Purchasing Managers' Index January Services Preview: No reason to pull back now

- Service sector to maintain its eighth month of expansion.

- Index expected to slip to 56.8 in January from 57.7.

- Markets will notice but await NFP on Friday.

Business executives in the US have been steadfast in their view to the future since the initial recovery in June from the lockdown induced economic collapse in the spring.

That optimism is expected to continue in January with the dip in the overall Purchasing Managers' Index (PMI) to 56.8 from 57.7, the New Orders Index to 55.2 from 58.6 and a rise in employment to 49.7 from 48.7. All three of these indexes were revised higher in December.

Services PMI

FXStreet

Over the past seven months the Services PMI from the Institute for Supply Management (ISM) has averaged 56.8, the best for a comparable period since April 2019.

Manufacturing PMI

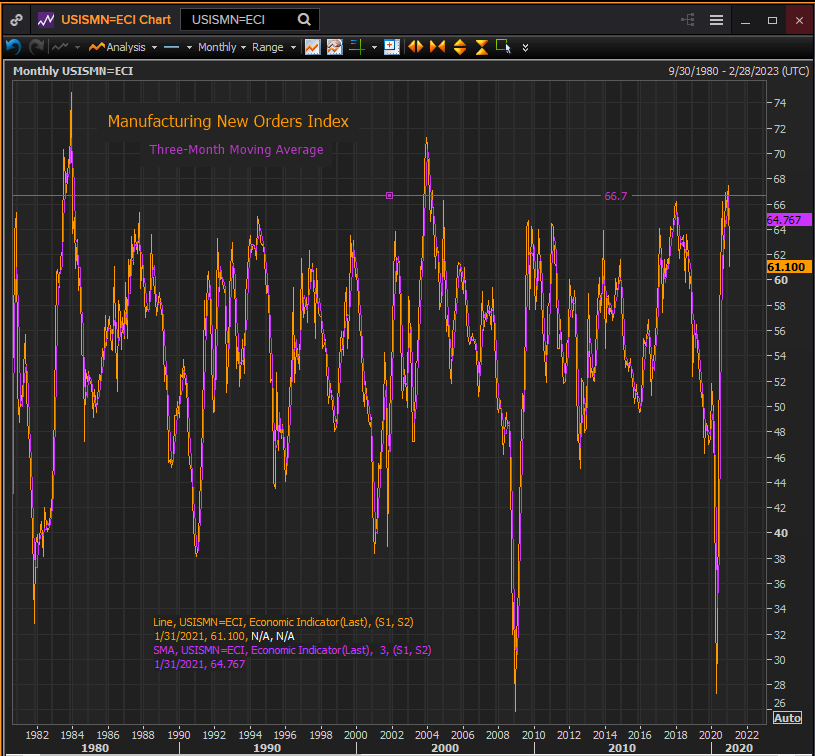

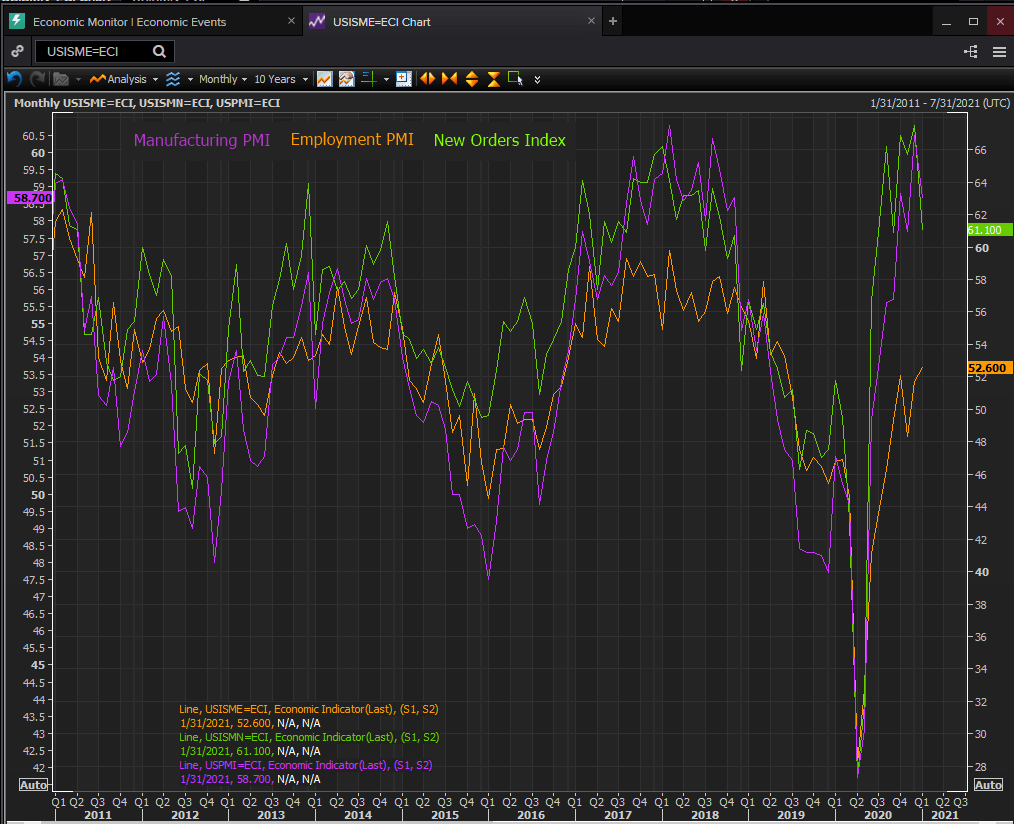

The manufacturing sector, though a minority contributor to GDP at 15%, has long been considered a leading indicator for the economy as a whole. Most factory production is a more complicated endeavor than activity in services with inputs from raw material to new machinery that require a much greater lead time and an analysis of where the economy might be in six months to a year or more.

Manufacturing PMI has consistently outperformed expectations for eight months beginning in June, beating forecasts in five of those months.

For January the overall index missed its forecast by 1.3 at 58.7. The New Orders Index slipped to 61.1 in January from 67.5, but the three-month moving average in December at 66.7 was, but for December 2003 and January and February 2004 the highest in twenty-five years.

Reuters

Only the Manufacturing Employment Index increased in January to 52.6 from 51.7 which was it best reading since June 2019.

Reuters

The Manufacturing Index was invented by ISM and has been issued continuously since 1931 with a four-year halt during the Second World War. The index is formulated with the division between contraction and expansion set at 50. All later indexes from ISM and others have followed this model.

Retail Sales and employment

Since Manufacturing PMI unexpectedly returned to expansion in June, it has maintained 50 despite the rise in unemployment claims in December and January and negative Retail Sales in the fourth quarter.

Initial Jobless claims averaged 740,500 in November, 837,500 in December and with one week to go in January the average is 867,750 with 830,000 expected for that final statistic.

Nonfarm Payrolls also reversed in December losing 140,000 jobs, the first subtraction since April.

Retail Sales which recovered so smartly from the lockdown debacle and maintained an excellent pace through the end of the third quarter, also turned south in the final three months averaging -0.73%,

Conclusion

Business executives have been anticipating the recovery for six months and more. They have kept their outlook secure through the fall and winter surge of COVID-19, now in sharp retreat.

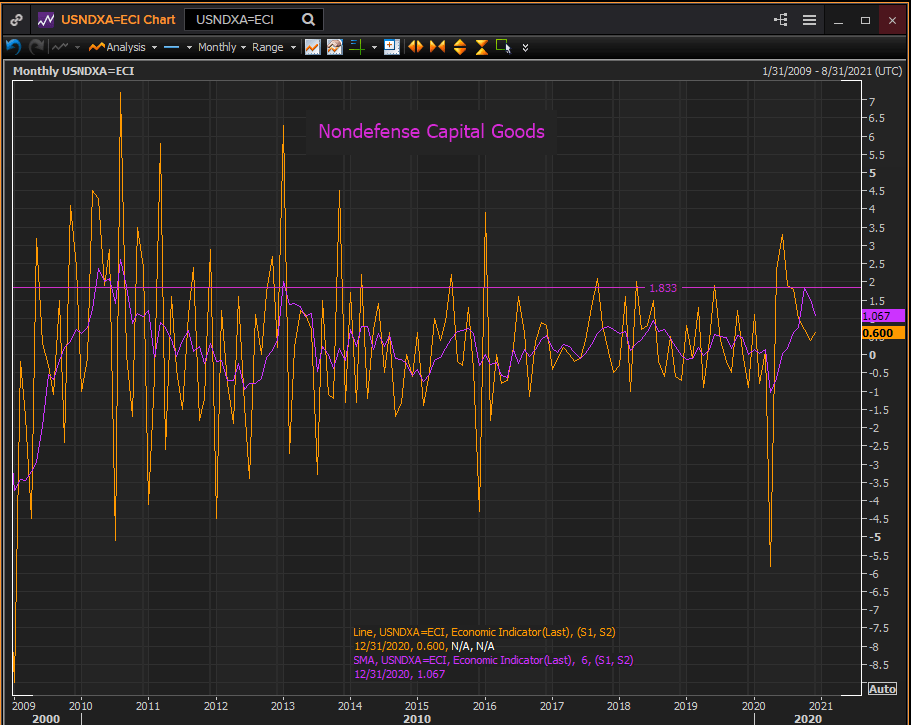

Nondefense Capital Goods ex-aircraft had the best half year to December since 2013, except for the prior months of October and November which were even better.

Reuters

Managers have not just said they are optimistic they have put their company funds in service of that view. With the pandemic on the wane they will not surrender to dismay now.

The strength of the Manufacturing and Services Indexes, in contrast to Initial claims and NFP, guarantee an interesting payroll report on Friday.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.