USD/CAD Weekly Forecast: Decision avoidance

- Ivey PMI in June registers its best score in 20 months.

- Employment change in June much stronger than expected.

- March and April loss of 3 million jobs 41.4% replaced in May and June.

Canada’s economy is making a faster recovery from its pandemic shutdown than economists had anticipated with companies rehiring almost half their furloughed workers and with business outlook at its best level in over a year-and-a-half.

The Ivey purchasing managers index jumped back into expansion after three negative months and its lowest ever score of 23.6 in April with a rollicking 62.9 in June its highest reading since October 2018.

National payrolls soared 952,900 in June, far more than the 700,000 forecast and when added to May’s 289,600, the 1.242 million total is 41.4% of the 3 million jobs lost in March and April.

The home construction industry also rebounded to 211,700 it best annualized rate since January.

The USD/CAD continued its month long bout of range trading with the four-week movement limited to 1.3500-1.3700 and the July action to an even narrower band of 1.3500-13600.

Currencies have been trapped for weeks between the safety trade--higher dollar, risk-off--from rising Covid cases (positive tests) in the US, though with only small increases in hospitalizations and fatalities and the attendant fear of re-imposed business closures, and the risk on lower dollar motivation of the rapidly improving US and Canadian economies.

The danger from the rising number of positive tests, both symptomatic and asymptomatic, is not yet clear as the availability of hospital beds and intensive care units are not threatened and the fatality rate has stayed remarkably low considering the large rise in positive tests. As the disease normally takes several weeks to produce a fatality, the next two weeks should begin to provide conclusive evidence if the current outbreak will strain the health care systems in the various states affected. If it does governors may be forced to order a second round of business shutdowns with all the accompanying economic damage. If it does not then the recovery should continue apace.

USD/CAD outlook

The constricted range trading of the last month will likely continue for a few more weeks as markets assess the economic danger from the current Covid outbreak.

Equites have continued to move higher as improving economic statistics have been bolstered by positive results from Covid tests of two potential treatments, Remdesivir and Hydroychloroquine.

Bonds have remained resistant to better news with the US 10-year Treasury yield of 0.643% and the 2-year at 0.157% both near their pandemic low though the weakness in interest return has not has an appreciable impact on the dollar.

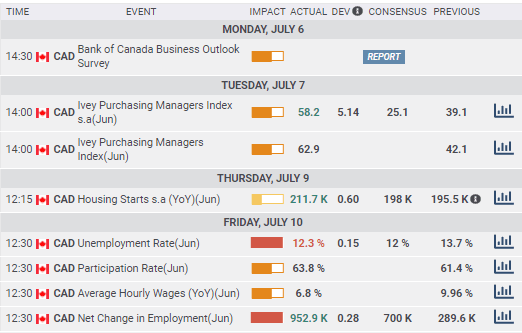

Canada statistics July 6-July 10

Tuesday

The Ivey PMI for June was 62.9 far ahead of May's 42.1 score and the first expansion reading in four months.

Thursday

The leading index was 0.95% in June and May was revised to 0.89% from 0.87%, both are the highest scores in the 64 year history of the series.

Friday

Employment change added 952,900 jobs in June far more than the 700,000 forecast. Average hourly wage gains dropped to 6.8% from 9.96% in June as people returned to work. The unemployment rate dropped to 12.3%, missing the 12% estimate from 13.7% in may. Full-time employment rose 488,100 in June from 219,400 in May and part-time rose 464,800 from 70,300 in May. The participation rate climbed to 63.8% from 61.4%.

FXStreet

FXStreet

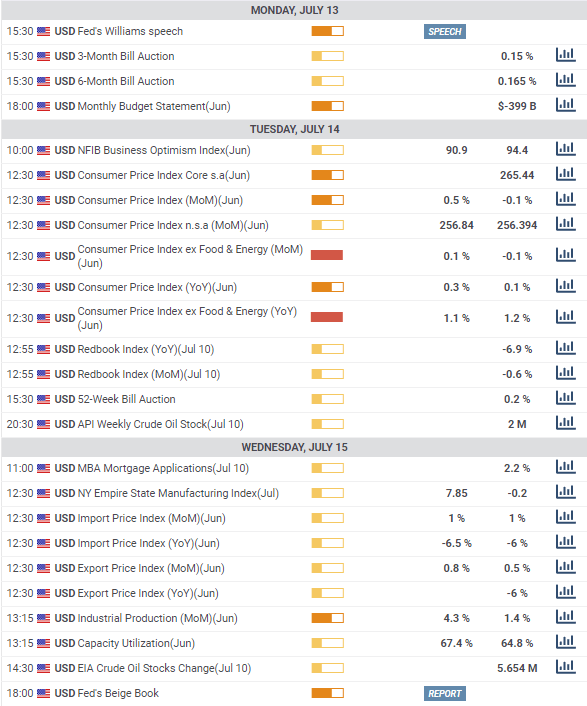

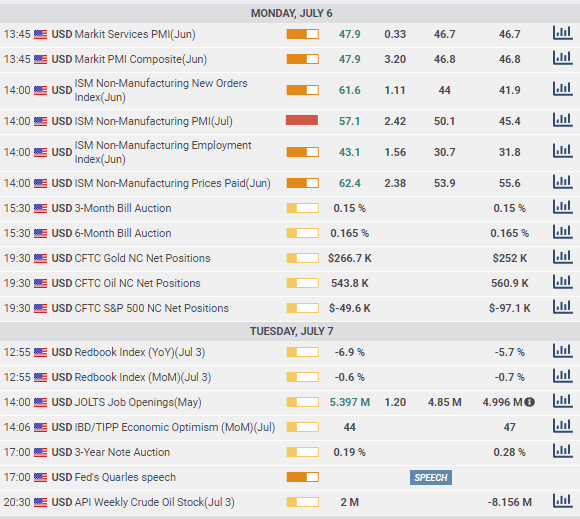

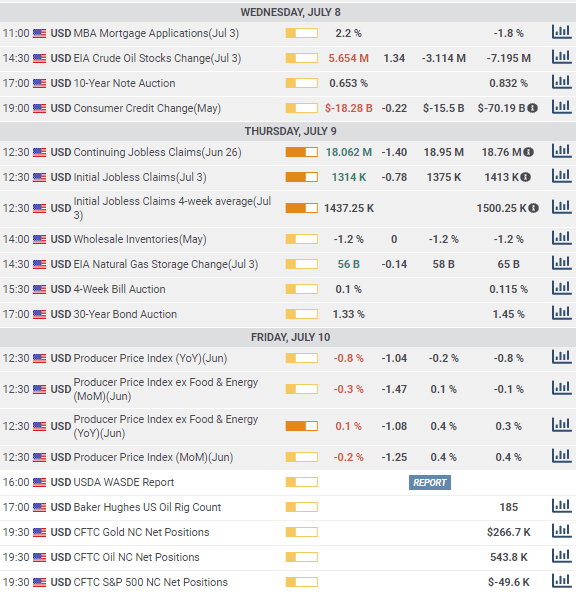

US Statistics July 6-July 10

Monday

The service sector purchasing managers’ index from the Institute for Supply Management unexpectedly jumped to 57.1 In June from 45.4 in May well beyond the 50.1 forecast. The new orders index rose a record 19.7 points to 6.16 from 41.9 leaving the forecast of 44 far behind. The prices paid index reached 62.4 from 55.6 in April. Only the employment index at 43.1 failed to reach expansion from 31.8 in May though it did surpass the 30.7 projection.

Wednesday

Consumer credit contracted by $18.28 billion in May following April’s record $70.19 drop.

Thursday

Initial jobless claims dropped to 1.314 million in the July 3 week from 1.413 prior. Continuing claims fell to 18.062 million from 18.76 million.

Friday

PPI fell 0.2% on the month and 0.8% on the year in June. Core PPI dropped 0.3% and rose 0.1% respectively.

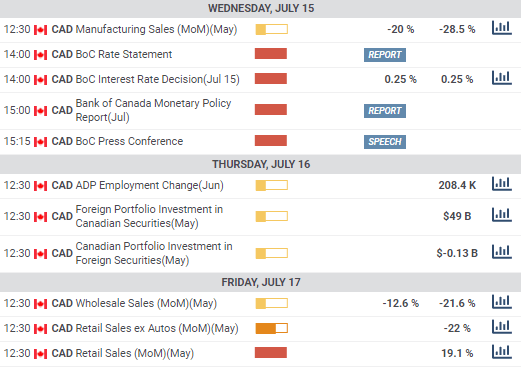

Canada statistics July 13-July 17

FXStreet

FXStreet

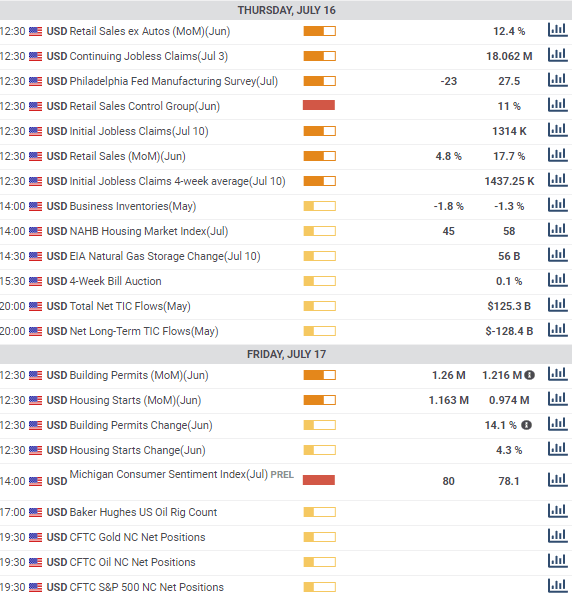

US statistics July 13-July 17

FXStreet

FXStreet

USD/CAD technical outlook

The relative strength index is just below neutral as the USD/CAD is near the mid-point of its one month range. The moving averages have divided with the 100-day far above the market at 1.3833, the 21-day at the market at 1.3585 and the 200-day at 1.3505 offering additional support.

Resistance: 1.3630; 1.3700; 1.3800; 1.3880; 1.3950

Support: 1.3540; 1.3500; 1.3440; 1.3320

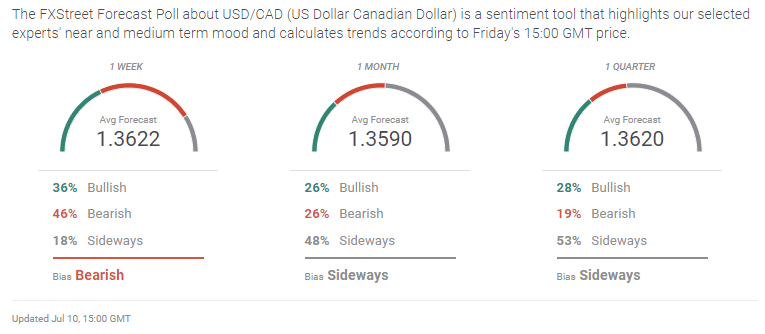

USD/CAD sentiment poll

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.