Another week in 2021, another few historic moments for Bitcoin. Last week saw a $1.5 billion investment in BTC by Tesla and Mastercard’s announcement that it would be accepting Bitcoin on its network. This week, BTC crossed through the $50,000 mark for the first time, and held levels above $50K for most of the week.

The move past $50K has brought with it much media attention: Bitcoin, which was already riding high in the headlines because of the Tesla announcement, has stayed in the center of attention–although, not all of that attention has been positive.

Bitcoin’s rally continues–and so do its PR problems

For example, Tesla chief executive Elon Musk appeared to put some distance between himself and Bitcoin in a series of Tweets on Thursday night. In response to a Bloomberg interview with Binance chief executive Changpeng Zhao, Musk wrote that “Bitcoin is almost as bs as fiat money. The key word is ‘almost’.”

“Tesla’s action is not directly reflective of my opinion. Having some Bitcoin, which is simply a less dumb form of liquidity than cash, is adventurous enough for an S&P500 company,” Musk explained in another tweet. “[…]

However, when fiat currency has negative real interest, only a fool wouldn’t look elsewhere.”

Additionally, Treasury Secretary Janet Yellen once again raised her grievances with BTC on Thursday, telling CNBC that it is a “highly speculative asset,” citing BTC’s volatility over the past several years.

Yellen also referenced Bitcoin’s association with illegal activities: “I think it’s important to make sure that it is not used as a vehicle for elicit transactions and that there’s investor protection,” she said.

However, the Treasury Secretary did say that she believes that proper regulation could solve some of Bitcoin’s problems: “regulating institutions that deal in Bitcoin, making sure that they adhere to their regulatory responsibilities, I think is certainly important.”

In addition to the comments by Elon Musk and Janet Yellen, Bitcoin has also had to once again face up to its carbon footprint problem. It seems that every time Bitcoin’s price captures media attention in a big way, its carbon footprint inevitably follows: headlines comparing Bitcoin’s energy consumption to that of New Zealand, Switzerland, and the Netherlands have populated the cryptosphere for several weeks.

In an interview with Finance Magnates earlier this week, Argo chief executive Peter Wall commented that this is a problem that the Bitcoin community needs to solve: “It doesn’t make sense to be burning coal to make Bitcoin. That’s just not cool,” he said. “The planet has enough problems as it is [without] adding carbon to the atmosphere to create Bitcoin.”

Fields of green across the board–for now

Still, it may be for Bitcoin that there’s no such thing as bad publicly: in spite of the pieces of negative commentary that have been raised against Bitcoin this week, Bitcoin was stronger than ever. At press time, BTC was sitting at roughly $52,800, and showed no signs of backing down.

While BTC may have taken up most of the media spotlight over the past several weeks, it hasn’t been the only cryptocurrency that performed well this week. At press time, Ether (ETH) was sitting at $1930, just $20 short of its latest all-time high; Binance Coin (BNB) had shot up over 40 percent over the last 24 hours, bringing its value to $259.39 at press time. Bitcoin and ETH were both up roughly 10% over the course of the week; BNB had risen a whopping 100%.

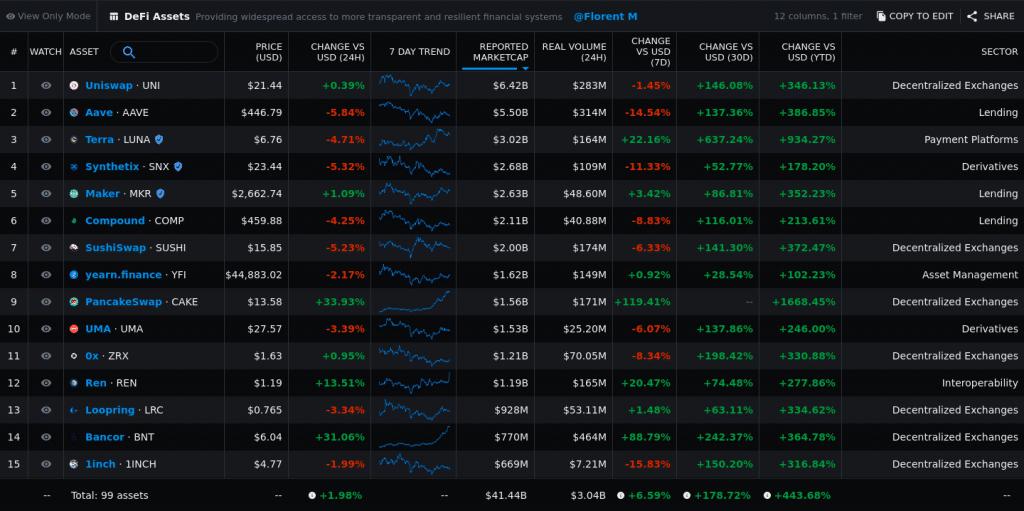

Additionally, a number of DeFi assets were performing rather well at press time. According to data from Messari, a number of tokens associated with DeFi projects were up in double-digit or triple-digit percentages over the course of the last seven days; at least 30 of 80 DeFi assets showed gains over the last 24-hour period; of those that showed drops, the worst was less than 25 percent.

A number of analysts have pointed out that when Bitcoin is doing well, DeFi tokens and other altcoins tend to follow: that Bitcoin has some sort of a “run-off” effect. Do Kwon, Co-Founder and CEO of Terraform Labs (TFL), explained the phenomenon to Finance Magnates last week in this way: “as the flagship cryptocurrency, Bitcoin tends to lead while the rest of the industry follows.

In other words, crypto markets seem to have entered a sort of halcyon period: Bitcoin is booming, and altcoins–which are already doing quite well–may soon follow.

However, as well as know, nothing gold can stay. How did we get here–and what’s next?

The channels for institutional BTC investment are more accessible than ever before

John Wu, President of Ava Labs, pointed out to Finance Magnates that the influx of cash into Bitcoin seems to be flowing in from institutional investors. After Microstrategy led the charge with a massive investment last August, a number of major institutions have publicly taken holdings in BTC–Square and Stone Ridge, to name just a few.

Additionally, Craig Kirsner, MBA, and President of Stuart Estate Planning Wealth Advisors, pointed out to Finance Magnates that institutions have also recently been very active with other investing channels related to Bitcoin–specifically, Bitcoin futures markets.

Kirsner explained that the Chicago Mercantile Exchange (CME) “has reported volume spikes” in its BTC futures offerings. Additionally, “open interest for large institutional holders in the bitcoin futures contracts [is] at an all-time high. You can also invest in BTC on the publicly traded markets by buying GBTC (the Grayscale Bitcoin Trust.)”

Institutional cash in Bitcoin could eventually roll into altcoin markets

However, Tesla’s public investment in Bitcoin last week may have been something of a turning point for BTC: the first time a major publicly-traded company made a sizeable, public investment in BTC.

Therefore, Wu believes that the Bitcoin world is at some kind of a turning point: “institutions are just now turning the corner on accepting bitcoin as a high-quality, investable asset, and I suspect bitcoin will continue to be the first asset in every institution’s foray into crypto,” he said. “Bitcoin will still be the main gateway for most, fulfilling the ‘digital gold’ and ‘store of value’ role.”

But just as is often the case with retail investors, Bitcoin’s “run-off” effect could also apply to some of the institutional investors that make their way into Bitcoin.

“I hope [Bitcoin] will open their eyes to projects that are just outside the bitcoin frame,” Wu told Finance Magnates.

“There has been massive progress and pockets of true innovation across the ecosystem with networks enabling entirely new use cases like decentralized finance to flourish. It will also separate the winning platforms from the losers as investors looking to find the next BTC or ETH must examine each project individually, rather than assessing them as a collective.”

”I think that Bitcoin will hit $55,000 and then pull back sharply.”

However, while altcoins will likely follow BTC as it continues to gain higher levels, they will also likely follow Bitcoin when it begins to lose steam. While it’s not clear when this might happen, analysts seem to agree that it’s an inevitability.

But when could a pullback happen, and how low could it go? “From a technical analysis standpoint, I think that BTC will hit $55,000 then pull back sharply,” Craig Kirsner told Finance Magnates, adding that “this pullback should be a good time to buy if you haven’t bought it before.”

Michael Calce, Advisor for TrustSwap, told Finance Magnates that a pullback in the price of Bitcoin could erase some of the FOMO-induced gains that may have come as a result of the latest media cycle around the Bitcoin-related Tesla and Mastercard announcements. In other words, those who bought into Bitcoin with the expectation that it will continue to appreciate in a linear fashion may exit the market.

“The worst-case scenario for a retrace will make people upset about losses and induce a panic to sell,” Calce said. “However, sometimes retracing is healthy, especially when a coin can rally back to its previous marker or even higher.”

”People are starting to trust Bitcoin more than before.”

However, even if a pullback is in the cards for Bitcoin in the near future, a number of analysts agree that the narrative of Bitcoin as a store-of-value is gaining strength. As such, Bitcoin is developing fundamental value.

“I do think that Bitcoin can be considered a ‘safe-haven’ or ‘store-of-value’ asset,” Craig Kirsner told Finance Magnates. “There is a finite amount of it and it is a true growing technology.” Therefore, “I do believe crypto adoption will increase in 2021 amongst both institutional investors and average investors,” he said.

Therefore, even if there is a pullback at $55K, it may not be long before BTC reaches back to $55,000 and beyond. Michael Calce told Finance Magnates that “as we see more people and companies get involved with Bitcoin, it will organically rise and surpass $55K.”

“[…] Trust is always the main component and people are starting to trust Bitcoin more than before,” Calce explained.

Hot

No comment on record. Start new comment.