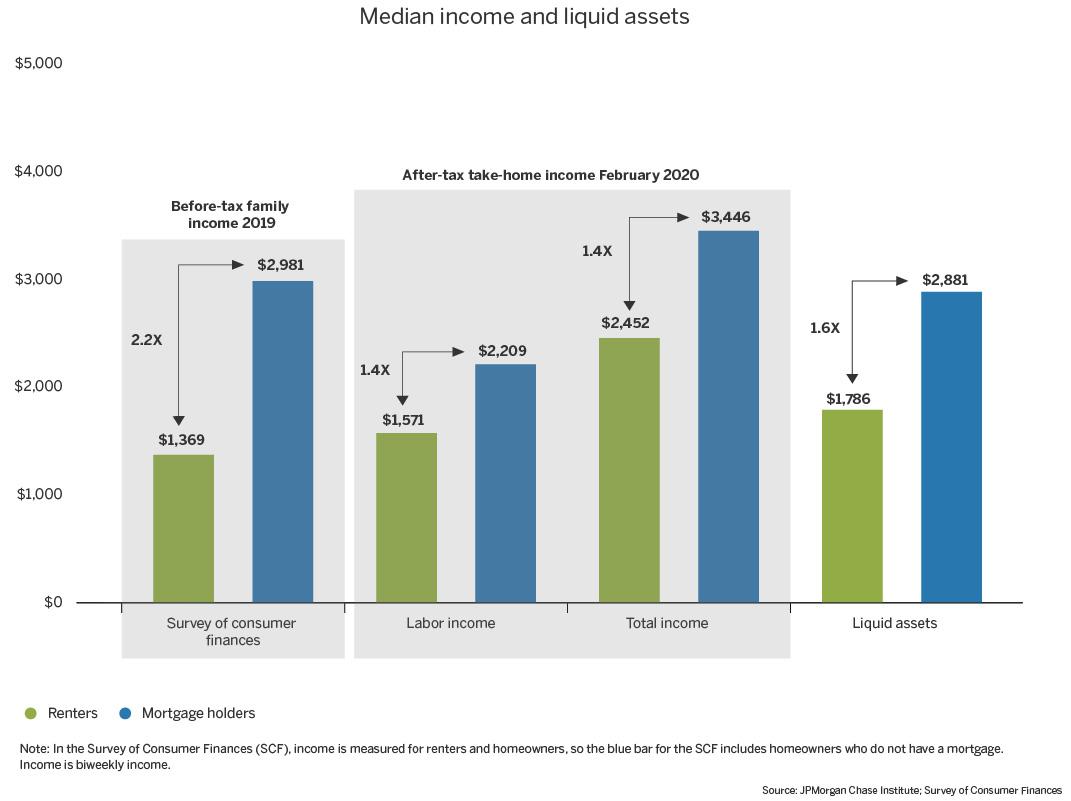

The Federal Reserve Bank of Boston’s Bill Payment Experiment and the Survey of Consumer Payment Choice data show that “the dominant methods for paying rent are cash (22 percent), check (42 percent), and money order (16 percent). Electronic methods are still rarely used, at 8 percent for bank account number payment and 7 percent for online banking bill payment, and less than 2 percent for debit and credit cards.”11 Based on our selection criteria, renters in our sample by definition either have a Chase credit card or pay their rent online. We are therefore less likely to be able to identify several segments of the renter population—for example, families that pay rent using cash, checks, or money orders or those receiving rental assistance through the Housing Choice Voucher Program, which is typically paid directly to the landlord. Therefore, even though the broader deposit account population is fairly representative of the banked population, the limited ways we have to identify renters causes the renters in our sample to have income levels that are significantly higher than typical renters. Figure 1 shows that, after accounting for taxes, the median renter in our sample may well have an income level that is up to twice as high as the median renter in the Survey of Consumer Finances (SCF).12 Another way to quantify this is that in our data, mortgage holders have income levels that are 1.4 times those for renters whereas in the SCF, homeowners have incomes that are 2.2 times those of renters.13 Given the pandemic’s disproportionate effect on lower income households, our results likely represent a “best case scenario” for renters relative to mortgage holders.

Despite the significant upward income skew in our rental sample, this research provides an important window into the financial lives of renters during the pandemic. There are very few data sources that provide a comprehensive and timely view of the labor market outcomes of renters. While surveys such as the Census Pulse Survey provided a self-reported view of renters’ past rent payments and their confidence in terms of making future payments, they do not allow for precise measures of the size of income changes and savings levels. Also, some of the surveys and other administrative rent payment datasets lack the longitudinal ability to provide a year-over-year view (Census Pulse Survey, Avail).

Figure 1: Renters have significantly lower labor income, total income, and liquid assets than mortgage holders.

Reprinted from JP Morgan,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.