European Equities: Private Sector PMIs and Capitol Hill in Focus

Economic Calendar:

Monday, 4th January

Spanish Manufacturing PMI (Dec)

Italian Manufacturing PMI (Dec)

75% of retail CFD investors lose money

French Manufacturing PMI (Dec) Final

German Manufacturing PMI (Dec) Final

Eurozone Manufacturing PMI (Dec) Final

Tuesday, 5th January

German Retail Sales (MoM) (Nov)

German Unemployment Change (Dec)

German Unemployment Rate (Dec)

Wednesday, 6th January

Spanish Services PMI (Dec)

Italian Services PMI (Dec)

French Services PMI (Dec) Final

German Services PMI (Dec) Final

Eurozone Markit Composite PMI (Dec) Final

Eurozone Services PMI (Dec) Final

German CPI (MoM) (Dec)

Thursday, 7th January

German Factory Orders (MoM) (Nov)

German IHS Markit Construction PMI (Dec)

Italian CPI (MoM) (Dec)

Eurozone CPI (YoY) (Dec)

Eurozone Retail Sales (MoM) (Nov)

Friday, 8th January

German Industrial Production (MoM) (Nov)

German Trade Balance (Nov)

French Consumer Spending (MoM) (Nov)

Eurozone Unemployment Rate (Nov)

The Majors

It was a bearish end to the year for the European majors on Thursday, with the CAC40 and the EuroStoxx600 falling by 0.86% and by 0.30% respectively.

The rollout of U.S tariffs on EU goods weighed on the European majors on the final trading day of the year.

Concerns over a Brexit and rising COVID-19 cases also dampened the mood on Thursday, while most European markets were closed.

The Stats

It was a particularly quiet day on the economic calendar. There were no material stats to provide the majors with direction in a shortened session.

From the U.S

Weekly jobless claims figures were in focus late in the day. The few European bourses that were open on the day had already closed ahead of the release, however.

In the week ending 25th December, initial jobless claims fell back from 806k to 787k. Economists had forecast a rise to 833k.

The Market Movers

The German markets were closed on Thursday.

From the CAC, it was a mixed day for the banks. BNP Paribas and Credit Agricole fell by 0.86% and by 0.43% respectively. The Soc Gen rose by 0.24%, however, to buck the trend on the day.

It was a bearish day for the French auto sector. Peugeot and Renault fell by 0.22% and by 0.51% respectively.

Air France-KLM declined by 0.78%, with Airbus SE sliding by 1.61%.

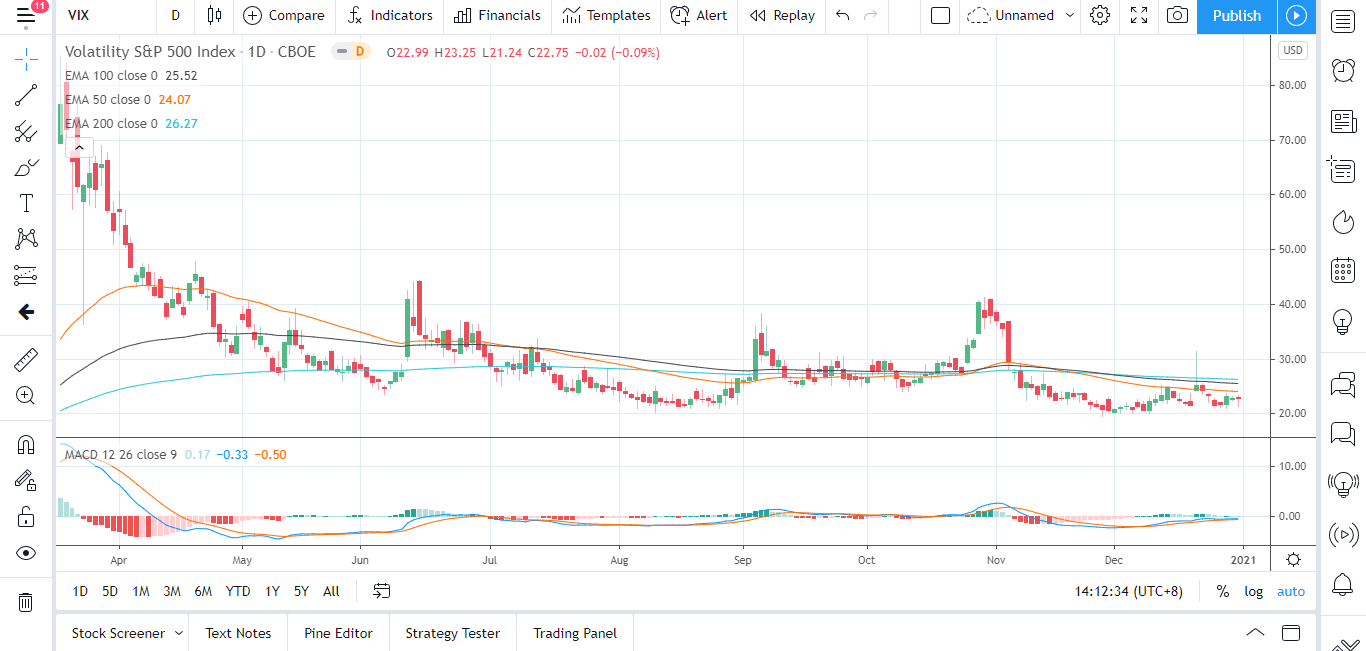

On the VIX Index

It was a 2nd consecutive day in the red for the VIX on Thursday. Following a 1.34% decline on Wednesday, the VIX slipped by 0.09%, to end the day at 22.75.

The Dow and the S&P500 rose by 0.65% and by 0.64% respectively, with the NASDAQ seeing a more modest 0.14% gain.

Better than expected jobless claims figures provided riskier assets with support on the final session of the year.

The Day Ahead

It’s a busy day ahead on the economic calendar, with prelim private sector PMI figures for December in focus later this morning.

Italy and Spain’s manufacturing PMI figures are due out along with finalized PMIs for France, Germany, and the Eurozone.

Barring material revisions to prelim figures, expect Italy and the Eurozone’s Manufacturing PMIs to have the greatest impact.

From the U.S, finalized manufacturing PMI figures will also be in focus late in the European session.

Earlier this morning, China’s manufacturing PMI for December will set the tone.

Away from the economic calendar, updates from Capitol Hill will continue to influence along with COVID-19 news.

The Futures

In the futures markets, at the time of writing, the Dow Mini was up by just 8 points.

For a look at all of today’s economic events, check out our economic calendar.

Reprinted from Fxempire_ForecastsSpider,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.