US Manufacturing PMI December Preview: COVID is the present but recovery is the future

- Manufacturing PMI expected to dip to 56.5 in December from 57.5.

- New Orders Index forecast to jump to 74.8.

- Employment Index to climb to 50.7 from 48.4.

- Dollar could receive a boost in the first major statistic of the New Year.

Can the US recovery continue as COVID-19 cases reach new levels? The question has not changed since diagnoses began to rise the fall.

Judging from the manufacturing sector where the Purchasing Managers' Index from the Institute for Supply Management (ISM) has been in expansion for six months and is expected to add a seventh in December, the answer is yes. The run from June has been the best half-year since the first six months of 2019.

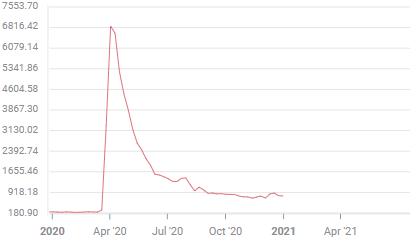

Manufactruing PMI

The New Orders Index jumped from 31.8 in May to 56.4 in June and has not been below 60 since then. The forecast of 74.8 for December is astonishing. If accurate it would be the second highest score for expected business in the 70 odd years of the survey.

New Orders Index

Employment has lagged the other indexes throughout the recovery. It only reached the 50 expansion-contraction mark in October at 53.2 after 14 straight negative months. Then dropped back to 48.4 in November. It is projected to rise to 50.7 in December.

Initial Jobless Claims and Payrolls

Claims have had a jumpy two months as reverting lockdowns in California and restaurant restrictions in New York and elsewhere have pushed people back onto the unemployment rolls.

First time claims rose from a pandemic low of 711,000 in the week of November 6 to 787,000 two weeks later, fell back to 716,000 the following week, jumped back to 892,000 two weeks after that on December 11 and were 787,000 in the final period of the year.

Initial Jobless Claims

Continuing Claims have more stable with the last rise in the November 27 week and the latest reporting on December 18 at 5.219 million, the lowest of the pandemic era.,

Nonfarm Payrolls have weakened considerably in November falling to 245,000, less than half the 641,000 average of the prior two months. The December gain, to be released this Friday, is expected to be just 100,000. The unemployment rate is forecast to rise 0.1% to 6.8%. It would be the first increase since April.

Conclusion and the dollar

Manufacturing executives are looking and planning for the end of the pandemic sometime in the spring or early summer. Despite the gloom in the labor market that expectation should continue to keep the factory outlook optimistic.

The US dollar had a miserable December, losing ground in every major pair. Trends in December, especially in the liquidity-starved final two weeks, tend to exaggeration.

A strong December manufacturing ISM, ignoring the current COVID-19 diagnoses, could be just the tonic the greenback needs.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.