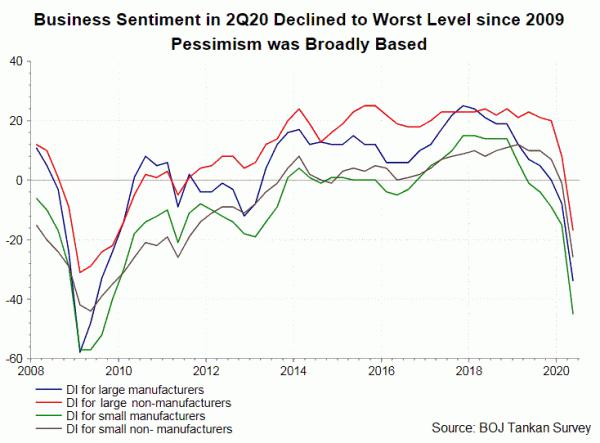

While we expect BOJ to maintain all of its monetary policy measures unchanged, the central bank would likely downgrade the economic forecasts for FY2020. BOJ’s Tankan survey revealed that companies of all sectors were worse off in 2Q20, sending the sentiment to the weakest level since global financial crisis in 2007/08. Moreover, as suggested in the regional quarterly report released Thursday (July 9), all 9 regions have revised down their assessments from April’s. The key factor of the revision is obviously the severe impacts of the coronavirus pandemic on economic activities.

Monetary Policy

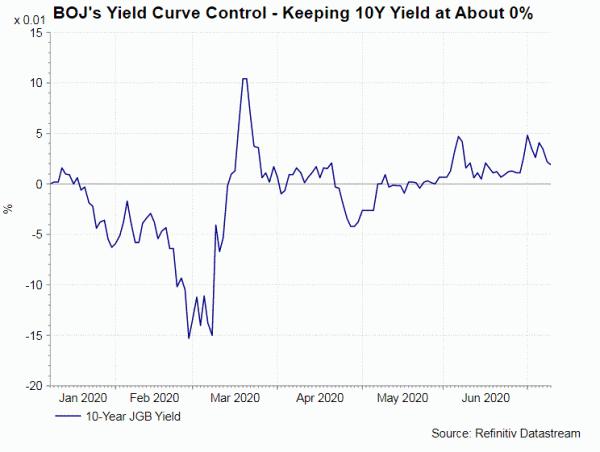

BOJ’s adoption of negative interest rates and yield curve control is rather a legacy of global financial crisis in 2007/08, rather than the coronavirus pandemic. At the June meeting, the members decided to maintain the policy rate at -0.1% and continue purchasing 10-year Japanese government bonds (JGBs) so that the corresponding yield will stay at around 0%.

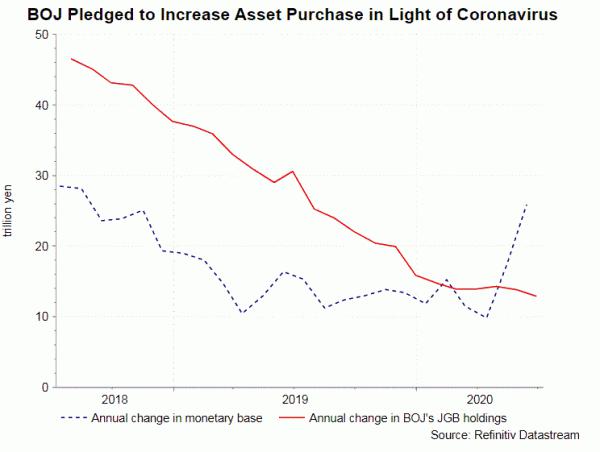

QE measures were expanded in light of the severe damage of economic activities resulting from the coronavirus pandemic. Scrapping the annual purchase limit of 80 trillion yen, BOJ pledged in April to “actively purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs) for the time being so that their amounts outstanding will increase at annual paces with the upper limit of about 12 trillion yen and about 180 billion yen, respectively. For commercial papers and corporate bonds, BOJ would maintain their amounts outstanding at about 2 trillion yen and about 3 trillion yen, respectively. Moreover, until the end of March 2021, it will conduct additional purchases with the upper limit of the amounts outstanding of 7.5 trillion yen for each asset. We expect these measures will remain unchanged.

Economic Assessments

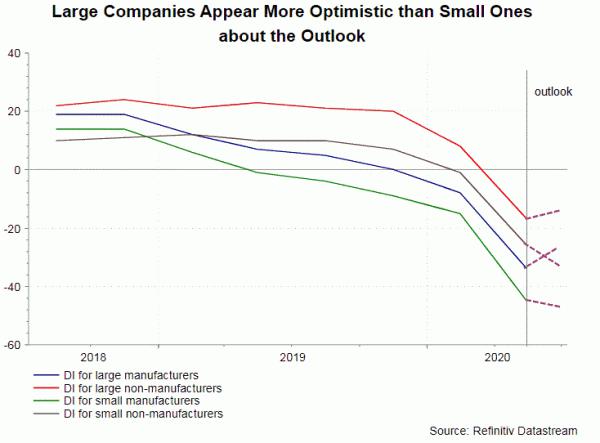

Released last week, BOJ’s quarterly Tankan survey revealed a sharp decline in business sentiment in 2Q20. The diffusion index (DI) of large manufacturing firms plunged to -34 from -8 in March, worst since Jun 2009. DIs deteriorated across all 16 manufacturing sectors with the largest declines coming from motor vehicles, lumber & wood products, iron & steel, and pulp & paper. The index for large non-manufacturers dropped to -17 from +8. This is compared with the GFC low of -31. Both came in weaker than market expectations. For small and medium-sized enterprises (SMEs), DIs for manufacturers and non-manufacturers both deteriorated sharply from March. Yet, it appears that large companies are more confident about the future while SMEs expect prolonged struggle, as outlook DIs suggested.

The regional quarterly report released Thursday (July 9) revealed that all 9 regions saw economic activities “deteriorated” or stayed in “severe conditions” due to the coronavirus pandemic. 3 out of 9 regions noted that business fixed investment “has been relatively weak”, 4 suggested that “The pace of increase has slowed”. Meanwhile, 6 out of 9 regions suggested that private consumption has been “declining”, remaining “in a severe situation” or remaining “depressed”.

We expect BOJ to revise lower GDP growth and inflation forecasts for FY2020. At the quarterly economic outlook released in April, BOJ cut its real GDP growth to a range of-5% and -3%, from +0.9% projected in January. The downgrade was still above consensus of -5.4% and IMF’s forecast of -5.8%. It is likely that BOJ will revise lower the FY2020 GDP growth forecast to the lower end of the above-mentioned range this month. The central bank projected that core CPI would decline to a range of -0.7% and -0.3% in FY 2020, compared with +1% projected in January. This was largely in line with consensus of -0.5%. BOJ’s use of ranges, rather than median, in April’s projections was likely due to high uncertainty of the pandemic’s impact on the economy at that time. As a number of economic data have already been announced for April and May, when the state of emergency was in effect, we expect BOJ to go back to using median projections at the upcoming release.

Hot

-THE END-