A Guide to the 5 Major Cryptocurrencies

Bitcoin

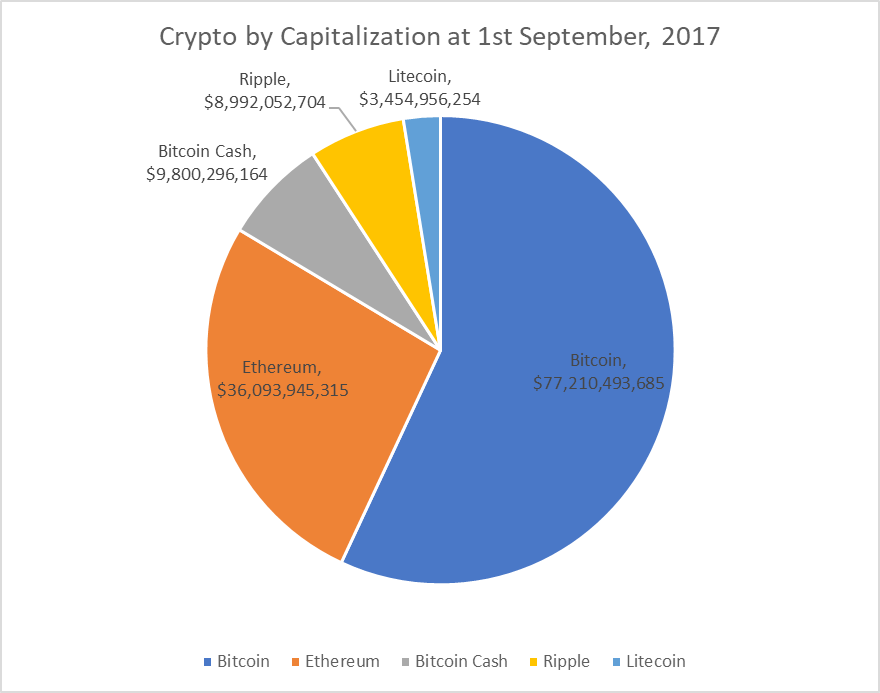

Bitcoin is currently the largest, most famous, and most valuable cryptocurrency. It was also the first, being launched by the still-anonymous “Satoshi Nakamoto” in 2009. Its market capitalization on 1st September 2017 was more than $77 billion, when there were an estimated 3 million individual owners of Bitcoins. It is accepted at more retail outlets than any other cryptocurrency. Bitcoin is the obvious choice for most investors, speculators and traders, as it is the most liquid cryptocurrency and can be bought, sold, or otherwise traded through more platforms than any alternative. Bitcoins are created by mining, which used to be within the capability of retail laptops and PCs, but is no longer so easily attainable. At current mining rates, 12.5 Bitcoins are created approximately every 10 minutes.

This rate of creation will gradually slow, until the total number of Bitcoins in existence reaches at most 21 million, which is expected to occur around the year 2140. All transactions, including the creation of new Bitcoins and all Bitcoin sales and transfers, are recorded in a public ledger. As such, transactions must be accepted by most nodes in the Bitcoin blockchain technology, and since Bitcoin is relatively widely owned, transactions take at least 10 minutes to be fully verified. Bitcoin miners act as the nodes within the blockchain, effectively administering the system and processing all transactions. Once all 21 million bitcoins have been mined, miners will have an increased need to charge transaction fees to maintain profitability. For this reason alone, traders are concerned that the cryptocurrency may face a problem in the future. It is worth noting though, that the purchase of assets or even an exchange of currency also incurs a transaction fee, so Bitcoin is not necessarily disadvantaged compared to other tradeable assets. Miners may already charge transaction fees if they wish, and choose which pending transactions to prioritize by whether they generate a fee. This means that if you are in a hurry, you can pay a little extra to get your transaction processed faster.

Bitcoin transactions and ownership are effectively private, as although the blockchain’s ledger is public and contains a record of every transaction ever made, owners are identified by digital credentials (“keys”) and not by name or other identifying factors. Owners may store and safeguard their keys using a variety of methods, all which will be covered later in more detail.

As well as being the largest and most famous cryptocurrency, Bitcoin has a pioneering and rebellious image, is backed by no large corporations, and is seen as swashbucklingly disruptive. In other words, Bitcoin may just be the Wikileaks of cryptocurrencies!

Ethereum

Ethereum is second to Bitcoin in size. It went live in 2015, and was developed by a Bitcoin programmer who was disenchanted with Bitcoin’s functionality.

Its market capitalization on 1st September 2017 was over $36 billion, a little under half that of Bitcoin, and there are an estimated 750,000 individual owners of Ether (as the currency is technically known). It is accepted by very few retail outlets or any other commercial organizations as a means of payment. The essence of Ethereum is that it is a blockchain technology designed to operate “smart contracts”, which are computer protocols intended to facilitate, verify, or enforce the negotiation or performance of a contract. The way to think of Ethereum is as a currency for business contracts over the internet, as opposed to Bitcoin which aims to be more of a store of value and generalized means of exchange. The amazing thing about “smart contracts” is that they are self-policing: the contracts are automatically voided when one party fails to fulfil their obligation.

In other ways, Ethereum is functionally similar to Bitcoin. It is also mined, but the rules governing how it will be mined in the future are less clear than Bitcoin’s rules. Ethereum has a more corporate image, and was brought to market by a Swiss company. Ethereum has had some negative publicity as its ledger has been successfully hacked, and it has undergone several splits by “hard forks”, the first of which was engineered as a method to recover assets stolen in the hacking event. Nevertheless, some cryptocurrency analysts see Ethereum as likely to overtake Bitcoin in market capitalization at some point in the future. Still, recent months have seen Bitcoin’s capitalization grow proportionally faster than Ethereum’s.

Bitcoin Cash

Bitcoin Cash is an offshoot of Bitcoin, created on 1st August 2017 from a “hard fork” in the Bitcoin blockchain. This “hard fork” was the result of tension between those who prioritized Bitcoin as a store of value (i.e. an investment) over a means of exchange (i.e. transactional cash). Some Bitcoin miners wanted limits to be lifted which would increase the speed of transaction times. The result was that some Bitcoins split to form a new cryptocurrency with a faster transaction time, called Bitcoin Cash. It is mined and otherwise functions in the same way as Bitcoin. Its market capitalization on 1st September 2017 was over $9.8 billion, about one-eighth that of Bitcoin. Bitcoin Cash is typically most useful for people who need to derive their income streams from cryptocurrency, or make lots of fast business transactions. It can be seen as an investment vehicle as it has a market niche, and since the split, there is no doubt that its price has risen faster than Bitcoin’s has.

Ripple

Ripple is the fourth largest cryptocurrency. Its market capitalization on 1st September 2017 was just under $9 billion. It was released in 2012 but had been in development for 8 years prior. Ripple is quite different than Bitcoin and Ethereum, having a more corporate image and backing, and is really a decentralized transaction network verified by consensus rather than a straightforward cryptocurrency. It was developed as a fast and cheap real-time gross settlement system, and it can verify transactions in a few seconds, much faster than any other cryptocurrency. It is already used by several major banks, who consider it a more secure system than Bitcoin and other cryptocurrencies. Its native currency is the “Ripple”, but it can support any unit of value, whether fiat currency such as the U.S. dollar or even airmiles or other tokens! This flexibility, as well as its adoption by banks, attracts some investors who feel that Ripple’s technology will dominate the market and eventually overtake Bitcoin and Ethereum in market capitalization. However, it should be noted that its value has been rising much more slowly over the second and third quarters of 2017 than the value of other major cryptocurrencies.

It was released in 2012 but had been in development for 8 years prior. Ripple is quite different than Bitcoin and Ethereum, having a more corporate image and backing, and is really a decentralized transaction network verified by consensus rather than a straightforward cryptocurrency. It was developed as a fast and cheap real-time gross settlement system, and it can verify transactions in a few seconds, much faster than any other cryptocurrency. It is already used by several major banks, who consider it a more secure system than Bitcoin and other cryptocurrencies. Its native currency is the “Ripple”, but it can support any unit of value, whether fiat currency such as the U.S. dollar or even airmiles or other tokens! This flexibility, as well as its adoption by banks, attracts some investors who feel that Ripple’s technology will dominate the market and eventually overtake Bitcoin and Ethereum in market capitalization. However, it should be noted that its value has been rising much more slowly over the second and third quarters of 2017 than the value of other major cryptocurrencies.

Litecoin

Litecoin is the fifth largest cryptocurrency. Its market capitalization on 1st September 2017 was $3.4 billion. It was released in 2011 and was a fork from Bitcoin, i.e. an offshoot of Bitcoin. Its operation is nearly identical to Bitcoin’s in every way, except it has always had a much faster processing speed, and can currently process transactions at about four times the speed of Bitcoin.

Litecoin is the fifth largest cryptocurrency. Its market capitalization on 1st September 2017 was $3.4 billion. It was released in 2011 and was a fork from Bitcoin, i.e. an offshoot of Bitcoin. Its operation is nearly identical to Bitcoin’s in every way, except it has always had a much faster processing speed, and can currently process transactions at about four times the speed of Bitcoin.

Overview of the 5 Major Cryptocurrencies

From an investment or trading perspective, it makes sense to look at the differences and similarities between each of the major Cryptocurrencies as a starting point. In this way, you can make sure that you are not buying too much of the same kind of thing. So, let’s characterize each of the cryptocurrencies.

Edited 26 Jul 2022, 15:23

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.