FX news today – To new beginnings!

Markets are returning from the long holiday weekend!

The dollar has started the new year with a declining bias, which is of course where it left off last year, wagering the world’s pandemic recovery will drive other currencies higher.

2020 ended on a bullish note for Treasuries and equities. Yields finished slightly richer on the day, and measurably lower on the year. Optimism for 2021 supported Wall Street where the USA30 and the USA500 climbed to new all-time peaks. The three indexes together managed to set 102 record closing highs last year amid unprecedented monetary and fiscal support, along with vaccines and therapeutics. However, there are renewed worries given the new virus strains and more stringent lockdowns.

Japan said Tokyo and some surrounding districts may have to declare a state of emergency and the US also warned that things may get worse in coming weeks. Nikkei lost -0.8%. China’s manufacturing PMI meanwhile dropped back in December, but still signaled expansion, while the Hang Seng and CSI 300 lifted 0.7% and 1.1% respectively. Lockdowns and restrictions won’t go away any time soon, even if there is now light at the end of the tunnel.

Trading could be constrained today ahead of the Georgia Senate runoff elections tomorrow that will determine control of the Senate and thus the legislative agenda.

Currency market update

-

EUR – up to 1.2265 above PP

-

GBP– retesting 1.3700 (R1) since this morning

-

JPY – extending gains against USD – below 103.00

-

CAD – currently at 1.2690

-

AUD –entered 2017 area – extended to 0.7730

-

GOLD – broke 6-month downwards channel, above 1900 – currently at 1924.84

-

USOil – re-entered pre-Covid crisis ranges in recent weeks. It is at $49.44, with a full OPEC meeting scheduled for today, amid warnings of plenty of downside risks for the first half of the year.

-

BTC – rallied to yet another record peak. Cryptocurrencies look likely see much more upside amid signs that long-term institutional investment managers have been buying and holding bitcoin and other leading cryptocurrencies as an inflationary hedge

Today – The calendar today mainly focuses on final manufacturing PMI readings for December, with both UK and Eurozone numbers expected to confirm a robust pace of expansions and the fact that the prospect of vaccinations lifted spirits that month. Also we have US construction spending and the OPEC meeting.

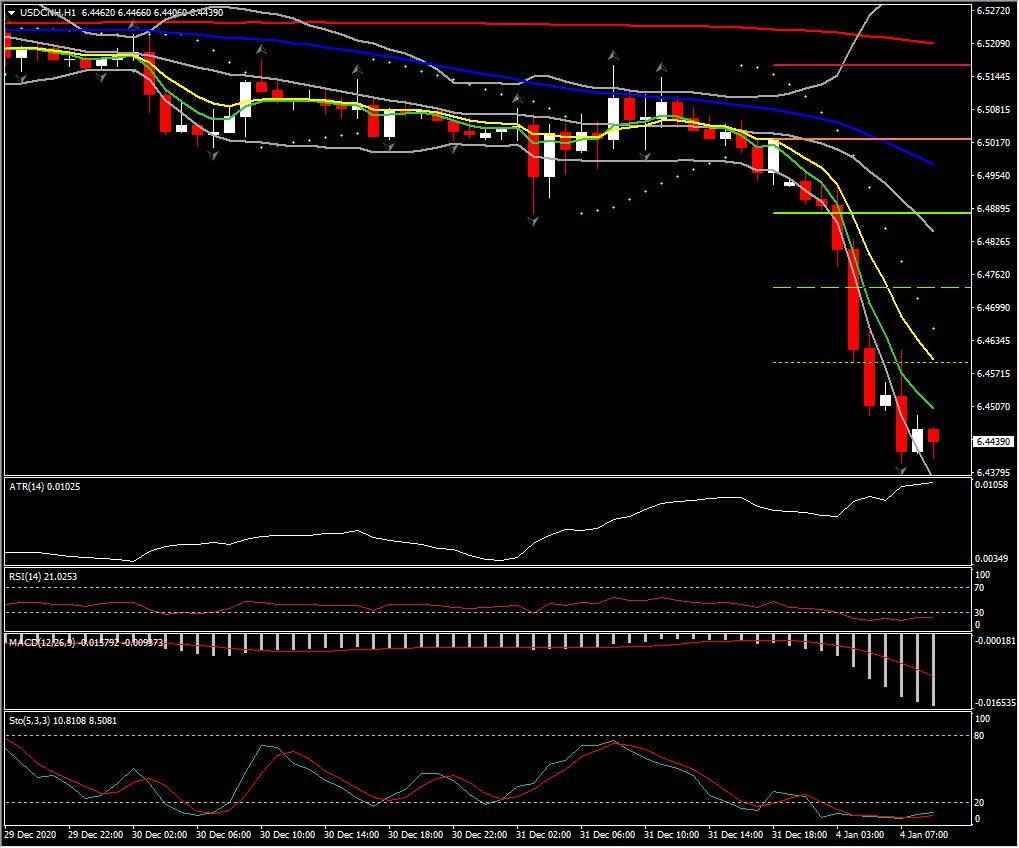

Biggest (FX) Mover – USDCNY ( -1.02% as of 09:50 GMT) – It continued aggressively southwards for the 8th month in a row, reversing more than 75% of its 3-year gains. It set at 6.4445. Technical indicators on long and short term are negatively configured with any rebound implying a correction of the sharp selloff. ATR 0.01035, Daily ATR 0.02629.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.