Stock pick update: Intel Corp stock possible breakout

Header: Which stocks could magnify S&P 500’s gains in case it rallies? Take a look at a part of our Stock Pick Update. We have included two Technology stocks and one Health Care stock this time.

In the last five trading days (December 23 – December 29) the broad stock market has extended its record-breaking run-up. The S&P 500 index reached new record high of 3,756.12 on Tuesday following the recent stimulus news.

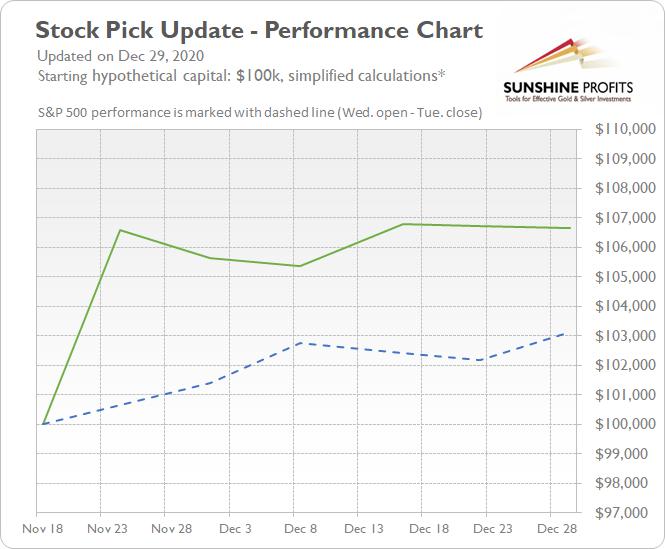

The S&P 500 has gained 0.91% between December 23 open and December 29 close. In the same period of time our five long and five short stock picks have lost 0.07%. Stock picks were relatively weaker than the broad stock market last week. Our long stock picks have lost 0.30% and short stock picks have resulted in a gain of 0.16%.

There are risks that couldn’t be avoided in trading. Hence the need for proper money management and a relatively diversified stock portfolio. This is especially important if trading on a time basis – without using stop-loss/ profit target levels. We are just buying or selling stocks at open on Wednesday and selling or buying them back at close on the next Tuesday.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

Our last week’s portfolio result

Long Picks (December 23 open – December 29 close % change): CRM (-4.32%), NVDA (-2.36%), PSX (0.00%), FANG (+4.72%), SPGI (+0.47%)

Short Picks (December 23 open – December 29 close % change): SO (+0.10%), AES (+0.73%), WY (-1.27%), ARE (-0.88%), CL (+0.52%)

Average long result: -0.30%, average short result: +0.16%Total profit (average): -0.07%

Stock Pick Update performance chart since Nov 18, 2020

Let’s check which stocks could magnify S&P’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, December 30 – Tuesday, January 5 period.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (December 30) and sold or bought back on the closing of the next Tuesday’s trading session (January 5).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF’s .

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our 5 long and 5 short candidates using trend-following approach:

-

buys: 2 x Technology, 2 x Health Care, 1 x Communication Services

-

sells: 2 x Utilities, 2 x Energy, 1 x Real Estate

Buy Candidates

NVDA NVIDIA Corp. - Technology

-

Stock trades along medium-term upward trend line.

-

Possible breakout above short-term consolidation.

-

The support level is at $490-500 and resistance level is at $550, among others.

INTC Intel Corp. – Technology

-

Stock retraced most of its recent declines.

-

Possible breakout above medium-term downward trend line.

-

The support level is at $47 and the nearest important resistance level is at $52.

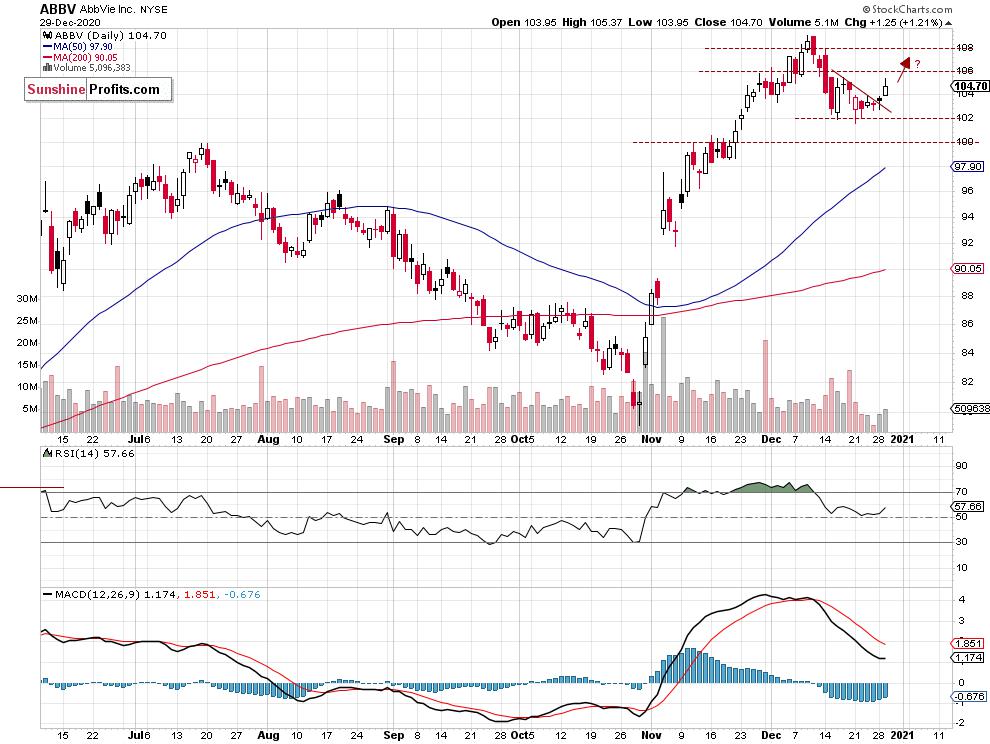

ABBV AbbVie Inc. – Health Care

-

Stock broke above short-term downward trend line – uptrend continuation play.

-

The support level is at $100-102 and resistance level is at $106-108.

Summing up , the above trend-following long stock picks are just a part of our whole Stock Pick Update . The Technology and Health Care sectors were relatively the strongest in the last 30 days. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.