US maintains its Goldilocks scenario

Risk has rallied and USD sold off after a weak NFP print (despite more or less in line with expectations, but downward revisions to previous months) and moves towards another US fiscal stimulus package. The NFP print was weak enough to keep the US in a Goldilocks scenario where Monetary and Fiscal policy can remain loose.

The Covid news over the weekend was focused on the study which showed that the AstraZeneca vaccine fails to prevent mild and moderate Covid from the South African strain of the virus. The study was a small sample and also showed that no severe cases resulting in hospitalization or death.

Another important week for US yields as there will be a record amount of treasury auctions as well as inflation data on Wednesday, a strong print could reignite taper concerns and lead to USD higher and risk off. We will also hear from Powell on Wednesday

Canada employment was also weak with -213k net change and the unemployment rate jumping up to 9.4%. All of the loss of jobs came from Part-Time.

Yellen in the news over the weekend pushing for a large fiscal package saying that the US could reach full employment next year if Congress passes Joe Biden’s $1.9tn stimulus package which should also support risk sentiment.

Any risk off views are best expressed via short CAD (due to weak employment last week) or short ZAR due to the vaccine resistance virus variant there.

CrossJPY does feel a bit overextended here even with the risk on moves. CADJPY breaking fresh highs and AUDJPY approaching 81.00. Probably not wise to chase those moves here and selling CADJPY here give the weak employment data last week could make sense.

Our overview and outlook of the key trading pairs and indices is as follows

EURUSD – The Euro bulls found support at the 1.1950 level amid upbeat market mood and US stimulus optimism. Stocks have rallied sharply across the globe and printed fresh record highs on Friday, pushing the single currency back above 1.20. If momentum persists and price breaks above 1.2050, it will open doors for further strength towards 1.2170.

GBPUSD – The pound is trading back above 1.37, on its way to hit our 1.3750 target, amid the risk-on mood in equities. However, despite the diminishing COVID-19 and death tolls, the UK government authorities are worried over the variants that spread widely. As a result, annual vaccinations might be very probable. Bullish momentum remains strong today so far, a break above 1.3750 will open doors for further gains towards 1.38 and 1.3850.

USDJPY – Surging US bond yields revived the USD demand and remained supportive of the move up, despite the disappointed NFP result. The January US unemployment report strengthened the case for more US fiscal measures to support the economy. Thus, the probability of a massive US stimulus package increased further which should push the US dollar higher. However, technically speaking, it is important to note that on a daily chart the USD/JPY has not yet breached the 200-day moving average and therefore a slight correction lower to test the key support level at 105 is highly likely.

FTSE 100 – Coronavirus cases in the UK dropped by 25% last week helping push the FTSE100 firmly into positive territory amid hopes of a rapid economic recovery with stocks in London set to continue climbing higher this morning taking cue from Asia’s main markets which were buoyed by the growing pace of the vaccine roll-out and US stimulus progress. Technically speaking, the benchmark is now above the key important 200-period moving average, however, the Relative Strength Index (RSI) is pointing down suggesting a slight drop lower is highly likely before the next wave higher, with 6520 as next support level.

DOW JONES – The Dow Jones Industrial Average ended the week on a positive note on Friday after the US unemployment rate unexpectedly dropped to 6.3% from 6.7% previous. This morning, on the futures market, the Dow nudged another all-time high echoing the rally in Asian shares with Japan’s Nikkei225 surging to its highest level in over 30 years on growing optimism over the global economy after surprisingly good corporate earnings reports last week. From a technical perspective, the Relative Strength Index (RSI) is signalling overbought conditions suggesting a slight correction back to the 50-period moving average at 31050 before the bullish rally resumes.

DAX 30 – Coronavirus cases in Germany dropped to lowest levels since October 19 helping push the DAX30 index to fresh new highs as market participants now look forward to the release later today of German Industrial Production figures. Strong corporate earnings reports and progress in the distribution of vaccines have also encouraged investors to buy stocks, however, technical indicators hint for German shares to ware off slightly on profit-booking as the RSI signals overbought conditions and a key important resistance level at 14200 has not yet been breached, with 14100 coinciding with the 50-period moving average to act as support level.

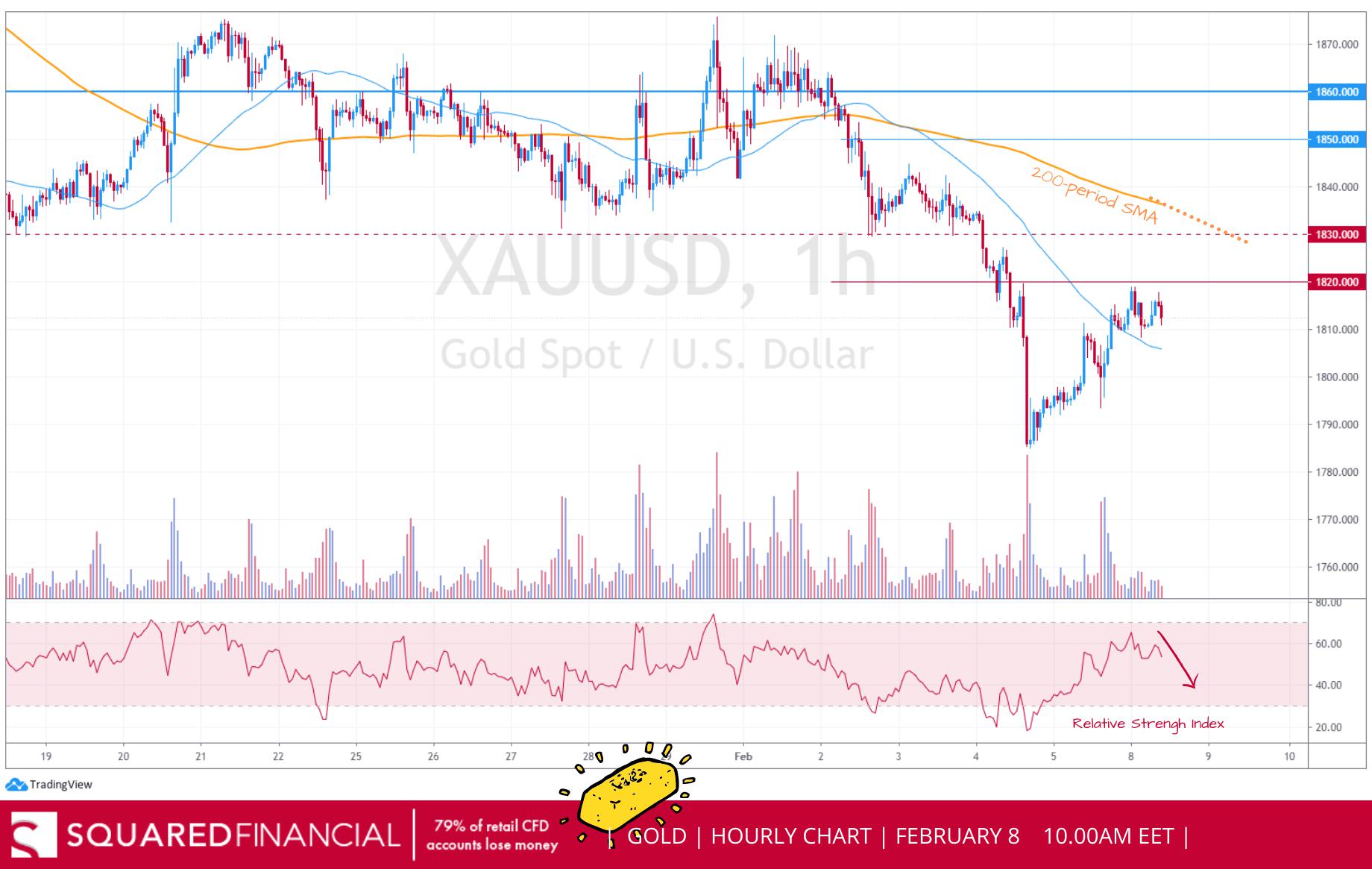

GOLD – Gold ended Friday’s session in the green after NFP data came in weaker than the upward revised consensus (Actual: 49K, Consensus: 50K revised upwards to 104K) sending the greenback lower as investors took ongoing weakness in the labor market as confirmation for further upcoming stimulus. An hourly close above 1815 resistance level will favour higher prints with 1825 and 1830 as the next closest resistance targets.

USOIL – First trading week of February all in the green for WTI Crude with Brent reaching the $60pbl mark as hopes for a faster recovery and tighter supply kept bullish momentum going strong on the black gold. Momentum indicators favour a pullback lower with $57 as closest support target, while a breach of $57.50 resistance level will favour higher prints with $58 as next resistance target.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.