January flashlight for the FOMC blackout period

Executive Summary

The January 26-27 meeting of the Federal Open Market Committee (FOMC) is now elevendays away, and we have entered the blackout period when committee members refrain from public comments. Notably, this will be first meeting to occur during the Biden administration, and in keeping with schedule, the first meeting of the year also means a rotation of regional board governors as well as the addition of new Board Governor Christopher Waller. In this edition of the Flashlight for the BlackoutPeriod, we breakdown the new seating assignments and what it means for policy.

In the lead-up tothe blackout period, a number of Fed officials have been addressing the timing of the eventual dialing back of theasset purchase programs that helped the financial system function smoothly throughout the pandemic. Although we do not expect the FOMC will increase the size or the composition of its asset purchase programs at this meeting, the committee could potentially provide some guidance on the conditions that will be needed before it starts to wind down those programs. While 10-year benchmark Treasury yields rose considerably at the start of this year, short-term yields like the effective fed funds rate remain quite low. This has some market participants wondering if the Fed may eventually raisethe rate of interest it pays on excess reserves (IOER). Inthe pages ahead,we describe how the recent stimulus bill factors into the Fed’s calculus for that decision.

New Voters, Same Policy Outlook

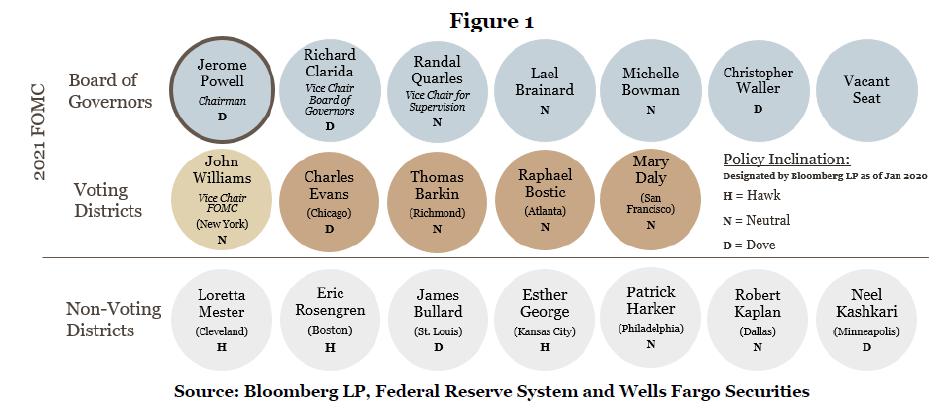

The first FOMC meeting of the year will usher in a new crop of voters (Figure 1). On net, the rotation of regional Fed presidents means one less hawk and one more centrist voter. The slight shift to the middle of the policy spectrum is likely to be reinforced by the confirmation of Christopher Waller, previously research director at the St. Louis Fed, to the Board of Governors since the FOMC’s last meeting in December.

Overall, we view the 2021 voting group as only marginally more dovish and the compositional shift as insignificant this year. Not only are there likely to be more centrists voting, but policy is not currently at a major inflection point. Based on recent statements and the December meeting minutes, FOMC members appear in widespread agreement that the current degree of accommodation will remain in place for some time. Furthermore, voting or not, all committee members have a voice at the table and are able to influence the policy debate.

With a new administration entering the White House and the Democrats controlling the Senate, it is worth discussing how the composition of the Board of Governors may evolve this year. Governors to the Federal Reserve Board are appointed by the president and confirmed by the Senate. Therefore the Biden administration should not have too much trouble filling the one remaining vacancy on the Board of Governors. A more substantial reshaping of the Board and consequently the FOMC, however, could begin late this year. Randall Quarles’ term as Vice Chair of Supervision ends in October. We suspect he will not be reappointed to that role as the Biden administration tries to put its own stamp on financial system regulation, and Quarles may well resign from hisBoard seat.1More importantly for the path of monetary policy, Jerome Powell’s term as FOMC Chair expires in February 2022. If not reappointed, he could choose to leave the Fed before his Board term expires in 2028. The Board could lose another key driver of policy around the same time with the expiration of Board of Governors Vice Chair Richard Clarida’s term in January 2022.

Download The Full Special Commentary

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.