GBPJPY Nears Key Support as January’s Sell-off Sharpens

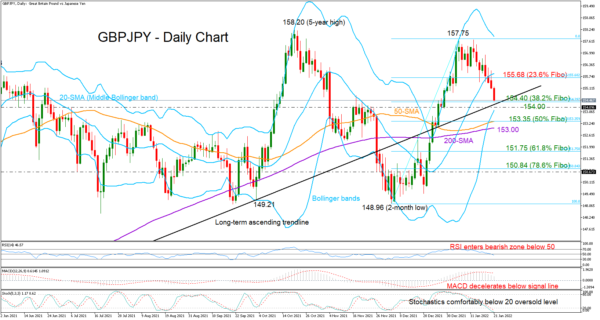

GBPJPY continues to trend southwards so far this month following the peak at a two-month high of 157.75, with the price recently slipping back below its 20-day simple moving average (SMA) to reach a new low at 154.39 on Friday.

The pair is decelerating within the lower bearish Bollinger zone and the momentum indicators are painting a gloomy picture for the short term as the MACD keeps losing ground below its red signal line and the RSI is entering the bearish territory below 50.

Encouragingly, the long-term ascending trendline from March 2020, which managed to add some footing under the price at the end of December, is within breathing distance around 154.40. A rebound here cannot be excluded as the Stochastics are already comfortably below their 20 oversold level. Also, the 38.2% Fibonacci retracement of the 148.96 – 157.75 up leg and the lower Bollinger band are in the neighborhood, increasing the odds for an upside reversal.

Should the bears breach that floor, the pair may weaken towards the 50% Fibonacci of 153.35 and the 50-day SMA. If the 200-day SMA at 153.00 gives way as well, the sell-off may sharpen towards the 61.8% Fibonacci of 151.75.

Otherwise, a bounce on the trendline could initially pause between the 23.6% Fibonacci of 155.68 and the 20-day SMA slightly above at 155.91 before it challenges the tough ceiling within the 157.75 – 158.20 territory. The 160.00 psychological mark, last seen in 2016, could be the next target.

In brief, GBPJPY is currently holding a bearish bias. Unless the 154.40 region blocks the way, the sell-off may stretch towards the longer-term SMAs.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.