Trading risk assets through the lens of inflation expectations

There has been a lot of talk about global reflation and then inflation on the horizon, on the back of continued stimulus support from both the federal government and central bank, a Biden presidency, and more recently successful Covid vaccines. Despite all of this, inflation expectations and the performance of many risk assets are still not convinced of this idea just yet. Also, the slowdown of economic data has further weighed on this notion.

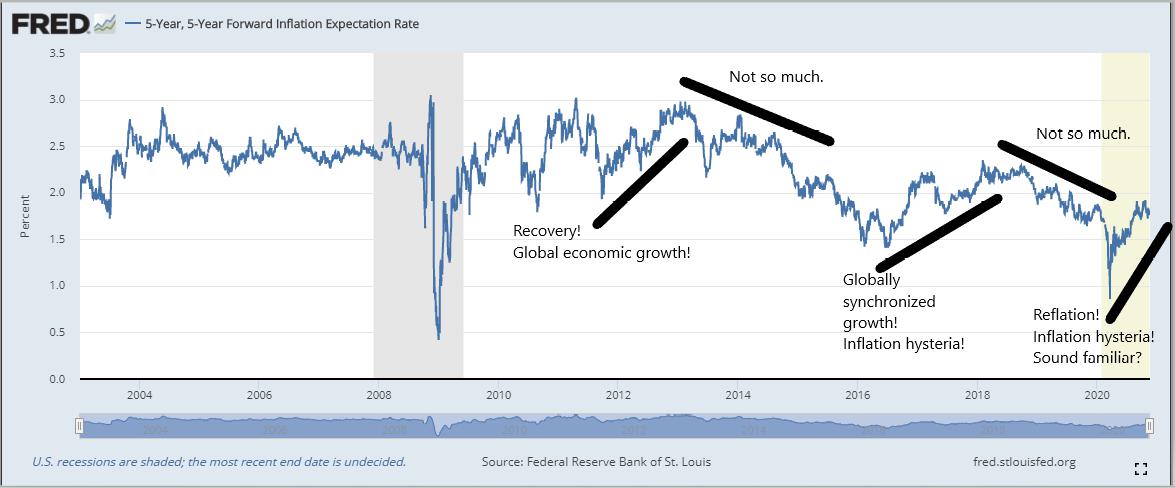

If we take a look at the 5-year forward inflation expectation rate, at the end of 2008 inflation expectations rose quite sharply as everyone thought QE would be successful in producing inflation and growth. Notice that the rate never sustained a move back above the levels it was at prior to the GFC. If we fast-forward to 2017-18, which was the last time we had any type of inflation hysteria, you can see current inflation expectations are not close to those levels. What’s significant about this, is that inflation and growth never materialized in 2017-18, yet here we are a few months after the biggest QE package ever (over 3 trillion), on the verge of a Biden presidency (democrats plan to spend more than republicans), and breakthroughs on a Covid vaccine, yet the expectation of inflation can’t even get to the levels it was at in 2017-18. There was a “reflation rally” (if you can call it that) right around election time, but there has been little to no follow through recently, especially on the side of inflation expectations. That does not bode well for risk assets going forward. I wrote a lot more about the inflation hysteria story here, but for now, let’s take a look at a couple of risk assets.

Let’s look at oil, as oil has been known to perform well in periods of global growth and inflation and poorly during periods of sluggish growth and disinflation. Its price is a good gauge of the global economy. If reflation, then inflation was around the corner like the mainstream believes, the price of oil would be rising. As we can see (below), oil has stalled about halfway from where its selloff started back in January, which preceded the Covid crisis by two months. If you look at oil and inflation expectations together (second chart below), they look very similar. The reason I bring that up is because inflation and growth expectations could be the driver for oil in the short-term. Expectations have stalled, just like the price of oil. If the markets start to actually believe reflation is right around the corner, it will surely be reflected in the price of oil. Up until this point, nothing in terms of reflation or inflation has actually materialized.

There is almost certainly another stimulus package on both the fiscal and monetary side in the very near future. Once that becomes a reality, oil will likely rise in the short-term, alongside other risk assets in another “reflation rally”. There is no reason to believe right now that more stimulus will be able to generate inflation and growth, after-all, it has failed to do so since 2008. I think we are a couple years away from seeing any real growth in the global economy. Once the market realizes stimulus is failing (again) to generate inflation and growth, risk assets will roll back over again. With that being said, I would potentially sell oil if it reaches the levels of supply I have drawn out on the chart. I think the level between $50-55 would be the best level to look for a short. It’s the level that took the price of oil negative back in April. There is also the possibility that oil continues to consolidate before rolling over again. Regardless of which route oil takes, I would be looking to take profit at the $30-32 area (short-term), about the $25 level, and if the deflation shock I’m expecting gets really bad we could be looking at the $15-20 level.

Copper is another interesting asset to look at, often referred to as “Dr. Copper” since it’s a solid gauge of economic health. When copper is in demand, that’s a good sign for the global economy, as it is used in various industries. Copper hasn’t stalled like oil has (below), but it is now being rejected from the level it reached back in the middle of 2018, which was the last time there was inflation hysteria similar to what we are experiencing now. It wouldn’t surprise me to see copper consolidate at these levels before it makes its next move. Even with another “reflation rally” potentially in the cards, copper might not break above that $3.30 level that was formed back in June 2018. But, if it does, the levels to fade the rally for me would be about $3.50 and $3.70. I think appropriate targets at which to take profit would be about $2.50-2.60 and $2.35-2.40.

There are many assets we could look at, but I just want to take a look at one more, the AUDUSD (below). The Aussie is a commodity currency, heavily reliant on global trade; therefore, when capital is flowing into Australia, that’s a good sign for the global economy. Similar to oil, its rise has been stalling since the end of August. If a “reflation rally” sends it higher, I think the .7600 level would give the AUDUSD problems, as well as the level at about .7750 which you can see more clearly if you switch to a daily time frame. The areas to look for profit would be about .6500 and .6000-.6200.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.