NZD/USD drops below 0.7700 level amid pre-Georgia Senate election market turmoil

- Some position squaring appears to be at play in the market on Monday ahead of Tuesday’s crucial Senate elections in Georgia.

- The US dollar has picked up from earlier lows driving NZD/USD below the 0.7200 level.

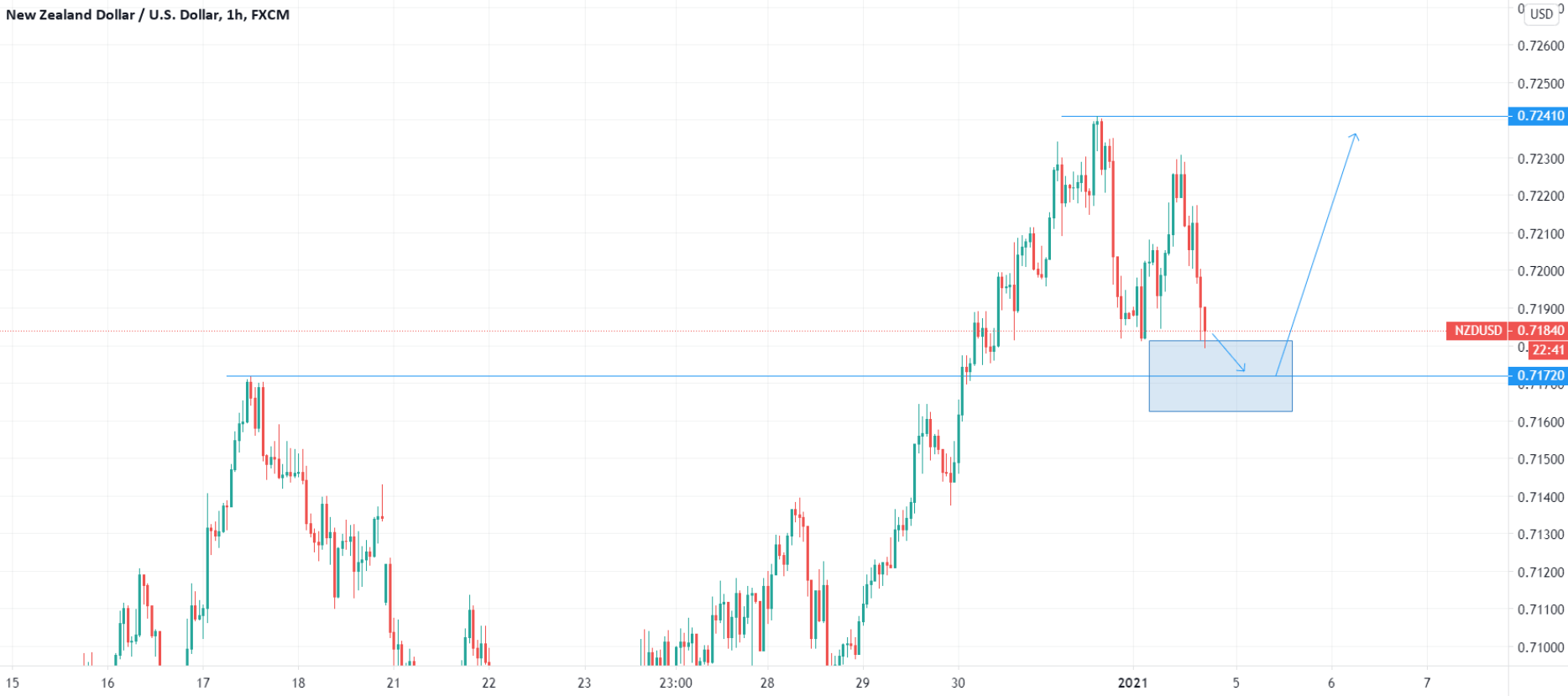

NZD/USD has dropped back from early European session highs and below the 0.7200 level again amid a pick-up in broader volatility that has seen global equity markets (S&P 500 trading down 1.1% and FTSE World now in the red) and crude oil markets (WTI now down nearly 2%) sell-off and USD pick up from lows. At present, the pair trades marginally lower on the day as it tests support at its early Asia Pacific session lows in the low 0.7180s.

Kiwi eyes international themes to drive the week

Amid a lack of any key economic or political events of note coming out of New Zealand this week, kiwi traders will have their eyes firmly peeled on global affairs. Thus, as seems already to be the case today, the market’s broader appetite for risk and US dollars will remain in the driving seat of NZD/USD price action.

Markets have adopted something of a risk-off tone in recent trade amid what appears to be a combination of 1) position adjustment (taking some risk off the table) ahead of Tuesday’s Georgia Senate runoff and special elections and 2) some concern about tightening of Covid-19 lockdowns in Europe (UK PM Boris Johnson is expected to announce a national lockdown at 20:00GMT and tighter restrictions are being mulled in Germany, Ireland and elsewhere in the EU).

Looking ahead, it may be a volatile week. The outcome of Tuesday’s Senate elections in Georgia is not expected to be known for some time as mail-in ballots are counted (similar to the 3 November Presidential election). If the Democrats pull off an upset and manage to win both seats and thus a majority in the Senate, this would hand them control over Congress and the power to enact significant further fiscal stimulus in 2021. The market reaction to such an outcome is likely to be positive, given the jubilant reactions seen in recent months to further fiscal spending.

Traders will also have to keep an eye on crucial US data in the form of December Institute of Supply Management PMI numbers, released on Tuesday and Thursday, as well as Friday’s official jobs numbers, also for December. Analysts/market commentators have argued that in the current bearish USD environment, the data presents downside risks to USD (and upside risks to the likes of NZD/USD) given the possibility of a risk on (USD negative) reaction to strong data versus potential pumping of expectations for more Fed easing in case of weak data (also USD negative).

NZD/USD dip buyers’ eye mid-December high

NZD/USD bulls keen for a bargain are likely to have their eyes on a potential test of support at 0.7172, the 17 December 2020 high. The target would then be a move back towards 2020 highs around 0.7240, with bulls hoping for a return of bearish USD conditions as the week/month progresses.

NZD/USD hourly chart

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.