Countercurrency flows and risk sentiment pushed the Kiwi higher last week. Can the comdoll extend its gains against its major counterparts?

Let’s check out the potential catalysts you need to prepare for:

Business confidence reports

- The Reserve Bank of New Zealand (RBNZ) considers business surveys in its decisions so you should too

- NZIER business confidence (Oct 5, 9:00 pm GMT) expected to improve from -63.0% to -60.0% in Q3 2020

- ANZ business confidence (Oct 8, 12:00 am GMT) last printed at -28.5 after a -26.0 reading in August

Overall market sentiment

- With not a lot of domestic data on the docket, the Kiwi may take its cues from investors’ risk appetite

- New Zealand is currently conducting its general elections where PM Ardern is expected to secure a second term

- Significant headlines over Trump’s COVID-19 infection will continue to influence risk-taking

- This week’s debate between VP candidates Pence and Harris can also affect high-yielding bets like the Kiwi

- RBA’s monetary policy decision, FOMC’s meeting minutes, and speeches from the Fed, ECB, BOE, and BOC head honchos can cause intraday swings for major NZD pairs

Technical snapshot

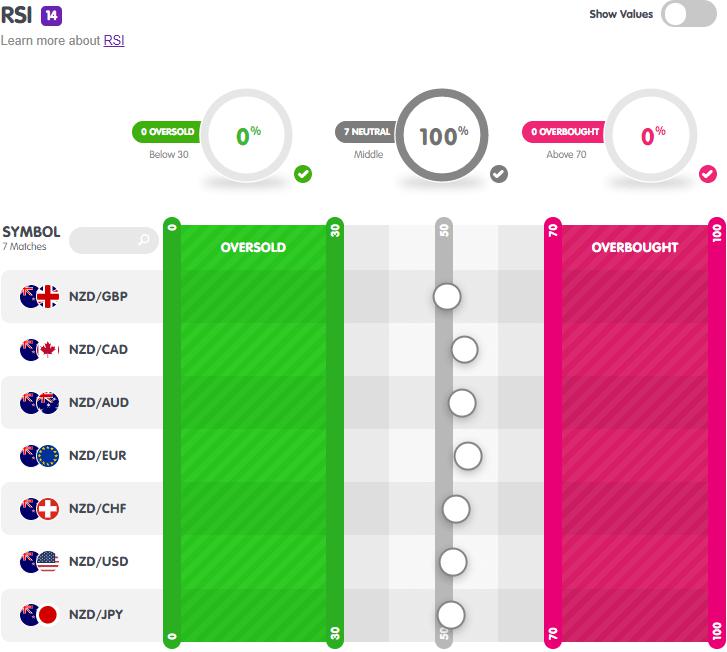

- RSI is showing NZD’s neutral conditions against its major counterparts on the daily time frame

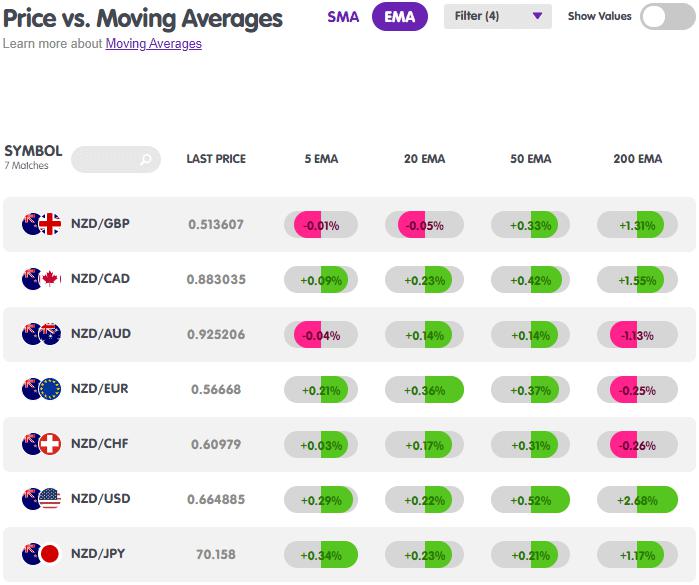

- NZD is on short and long-term bullish trends against USD, JPY, and CAD

- The Kiwi is seeing short-term bearish pressure against the pound

- NZD remains under the 200 SMA against AUD, EUR, and CHF

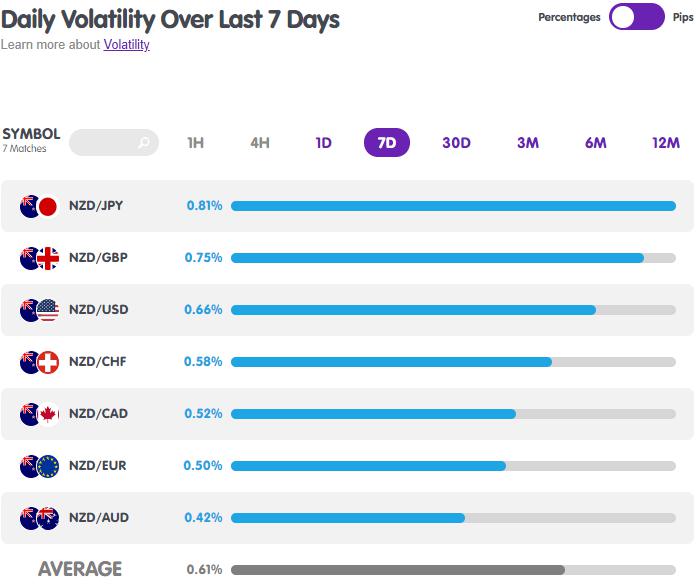

- NZD saw the most volatility against the safe havens and the pound in the last seven days

Missed last week’s price action? Read NZD’s price recap for Sept 28 – Oct 2!

Hot

No comment on record. Start new comment.