Finally signs of peak inflation? Three scenarios for Core CPI and the dollar

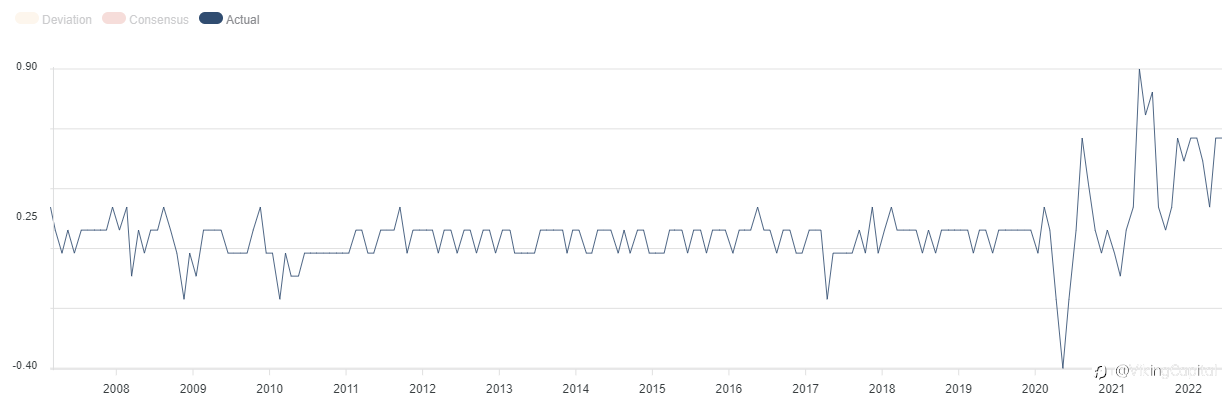

- Economists expect another core inflation rate of 0.6% MoM in June.

- A drop to 0.5% or below would show the economy is slowing, allowing for fewer rate hikes.

- Higher-than-projected figures would weigh heavily on stocks.

When will the heatwave end? That is question for dwellers of the northern hemisphere in midsummer – and for investors wary of boiling inflation. The US Consumer Price Index (CPI) report for June is a critical data point, focusing on Core CPI. That is the figure the Federal Reserve is watching and I am focusing on in this preview.

The central bank has almost no impact on energy and food prices, which are set on global markets and are excluded from Core CPI. However, costs of everything else are impacted by demand that the Fed impact via interest rates. Higher borrowing costs mean saving money makes more sense and taking out loans is dear.

Will the Fed raise rates by 50 or 75 basis points in late July? Where is the peak of interest rates, at 3% 3.5% or higher? The answers to these questions depend on whether inflation has already peaked in the US.

Looking at yearly price rises, headline inflation at 8.6% is worrying, but it could get even worse. Economists expect an increase to 8.8% as energy prices continued advancing last month. The price at the pump is propelling prices toward double-digit rises:

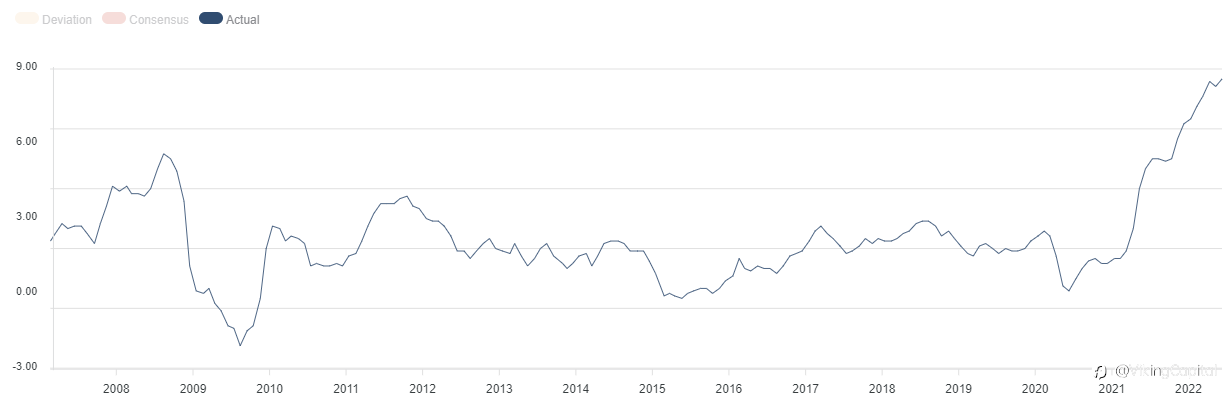

However, Core CPI was already high in June 2021, the figure which now falls out of the series. The calendar is pointing to a drop from 6% to 5.8%. If that happens, would it signal the worst is behind us? No.

Expectations for the monthly price increase stand at 0.6%, which represents an annual increase of over 7%. Moreover, that was the increase in May, so two consecutive jumps in underlying prices – I stress, this excludes gasoline prices – would mean inflation has not peaked.

Core CPI is above its historic norm:

Market reaction

Investors are set to react in a straightforward manner. Higher core inflation means higher interest rates and a stronger dollar. Elevated borrowing costs also make saving money more attractive and investment in risky stocks less so.

Here are three scenarios:

1) As expected: If Core CPI MoM meets expectations at 0.6%, it would be positive for the dollar and adverse for stocks. Not only would it show price pressures remain elevated, it would also point extend current trends in markets. I would argue that even a print of 0.5% would keep the greenback bid and under pressure, albeit to a lesser extent. Such a scenario would cement a 75 bps rate hike and would keep long-term rate expectations unchanged.

2) Below estimates: An increase of 0.4% would represent an annualized rise of 5%, below the yearly figure, and thus would point to a drop in inflation – that the peak is behind us. It would send the dollar down and boost stocks. Speculation about a 50 bps hike in July would gain traction, rather than a 75 bps one. It would also trigger speculation that the Fed could settle for a sub-3% terminal rate.

3) Above projections: A surprising increase of 0.7% or higher would already be depressing for stocks and a boon for the dollar. Investors might even begin considering a radical 100 bps rate hike in July, and arguably begin expecting the final interest rate to reach 4%. It would also raise fears of a global recession and trigger safe-haven flows to the dollar, adding fuel to the fire.

If I have to bet on one scenario, what would it be? I think we could see a 0.5% increase in Core CPI MoM, initially sending the dollar down and stocks up on the fact that inflation is softer than expected. However, as investors realize that it is a small miss and that a 6% annualized rate of core inflation is still high and more importantly – not necessarily reflecting a peak in inflation. That would eventually send the dollar higher and stocks lower, extending the trend.

Final thoughts

The CPI report for June is critical for markets and set to trigger more volatility than the Nonfarm Payrolls. Any sign that inflation has peaked would trigger a relief rally in markets, but there are higher chances that underlying inflation remains stubbornly high.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-