Trading Starts To Wind Down, Stocks At Record Highs, Dollar Dips

- Markets go quiet in thin holiday trading after US stimulus and Brexit hurdles cleared

- Pressure on the US Senate after House votes to increase stimulus checks

- Wall Street sets another record, Nikkei soars, London stocks play catch up

- Dollar on the backfoot again after rebound falters, pound pares losses

Markets in holiday calm but stimulus drama may not be over

Trading dwindled ahead of the New Year holiday amid thin liquidity as there was little reason for investors to stay at their desks now that both the US stimulus and Brexit deals were done and dusted. Or are they?

Democrats in the US Congress are pushing for the $600 stimulus check to be increased to $2,000 after President Trump made clear his preference for bigger payments. The Democratic-controlled House yesterday passed the measure, with some Republicans also voting in favour of it. However, it’s still not certain whether Senate Majority Leader Mitch McConnell will allow a vote in the upper chamber as there is strong opposition within the Republican party for even bigger handouts than what’s already been agreed in the $900 billion relief package approved last week.

But with the original deal already signed off by President Trump, there is only an upside risk for the markets should the Senate bow to pressure and give its thumbs up to higher stimulus checks.

Festive spirits in full swing in equity markets

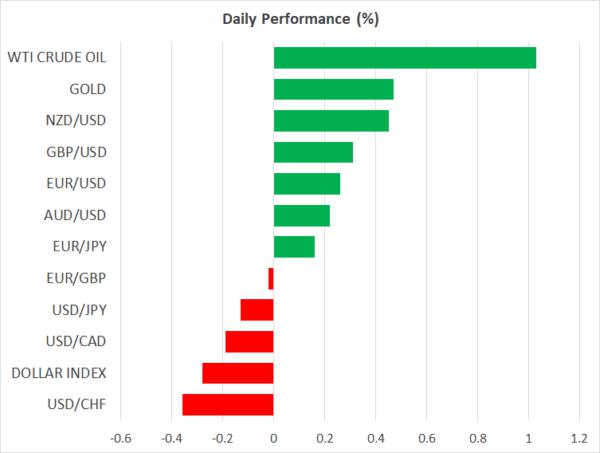

In the meantime, risk appetite is running high again after suffering a minor pullback yesterday when the US dollar caught a bid and the Brexit deal left some investors scratching their heads. The setback was mainly in currency markets, though, as equities maintained their steady uptrend.

All three indices on Wall Street closed at all-time highs on Monday and e-mini futures are pointing to another record session today. The positive sentiment also prevailed in Asia where the Nikkei 225 index soared by 2.7% to close at its highest in three decades.

In Europe, most bourses were up only modestly on Tuesday after a strong session yesterday, with the exception of the FTSE 100, as London markets were closed. But London shares were more than catching up today as they surged by almost 2%.

After a tumultuous year, stocks look almost certain to end 2020 on a high as there is no sign that the flood of fiscal and monetary stimulus is about to be scaled back. And with vaccine rollouts gathering pace, it is easy for investors to look past the daily grim headlines of record Covid infections and deaths.

A Brexit risk for financial markets; dollar down but within range

But apart from the short-term economic pain of tight virus restrictions, there is another risk in the days ahead that perhaps is being downplayed. The absence of an agreement on financial services in the Brexit deal means there is some uncertainty as to how financial institutions will cope with the new rules for cross-border transactions between the UK and EU when markets open for the first trading day of 2021 on January 4.

The possibility of some disruption could warrant some caution in the run up to the New Year. But for the time being, the mood is calm and upbeat, with the dollar back on the retreat after briefly spiking higher yesterday.

The pound was edging up again to test the $1.35 level after being sold off on Monday as investors were somewhat disappointed by the “skinny” deal agreed by UK and EU negotiators. The risk-sensitive Australian and New Zealand dollars also erased earlier gains yesterday as the greenback firmed, but both were rebounding today.

The euro, which was one of the few majors to still close up against the dollar on Monday, was extending its gains today.

Reprinted from ActionForex,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.