Yen Rises Again on Risk-Off Sentiment, Crypto Tumbles

Yen is regaining strength in Asian session today and sentiment turned risk-off again. In particular, selloff is particularly apparent in cryptocurrencies. Swiss Franc, Euro and Dollar are all ticking up slightly. On the other commodity currencies are under some pressure, with Aussie leading the way down. For the week, Yen is currently the best performer, followed by Canadian Dollar. Kiwi is the worst, followed by Euro.

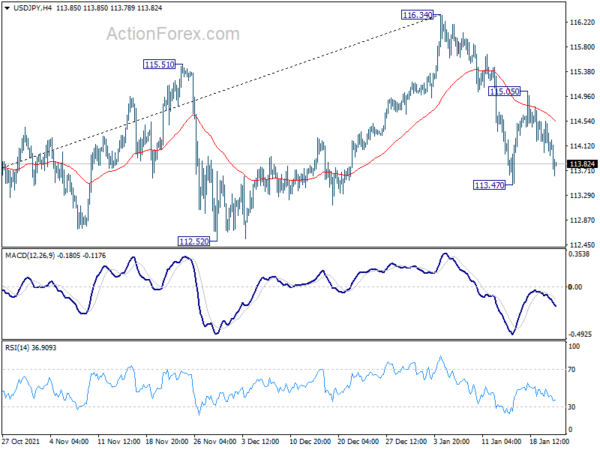

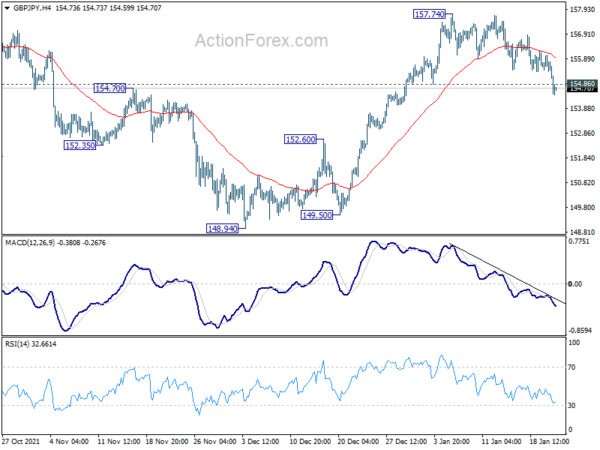

Technically, GBP/JPY’s break of 154.86 support now suggests that rise from 148.94 has completed at 157.74, ahead of 158.19 resistance. Deeper decline is now in favor back to 152.60 resistance turned support and possibly below. One focus is now on when USD/JPY would break through 113.47 support to resume the decline from 116.34, to solidify near term bullishness in Yen.

In Asia, Nikkei closed down -0.84%. Hong Kong HSI is down -0.67%. China Shanghai SSE is down -0.80%. Singapore Strait Times is down -0.14%. Japan 10-year JGB yield is down -0.0088 at -0.136. Overnight, DOW dropped -0.89%. S&P 500 dropped -1.10%. NASDAQ dropped -1.30%. 10-year yield rose 0.006 to 1.833.

Japan CPI core unchanged at 0.5% yoy in Dec

Japan CPI core (all item ex-food) was unchanged at 0.5% yoy in December, below expectation of 0.6% yoy. But that’s still the second increase in a row, and the fastest pace in nearly two years. All item CPI accelerated from 0.6% yoy to 0.8% yoy. All item ex-food, ex-energy CPI dropped from -0.6% yoy to -0.7% yoy.

In the minutes of December BoJ meeting, a board member said, “we’re seeing signs of change in the price-setting behavior of Japanese firms, which had been said to be cautious about raising prices for fear of seeing sales volume fall,.”

Another member noted, “it’s unlikely Japan will see wages rise as sharply as in the United States. But there’s a significant chance both economic growth and inflation could overshoot expectations,”

Earlier this week, BoJ raised 2022 and 2023 core CPI projection. But it also indicated there is no rush to change the ultra-loose monetary policy.

New Zealand BusinessNZ PMI rose to 53.7, return to growth

New Zealand BusinessNZ Performance of Manufacturing Index rose from 51.2 to 53.7 in December. Looking at some details, Production rose from 53.0 to 56.3. Employment rose from 48.5 to 52.0. New orders rose from 55.4 to 57.5. Finished stocks rose from 48.7 to 52.0. Deliveries rose from 43.9 to 50.0.

BNZ Senior Economist, Doug Steel stated that “in the final quarter of 2021 the PMI averaged 53.2, indicating a return to positive manufacturing GDP growth after a sharp negative in the prior quarter.”

Bitcoin breaks 40k, Ethereum breaks 3k, as selloff resumes

Bitcoin breaks down through 39636 temporary support today, after another rejection by 4 hour 55 EMA. Down trend from 68986 resumes and should now target 61.8% projection of 68986 to 41908 from 52101 at 35366. For now, such decline is seen as part of a long term range pattern between 29261 and 68986 only. Hence, momentum to start to diminish below 35366, and a bottom should be formed above 29261 low. Nevertheless, break of 44448 resistance is needed to indicate bottoming, or risk will stay heavily on the downside.

Ethereum also resumes recent fall from 4863.75 by breaking through 2927.20 today. Next target is 100% projection of 4863.75 to 3439.00 from 4126.20 at 2701.45, which is close to 2647.30 support. Downside momentum should start to diminish below this level. The question is where between 1715.62/2647.30 would ethereum forms a bottom. But in any case, break of 3411.05 is needed to indicate bottoming first, or risk will stay heavily on the downside. The fall from 4863.75 could eventually extend to 161.8% projection at 1820.95, which is close at 1715.62 low, become finishing.

Looking ahead

UK retail sales is the main feature in European session. Later in the day, Canada will also release retail sales, and new housing price index.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 154.88; (P) 155.47; (R1) 155.80; More…

GBP/JPY’s break of 154.85 support argues that rebound from 148.94 has completed at 157.74, ahead of 158.19 high. Fall from 157.74 is seen as the third leg of the consolidative pattern from 158.19. Intraday bias is back on the downside. Sustained break of 55 day EMA (now at 154.11) will target 148.94 support next. For now, risk will stay on the downside as long as 157.74 resistance holds, in case of recovery.

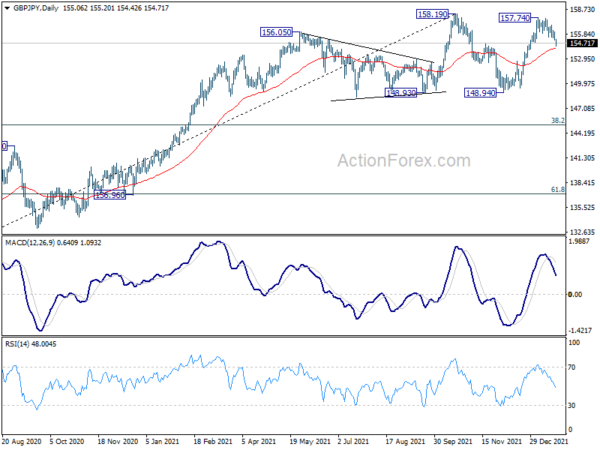

In the bigger picture, strong rebound from 148.93 key structural support retains medium term bullishness. Firm break of 158.19 high will resume whole up trend from 123.94 (2020 low), to 61.8% retracement of 195.86 to 122.75 at 167.93. Nevertheless, firm break of 148.93 will bring deeper correction to 38.2% retracement of 123.94 to 158.19 at 145.10, and possibly further lower, as a correction to up trend from 123.94 at least.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.