NZD/USD technical analysis: Exhibits sturdy bullish bias; upside pressure persists

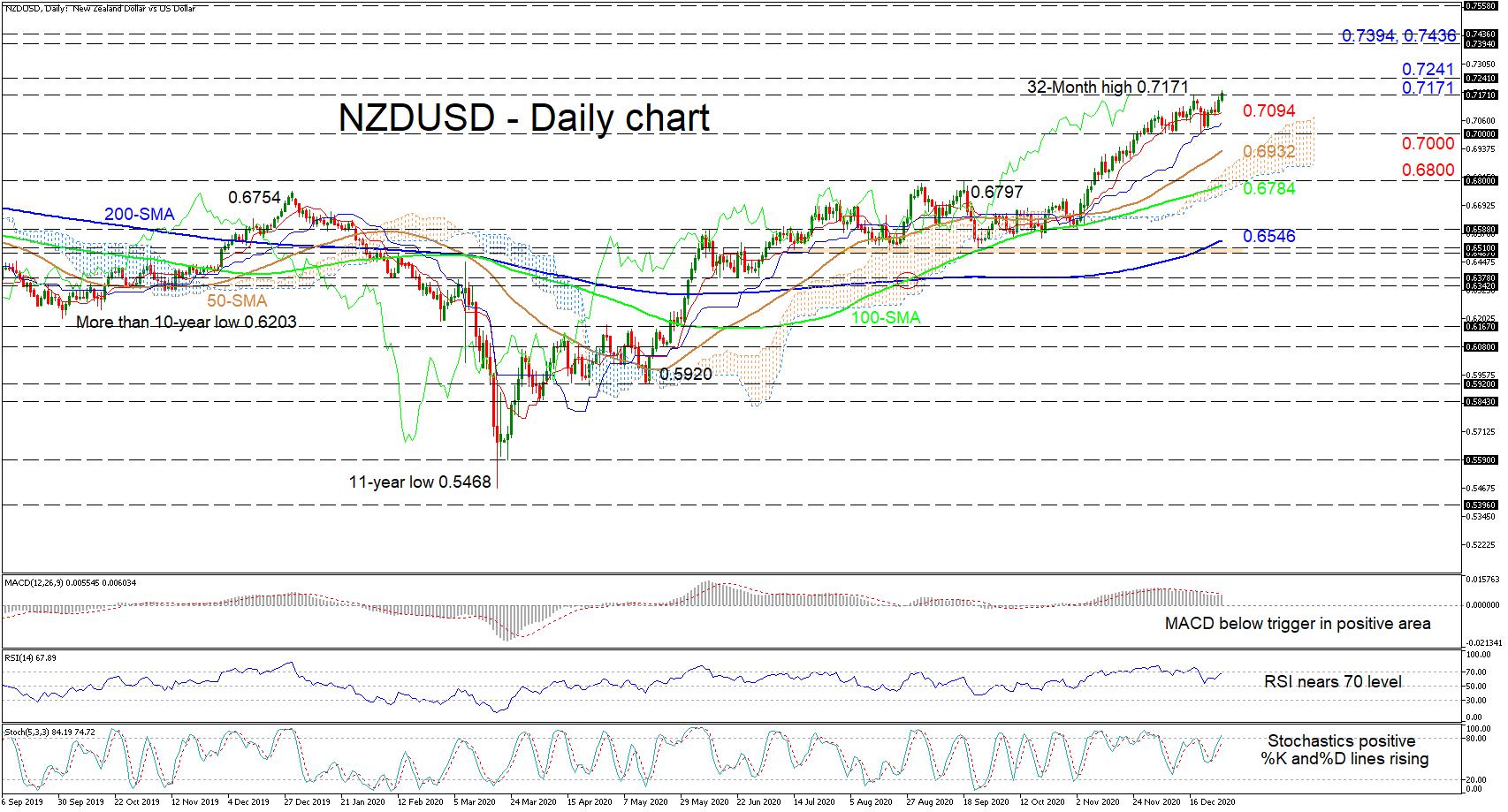

NZDUSD is in the process of pushing past the fresh 32-month peak of 0.7171 after having recently found some traction off the blue Kijun-sen line. All the simple moving averages (SMAs) are defending the positive structure, while the bullish Ichimoku lines are endorsing positive price action.

Likewise, the short-term oscillators are leaning towards further improvements in the pair. The MACD, some distance in the positive area, is below its red trigger line but looks set to return back above it, while the rising RSI is heading for the 70 overbought mark. Besides that, promoting positive sentiment is the bullish stochastic oscillator, together with the piercing of its %K line above the 80 level.

Resistance may originate from the nearby 0.7241 barrier if the bulls decisively clear the multi-year high of 0.7171. Overcoming this, the price may propel towards the respective 0.7394 and 0.7436 highs from April and January of 2018.

Otherwise, should buyers’ efforts be capped, sellers may find initial support from the red Tenkan-sen line at 0.7094 ahead of the key 0.7000 handle. Slipping under these lows, the pair may then meet the 50-day SMA at 0.6932. From here, should the price retrace into the cloud, the bears may then be challenged by the critical 0.6800 border and the reinforcing 100-day SMA of 0.6784 underneath.

Overall, NZDUSD maintains a robust short-to-medium-term bullish bias above the SMAs and the 0.7000 mark.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.