USDCAD Marks Yet More Lower Highs as Bearish Forces Linger

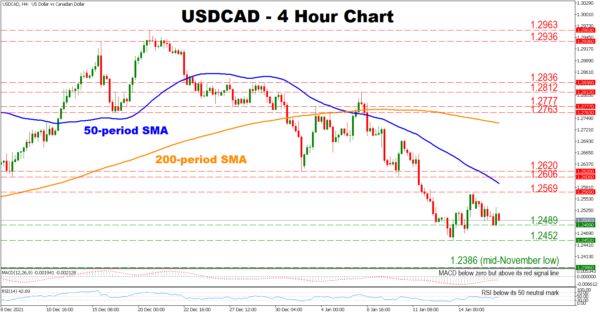

USDCAD has marked yet more lower highs and lower lows due to lingering negative forces. Moreover, the pair is also trading well below its 50- and 200-period simple moving average (SMA), and has recently completed a ‘death cross’ where the 50-period SMA has crossed below the 200-period SMA, increasing fears of a sustained bearish outlook.

Short-term momentum indicators are supporting a mixed picture as the RSI is located below its 50 neutral mark. However, despite the MACD being below zero, it is found above its red signal line, indicating that the negative bias might be fading.

Should the bears remain in charge, initial support might be found at the 1.2489 hurdle. A decisive move below this point could send the price to test the 1.2452 level. A break below the latter could increase selling pressures, shifting sellers attention towards the mid-November low at 1.2386.

On the flip side, should buyers regain control, initial resistance might be found at the 1.2569 barrier before shifting their attention towards the 50-period SMA currently at 1.2596. Crossing above the latter, the pair could test the congested region which includes the 1.2606 and the 1.2620 obstacles. A break above that area could induce further buying activity, opening the door towards the 200-period SMA currently at 1.2738.

In brief, the overall outlook for the bear is bearish. For sentiment to change, sellers would need to break above the 50-period SMA.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.