Markets Steady Awaiting BoE Rate Hike, Dollar Making Progress

Aussie and Kiwi firm up mildly in Asian session, following the rebound in risk markets. But overall, the currency markets are rather quiet, with major pairs and crosses stuck inside last week’s range. Traders are probably holding their bets for now, and await today’s BoE rate decision. Another big event of US non-farm payroll employment will come tomorrow.

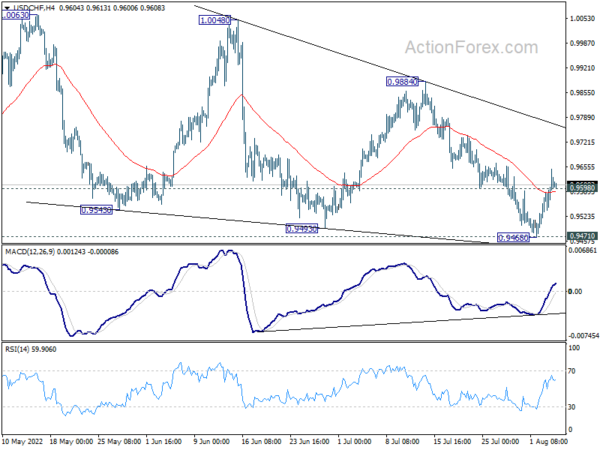

Technically, USD/CHF is making some progress and breaking 0.9598 minor resistance, which should confirm short term bottoming at 0.9468. Focuses will now be particularly on 1.0095 minor support in EUR/USD, 1.2062 minor support in GBP/USD, and 134.58 minor resistance in USD/JPY. Break of these levels would indicate a come back in Dollar.

In Asia, at the time of writing, Nikkei is up 0.60%. Hong Kong HSI is up 1.45%. China Shanghai SSE is up 0.15%. Singapore Strait Times is up 0.15%. Japan 10-year JGB yield is down -0.0097 at 0.180. Overnight, DOW rose 1.29%. S&P 500 rose 1.56%. NASDAQ rose 2.59%. 10-year yield rose 0.007 to 2.748.

Fed Kashkari: Likely scenario is continuing rate hikes and then sit there

Minneapolis Fed President Neel Kashkari said yesterday that Fed moved too slowly in 2021 in tackling high inflation. He’s concerned that inflation is pulling wages up and there are risks of going into a wage-driven inflation story. As inflation is spreading, he said that Fed need to act with urgency.

There are some financial markets that are indicating that Fed will cut interest rates in 2024. But Kashkari said, “I don’t want to say it’s impossible, but it seems like that’s a very unlikely scenario right now given what I know about the underlying inflation dynamics.”

“The more likely scenario is we would continue raising (interest rates) and then we would sit there until we have a lot of confidence that inflation is well on its way back down to 2%,” he said.

Fed Daly: 3.4% by year end is a reasonable place to get to

San Francisco Fed President Mary Daly said, “about 50% of the elevated inflation we’re seeing is from demand factors, 50% from supply factors.”

“50 bps hike would be a reasonable thing to do in September but if we see inflation roaring ahead undauntedly then perhaps 75 bps hike would be more appropriate,” she added.

Also, she does not believe that Fed has reached the threshold for interest rate to be considered restrictive As for tightening, having rate at 3.4% by the end end is a “reasonable place” to get to.

Fed Barkin: There’s a path to control inflation, but recession could happen in the process

Richmond Fed President Thomas Barkin said in a speech, “we are committed to returning inflation to our 2 percent target and have made clear we will do what it takes.” He expected Fed’s tools to “work over time” and “inflation to come down but not immediately, not suddenly and not predictably”.

“There is a path to getting inflation under control,” he said. “But a recession could happen in the process.”

“We are out of balance today because stimulus-supported excess demand overwhelmed supply constrained by the pandemic and global commodity shocks. Returning to normal means products on shelves, restaurants fully staffed and cars at auto dealers. ”

“Most importantly, moderating demand has a higher purpose squarely in our mandate: containing inflation. If there is any lesson that’s been relearned in the last year, it is that inflation is painful, and everyone hates it.”

BoE to hike 50bps, GBP/CHF ready for breakout?

BoE is expected raise interest rate by 50bps to 1.75% today. That would be the largest rate hike since 1995, while interest rate will then be at the highest level since 2008. The voting will again be a focus and the new economic projections will be scrutinized too. Back in June BoE said inflation is expected to rise to slightly above 11% in October while GDP was weaker than anticipated at the May report. The change in outlook would be reflected in the new economic projections.

Here are some previews on BoE:

- BoE Interest Rate Decision: Forecasters Can’t Make Up Their Minds

- Bank of England Preview

- Bank of England Ponders a More ‘Forceful’ Rate Hike

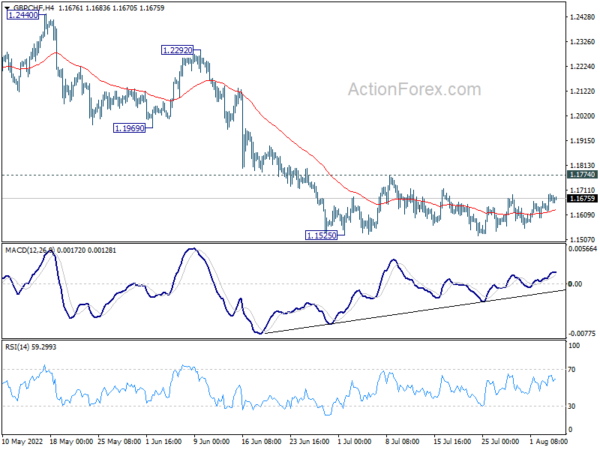

GBP/CHF turned into range trading after hitting 1.1525 in late June. There is risk of sell-on-fact in Sterling after BoE which prompt a downside breakout. But anyway, outlook will stay bearish as long as 1.1774 resistance holds, even in case of a rebound. Current down trend is still expected to resume towards 1.1107 low, which is close to 161.8% projection of 1.3070 to 1.2134 from 1.2598 at 1.1084 next, in the medium term.

Elsewhere

Australia goods and services trade surplus widened to AUD 17.67B in June, versus expectation of AUD 14.0B. Germany factory orders, UK construction PMI will be released in European session. ECB will publish monthly economic bulletin. Later in the day, US will release jobless claims and trade balance. Canada will release building permits and trade balance too.

GBP/USD Daily Outlook

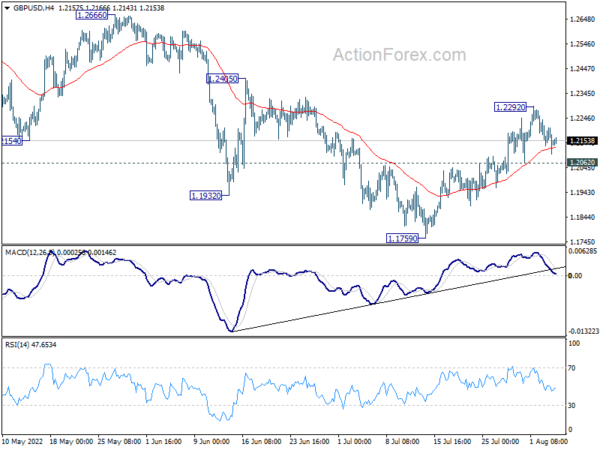

Daily Pivots: (S1) 1.2096; (P) 1.2152; (R1) 1.2203; More…

GBP/USD is staying in range below 1.2292 and intraday bias remains neutral first. Further rise could be seen as long as 1.2062 minor support holds. Above 1.2292 will target 1.2405 resistance first. Firm break there will target 1.2666 key resistance next. On the downside, however, break of 1.2062 minor support will argue that the rebound from 1.1759 is over, and turn bias back to the downside for retesting 1.1759 low instead.

In the bigger picture, fall from 1.4248 (2018 high) could be a leg inside the pattern from 1.1409 (2020 low), or resuming the longer term down trend. Deeper decline is expected as long as 1.2666 resistance holds. Next target is 1.1409 low. However, firm break of 1.2666 will bring stronger rise back to 55 week EMA (now at 1.2957).

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.