European stocks calm on final trading days of the year

European stocks were relatively unchanged today as investors focused on the rising coronavirus cases in Europe and the ongoing vaccinations. In Germany, the DAX index traded at 13,736 euros while in the United Kingdom, the FTSE 100 rose slightly to £6,607. On the virus issue, the main UK regulator approved the controversial vaccine developed by AstraZeneca and Oxford University. This vaccine is seen as being important because of its lower price and the fact that it can be stored in normal refrigerators. Meanwhile, Boris Johnson is expected to rush his Brexit deal through parliament today, where most MPs are expected to support it.

The US dollar slipped in thin trading as focus remained on the recently-passed stimulus deal. The Treasury Department has already started to disburse the $600 stimulus checks. At the same time, there are divisions about another $1,400 check that has been endorsed by Donald Trump, Democrats, and a handful of Republicans. The proponents say that a stimulus is needed to help Americans fund the recovery process. However, opponents say that the stimulus is unnecessary because of the total debt the US will accumulate. They also say that it will cause the economy to overheat.

Market activity was relatively muted today as most traders remain on holiday. More activity will start on Monday, which is the first trading day for most investors. Still, the price of digital currencies advanced today, with Bitcoin approaching the psychological level of $28,000. This is substantially high considering that the price dropped to below $4,000 at the height of the pandemic. Gold price was also subdued as more investors moved to the better-performing BTC.

XAU/USD

The XAU/USD pair dropped to an intraday low of 1,878 today. This price is slightly below this week’s high of 1,900. It is also along the ascending trendline that is shown in yellow. Also, the price is between the 50% and 61.8% Fibonacci retracement level and slightly below the middle line of the Bollinger Bands. Therefore, a move below the yellow trendline will mean that bears have prevailed, which will push the price lower.

EUR/USD

The EUR/USD pulled back today after it reached a YTD high of 1.2295 yesterday. The pair is trading at 1.2258, which is slightly below the 14-day and 28-day moving average on the hourly chart. It also moved below the important support of 1.2272, which was the highest level in December. The pair remains above the ascending blue trendline. Therefore, the pair will possibly continue dropping as bears target the next support at 1.2230.

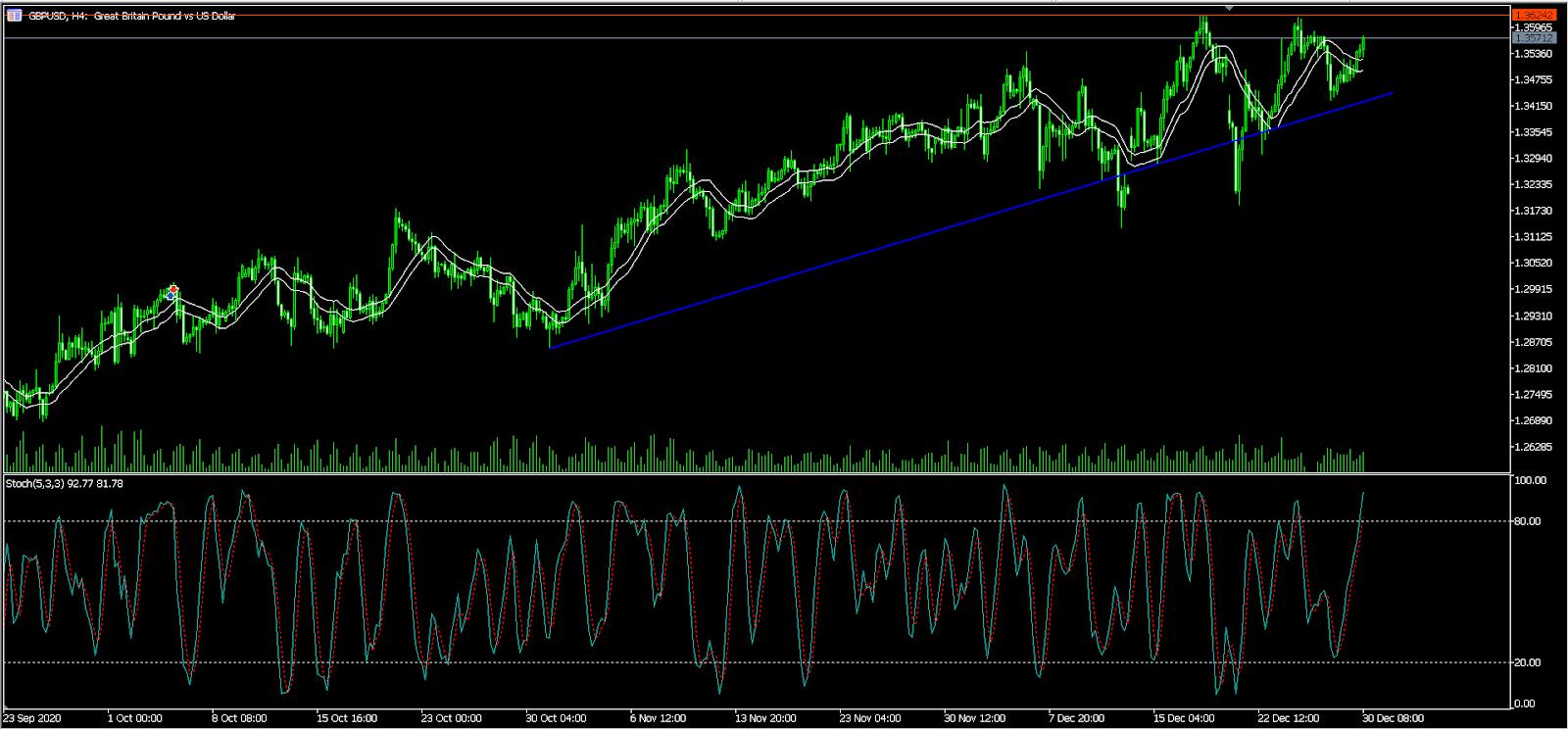

GBP/USD

The GBP/USD pair rose to an intraday high of 1.3570 ahead of the Brexit vote. The pair moved above the envelopes indicator while the Relative Strength Index (RSI) and Stochastic oscillator have moved above the overbought level on the four-hour chart. The pair is also above the dots of the Parabolic SAR indicator. Therefore, the pair will possibly continue rising, with the next target being at 1.3600.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.