Digital Revolution: Will Cryptocurrencies Take Over the World? Part II

Part II: Are Stablecoins Really “Stable”?

Summary

- Stablecoins, which are a category of digital currency, have many favorable characteristics. Payments can be settled essentially instantaneously, and “unbanked” individuals can easily use them. Their supplies are not limited, so potential problems with deflation do not arise with stablecoins as they potentially could with limited forms of digital currencies.

- Unlike other cryptocurrencies, such as Bitcoin and Ether that exhibit extreme levels of price volatility, the values of stablecoins tend to be stable. Many stablecoin issuers claim that their tokens are fully “backed” by reserves.

- However, assets that can experience their own periods of illiquidity and price dislocation represent a significant proportion of the reserves of some stablecoin issuers. If the confidence of investors in the value of their holdings is shaken, then stablecoin issuers can experience “runs,” much like commercial banks before the advent of deposit insurance and the creation of a robust supervisory and regulatory framework.

- If the explosive growth that stablecoins have enjoyed in recent years continues in coming years, then periods of financial market volatility could potentially become extreme.

- Stablecoin issuers have largely operated in a regulatory vacuum until now. But regulators have become acutely aware of the potential risks that stablecoins present, and they are scrambling to catch up. Some federal agencies have recommended that Congress pass legislation that would require stablecoin issuers to become insured depository institutions, which would be subject to supervision and regulation by the appropriate regulatory bodies.

- Furthermore, private stablecoin issuers may soon face competition from central banks that are gearing up to issue their own digital currencies. We will discuss central bank digital currencies (CBDCs) in Part III of this series.

Stablecoins: Benefits of Digitization Without Price Volatility

In the First Report of our series on cryptocurrencies (a.k.a. digital currencies), we discussed their ability to perform the three basic functions of money as well as some of their benefits and drawbacks. In terms of the functions of money, their use as a unit of account is limited at present. That is, prices of most goods and services continue to be expressed in terms of national currencies (e.g., U.S. dollars, euros, etc.) rather than in cryptocurrencies per se. Digital currencies are being used as mediums of exchange, albeit still well short of the volume of transactions that are being processed via national currencies at present. They can provide good stores of value, at least when held over long periods of time. But the high degree of price volatility that is inherent in digital currencies can limit their ability to serve as a store of value for individuals and businesses in the short term. Furthermore, the investment options of cryptocurrencies are limited at present, because there has been no issuance of crypto-denominated securities, to the best of our knowledge.

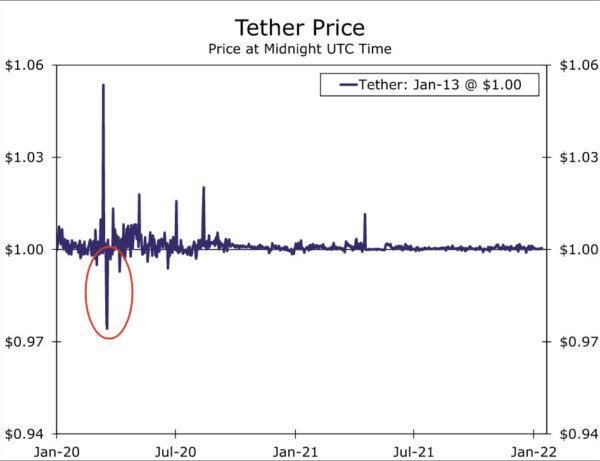

But there is a class of cryptocurrencies, which are known as “stablecoins,” that possess the benefits of digitization without the extreme price volatility of some other digital currencies, such as Bitcoin and Ether. As the first half of their name implies, prices of stablecoins tend to be stable, because their values are essentially pegged to another asset, such as a national currency. For example, Tether, which is the most widely used stablecoin, is convertible to U.S. dollars at a ratio of 1:1 and the issuers of Tether claim that every token is fully backed by $1 worth of dollar-denominated assets. Since it started trading in 2015, the day-to-day price fluctuation of Tether has generally been less than one-hundredth of a cent. That said, there have been episodes when the price has moved by significantly more, a topic to which we will subsequently return. Other widely used stablecoins include USD Coin and Binance USD, which also have very low price volatility.

Stablecoins have a number of benefits, some of which are inherent to all digital currencies and some of which are specific to stablecoins. Similar to all cryptocurrencies, payments made in stablecoins can be settled essentially instantaneously. This is especially important for payments that are made across national borders, which historically have been time-consuming and characterized by high transactions costs. In addition, stablecoins could be used to make costless payments for “unbanked” individuals, which we discussed in more detail in Part I. But what sets stablecoins apart from other digital currencies is that the former do not have wild swings in value, thereby enhancing their property as a short-term store of value. Furthermore, the supply of stablecoins is not limited. Consequently, the potential deflation issue associated with a limited money supply that we discussed in our first report does not arise with stablecoins.

But stablecoins do not overcome some notable drawbacks of digital currencies. Similar to other cryptocurrencies, there has been no issuance to date, to the best of our knowledge, of securities that are denominated in stablecoins. Therefore, individuals who own stablecoins earn a rate of return of 0%, unless they place those tokens in a crypto savings account, which we briefly noted in Part 1. But because stablecoins do not have wild swings in value, corporate treasurers in coming years could potentially start to issue securities that are denominated in stablecoins, which would enhance their quality as a store of value. In addition, stablecoins could be used increasingly by individuals and businesses to make payments due to their stable values.

Stablecoins Are Potentially Vulnerable to “Runs”

But there is a more significant drawback to stablecoins that was highlighted in a recent Speech by Federal Reserve Governor Christopher Waller. Specifically, stablecoins are issued by the private sector and, in essence, stablecoin issuers resemble 19th century commercial banks. As long as depositors in that bygone era were confident that they could withdraw all of their money from their bank, the system was sound. But as soon as that confidence was shaken, a “run” on the bank could ensue that could lead to the collapse of the bank. In a full-blown panic, such as what occurred in 1893 and again in 1907, the entire banking system was potentially at risk. The Federal Deposit Insurance Corporation (FDIC) estimates that about 9,000 American banks failed between 1930 and 1933, which contributed to the depth and the severity of the Great Depression.

In response, Congress created the FDIC in 1933 to guarantee the value of banking accounts. Today, the FDIC guarantees checking and savings accounts up to $250,000 per depositor, per insured bank. Furthermore, deposit-taking institutions are regulated and supervised by federal and state agencies. The existence of deposit insurance in conjunction with a robust supervisory and regulatory framework gives individuals confidence in the safety of their deposits. Bank runs, which were commonplace prior to the establishment of the FDIC and federal regulatory bodies, have been exceedingly rare since 1933.

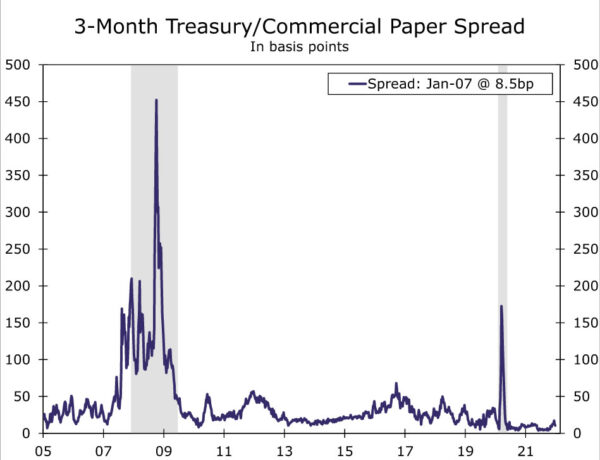

In contrast, the value of stablecoins are not guaranteed and stablecoin issuers are not currently regulated. Many stablecoin issuers claim that their coins are “backed” by some other asset(s). For example, the issuers of Tether state that “every Tether token is always 100% backed by our reserves,” which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties.” In that regard, the most recent independent accountant’s report, which was published in September 2021, showed that “commercial paper and certificates of deposit” accounted for more than 40% of Tether’s assets. Normally, the commercial paper (CP) market is deep and liquid with interest rates on high-quality CP only a few basis points above rates paid on Treasury bills (Figure 1).

However, the CP market can become illiquid during times of financial stress. As Figure 1 makes clear, CP spreads spiked during the 2008 financial crisis and again in March 2020 when the global economy was going into free fall amid the onset of COVID-19. This sharp rise in CP interest rates relative to T-bill rates implies that prices of CP nosedived. In other words, the value of the assets that, at least in part, “back” stablecoins fell sharply, and owners of stablecoins no longer had assurance that each token they owned was fully convertible into one U.S. dollar. Selling of stablecoins ensued, causing their prices to fall. As shown in Figure 2, the price of Tether dipped to $0.97 in March 2020. The price of USD Coin also fell during that period.

Periods of market dislocations, as occurred in March 2020, can potentially initiate negative feedback loops. That is, marked declines in CP prices can lead to weakness in stablecoin prices. Selling of CP by stablecoin issuers to finance redemptions puts added downward pressure on CP prices, which can then lead to further price declines of stablecoin prices, etc. Furthermore, dislocations in one asset market, such as the CP market, can quickly spill over to other asset markets. The Federal Reserve moved quickly to pump liquidity into financial markets in March 2020, but the price dislocations experienced in the CP and stablecoin markets during that period could have been more extreme and long-lasting had officials not acted so nimbly and adeptly. Stablecoins had not yet been created in 2008, but the sharp price declines experienced in the CP market during the global financial crisis undoubtedly would have put significant downward pressure on prices of stablecoins, had they existed at that time. Because the size of the stablecoin market has grown exponentially—the market capitalization of Tether, which is just one stablecoin among many, has shot up from about $4 billion at the beginning of 2020 to roughly $78 billion at present—stablecoins represent a potential risk to the financial system.

There is also the issue of market power. There are numerous issuers of stablecoins at present, but as demonstrated by other tech platforms over the past few decades, one company can become dominant due to network effects. For example, there initially were many “word processing” software programs available when the technology was first developed. But Microsoft Word eventually emerged as the program that essentially all individuals wanted to adopt, because a “critical mass” of other individuals were using it. The same winnowing process could eventually occur with stablecoins, which could lead to an undue amount of market power for that issuer. Is it good public policy to allow the payment system of an economy to be controlled by a small handful of private companies without public sector oversight?

Conclusion

Similar to all digital currencies, there are some significant benefits associated with stablecoins. They allow payments to be made essentially instantaneously, and “unbanked” individuals could use stablecoins provided they have a mobile phone. Issuance of stablecoins can be unlimited, so the potential deflationary risk that arises with digital currencies with limited issuance does not arise. Their attractiveness as a short-term store of value is enhanced by their generally stable values.

But there is a notable drawback to stablecoins at this time. Specifically, their values are not insured, as commercial bank deposits are, and stablecoin issuers are not regulated at present. Consequently, in periods of heightened financial stress, such as autumn 2008 and March 2020, stablecoin issuers could potentially experience destabilizing “runs.” If the explosive growth that stablecoins have enjoyed in recent years continues in coming years, then periods of financial market volatility could potentially become extreme.

Government regulation usually lags developments that occur in the private sector, and stablecoin issuers have largely operated in a regulatory vacuum. But regulators are becoming attuned to the risks that stablecoins potentially present, and they are scrambling to catch up. Although it is not clear what sort of legislation Congress may eventually enact, the days of laissez-faire in the stablecoin market are probably numbered. Furthermore, private stablecoins issuers may soon face competition from digital currencies that are issued by central banks, which is the topic of our next report in this series.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.