NZD/USD: Unsustainable Upside Is Likely To Reverse

NZD/USD has recently hit the 0.69 handle, while NZD trades firmly above the 100-day moving average of its trade-weighted index.

Going forward, as global macroeconomic uncertainties remain, it is unlikely that NZD will be able to sustain much further upside.

While the somewhat symbolic 0.70 handle (being a round number) remains in close proximity, macroeconomic differentials do not support much further strength.

In fact, while I would remain open to a bullish thesis in the longer term, changes in inflation and interest rates would suggest NZD has overshot.

NZ growth has also under-performed U.S. growth, and as we head into a winter without widespread vaccine usage, any risk-off events have the potential to hit NZD hard to the downside.

The NZD/USD currency pair, which expresses the value of the New Zealand dollar in terms of the U.S. dollar, is classically a risk-on instrument. NZD tends to rally when risk sentiment is positive, and vice versa; falls in risk sentiment correlate positively with the New Zealand dollar. The U.S. dollar is still viewed as a safe haven, although this year it has found weakness as U.S. interest rates have been slashed; the Federal Reserve's target short-term rate is now at the zero lower bound (0.00 to +0.25%).

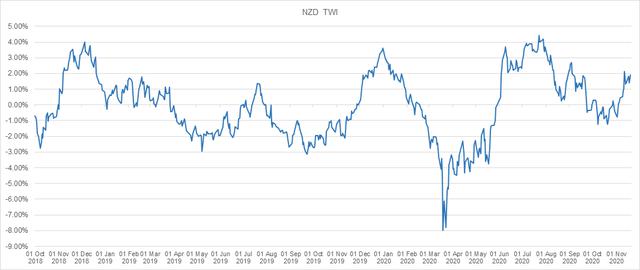

The chart below shows the NZD trade-weighted index, which is a common way to measure the effective exchange rate; a multilateral index that is compiled using weights against foreign currencies in accord with levels of international trade. Using this data (provided by the Reserve Bank of New Zealand, or RBNZ), I also add a sloping black line to indicate the breakout of the NZD TWI in recent days (a reversal out of the long-term downtrend).

(Source: RBNZ)

(Source: RBNZ)

The breakout should not necessarily be trusted. If we look outside of the trend, we can see that the 73 and 74 handles could serve as "resistance". When NZD climbs too far in trade-weighted terms, we usually do see a rebalancing that produces a short-term, short-NZD regime. This is not a fixed rule though, and NZD is not necessarily trading in a "euphoric" manner. The chart below is an updated version of the one above, which measures the NZD TWI against its running 100-day moving average (over the same period).

(Source: RBNZ)

(Source: RBNZ)

The chart indicates that the NZD TWI tends to find stronger resistance once we see that it has climbed up to circa 2% against its 100-day moving average. Excessive flows into NZD essentially create their own kind of "NZD-aversion". NZD is important to New Zealand for its exports (NZD is still viewed as a commodity currency in this regard) and, therefore, it is probable that the market views the potential for a combination of natural rebalancing through trade and the potential for RBNZ intervention to soften the currency. Softening the currency, especially when NZD is strong internationally, is a viable way to improve the price competitiveness (internationally) of NZD exports.

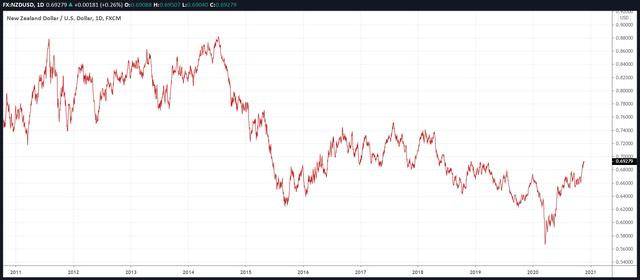

New Zealand is not known for currency wars, and indeed it frankly has not had to devalue its currency; NZD/USD, for example, has been in a bear market for years.

(Source: TradingView)

(Source: TradingView)

Due to increased risk sentiment, USD has not been favored in recent months, while NZD has rebounded on the back of both risk-taking activity and cautious optimism. Yet the COVID-19 crisis still remains, and in spite of new vaccine hopes, the short- to medium-term is still fairly fraught with uncertainty.

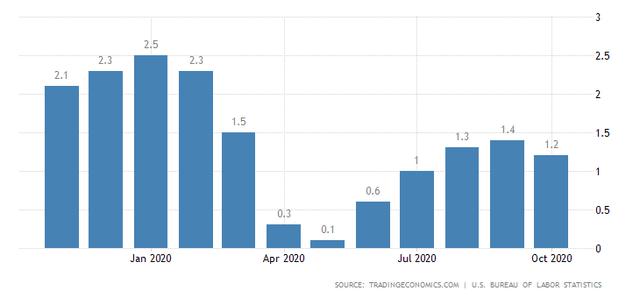

In terms of inflation and interest rate dynamics, the U.S. Federal Reserve has slashed its rate from 1.50-1.75% to 0.00-0.25%, as mentioned earlier. This represents a cut of 150 basis points. The RBNZ has cut its comparable rate from 1.00% to 0.25%. Meanwhile, U.S. inflation has fallen from 2.3% (year-over-year) in December 2019 to 1.4% as of Q3 2020 (it also reported slightly lower inflation in October, at 1.2%).

(Source: Trading Economics. U.S. inflation has ticked down this year.)

(Source: Trading Economics. U.S. inflation has ticked down this year.)

If we take the 150 basis point cut in the short-term rate and subtract the change in inflation from December to September, we get an implied change in the real interest rate of -60 basis points (i.e., 150 minus the inflation balance of 140 minus 230). The implied real yield for the U.S. dollar is therefore both negative and falling.

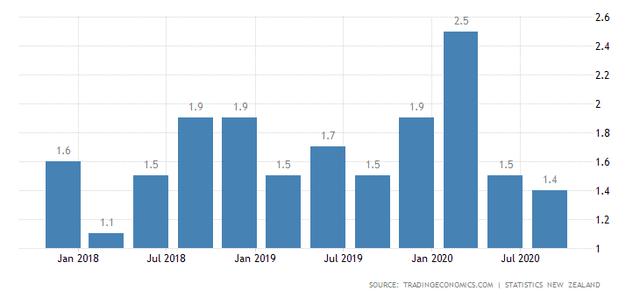

NZ inflation has similarly fallen. Reported on a quarterly basis rather than monthly, NZ inflation has dropped from +190 basis points (or 1.9%) in Q4 2019 to +140 basis points (or 1.4%) in Q3 2020.

(Source: Trading Economics. NZ inflation has ticked down during 2020.)

(Source: Trading Economics. NZ inflation has ticked down during 2020.)

Using the same calculation as above, the implied real interest rate for NZD has essentially changed from -90 basis points (i.e., the interest rate of 100 basis points, minus Q4 2019 inflation of +190 basis points) to a net yield of -115 basis points (comprised of the more recent interest rate of +25 basis points, minus Q3 2020 inflation of +140 basis points).

In summary, the USD real interest rate (on a midpoint basis) has changed from -67.5 basis points to -127.5 basis points. The NZD real interest rate has changed from -90 basis points to -115 basis points. The adverse variance for the USD rate is -60 basis points; the adverse variance for the NZD rate is -25 basis points. A stronger NZD/USD rate is, therefore, supported by the change in inflation and interest rates.

However, this is still a relatively modest change in the real interest rate spread. The midpoint for NZD/USD in Q4 2019 was circa 0.6490. The current market price, at the time of writing, is circa 0.6930. This represents a climb of over 6.7%. On a closing basis, NZD/USD has risen 2.33% since November 6, 2020, which coincides with the recent risk-on activity that followed the positive vaccine news from companies such as Pfizer and Moderna. While NZD may be attractive on a much longer-term basis, there is still going to be plenty of uncertainty in the short- to medium-term, and economic fundamentals are unlikely to support such a strong NZD into 2021 (especially through winter).

The coming winter period coincides with the conventional wisdom of seasonality of the spread of coronaviruses and flu viruses. The second wave of COVID-19 is not over, and vaccines will not be in widespread use until next year (likely past the winter period, or towards the end). Any risk-off activity will also likely prove NZD to be currently in an over-extended position; short-term USD rallies are likely to provide a gravitational pull on the NZD, back to a more modest year-over-year change against USD.

A weaker USD premium over other currencies could persist, but I think that inflation and interest rate dynamics would support a generally firmer USD relative to its current position. This might also apply to alternative USD FX crosses, such as EUR/USD, although these crosses deserve separate assessments.

I referenced the Q4 2019 midpoint for NZD/USD as being circa 0.6490. In my view, this represents the market's assessment of fair value pre-COVID. The full-year 2019 midpoint of circa 0.6580 would support a fair value at the 0.65 handle (pre-COVID). Changes in rates and inflation in the present year support a stronger NZD/USD rate, but not to the extent of the 0.70 handle which is currently being approached. NZD was likely trading closer to fair value prior to November, between 0.65 and 0.68. This is supported by the more modest U.S. inflation reading for October, not to mention that NZ growth was negative at -12.4% year-over-year in Q2, whereas U.S. growth troughed at -9% in Q2 (more recently reporting a year-over-year decline of "just" 2.9% in Q3).

I believe NZD/USD has overshot and heading into 2021 we are likely to see NZD FX crosses see the New Zealand dollar trading in a generally more modest fashion. From the 0.69 handle at present, we should watch for NZD/USD to trade under the 0.68 handle in the first instance, with the potential for 0.65 to be seen again in a more significant risk-off scenario. While the 0.70 handle is still possible in the near term given proximity (and to possibly clip the high of December 2018, just below 0.70), I do not think the market will be able to sustain higher NZD prices for much longer.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Reprinted from Seeking Alpha,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.