3 Stocks You Can Confidently Buy After a Market Downturn

Motley Fool Issues Rare “All In” Buy Alert

The market has been on an epic run since the depths of the 2020 pandemic-driven bear market. But every bull market is, indeed, followed by a bear. The time to prepare for the downturn is during the upturn, by creating a list of great companies that you would like to own if only they were cheaper. Here are three you'll want to put on that list today.

1. The best of the best locations

Real estate investment trust (REIT) Federal Realty (NYSE:FRT) owns a collection of 106 shopping center and mixed-use assets, most of which have grocery components. In many ways, this is a stunningly boring business, though one that plays an important role in the everyday lives of the American public. However, boring can be beautiful, especially if you like dividends -- Federal Realty is a Dividend King with over 50 years worth of annual dividend hikes. It is the only REIT that can claim that highly elite title.

IMAGE SOURCE: GETTY IMAGES.

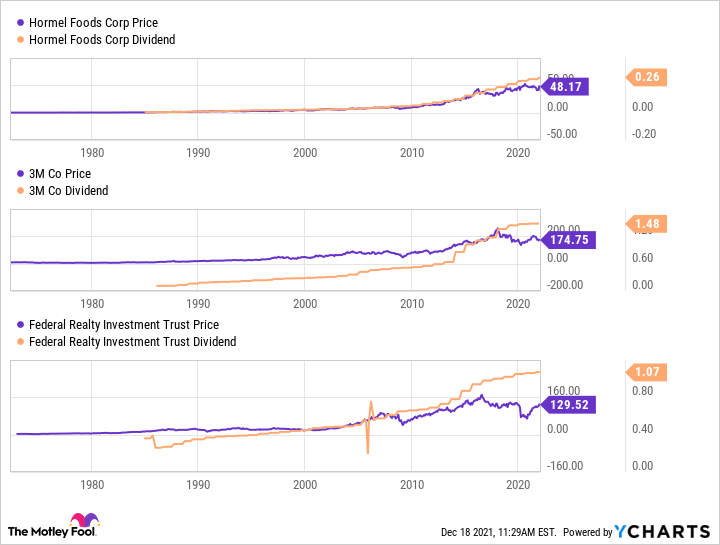

The problem is that investors are well aware of how consistently well Federal Realty performs, and the dividend yield is a miserly 3.3%. During the last bear market, the yield spiked to more than 6%. Granted, there were unique features to the pandemic that helped with the negative investor sentiment -- but given its retail focus, another bear market is likely to present a buying opportunity here.

What you are getting in the meantime is a company with extremely well-located and profitable assets. Although it has just 106 properties, they generated a massive $247 million in rent in the third quarter of 2021. Regency Centers, one of Federal Realty's largest peers, owns 394 properties and generated $283 million in rent. In other words, with less than a third as many locations, Federal Realty earned nearly as much in rent. If this REIT sells off again, buy it.

2. An excellent brand manager

Next up is Hormel Foods (NYSE:HRL), which owns a collection of industry-leading brands, including SPAM, Planters, and Wholly Guacamole. Like Federal Realty, it is a Dividend King, with 55 years of annual dividend increases behind it. The yield is around 2.1%, which is actually toward the high end of its historical range. That said, during the 2007-2009 recession, which included a bear market, the yield got to nearly 3%. It's not a bad price right now, using yield as a measure of valuation, but at nearly 3% it would be a massive steal.

What's really interesting here is that Hormel has multiple levers for growth from a very strong base of iconic brands. For example, it is only just starting to reach into foreign markets, using acquisitions to gain a sizable foothold for expansion. Its recent acquisition of Planters expands its scale in the convenience store market, where Hormel can easily start selling other brands it owns. It has a unique food service model selling pre-cooked meat directly to restaurants and others that has taken off amid the pandemic because of tight labor markets. And it is working to build its scale in the deli space, which has higher margins than its core center-of-the-aisle properties.

If history is any guide, investors can expect great things in the future. Notably, Hormel's annualized dividend increase over the past decade has been a huge 15%! That may not repeat itself, but even half of that would be impressive, and definitely worth adding to your portfolio on broad-based market weakness.

HRL DATA BY YCHARTS

3. Tough to love right now

Last up is industrial giant 3M (NYSE:MMM), which is also trading with a yield (at 3.3%) toward the high end of its historical range. Like each of the names above, it is a Dividend King. That said, during the 2020 bear market the yield spiked to nearly 5%, which is huge for this company. If it were to get anywhere near that number again, investors should consider backing up the truck, as the saying goes.

3M has a global business spread across dozens of different industries. It breaks its operations down into four broad groupings, but they don't do justice to the number of products, often backed by proprietary technology, that this industrial giant offers. What's interesting is the way in which it spreads a good idea across the company to seed innovation. For example, adhesives are a core competency. The company uses adhesives in its range of dental products, auto products, wound care, wall hangers, and, of course, the iconic Post-it notes it sells.

Right now the company is dealing with a broad growth slowdown, but its research and development can't be timed to perfection. History suggests it will eventually innovate, or buy, its way to higher growth rates. It is also dealing with some lawsuits, but it is large enough and financially strong enough to handle the likely hit here. While 3M looks fairly attractive today, if you'd like an even better price, put this one on your wish list too.

Ready to pounce

Investing is very much about controlling your emotions. That can be hard to do when the market is selling off. However, if you prepare ahead of time by making a list of great companies that you'd like to own, you will be ready to act when fear has gripped other investors.

Federal Realty is a great shopping center landlord trading at a premium today, but a downturn could present a buying opportunity. Hormel and 3M both seem fairly priced right now, using dividend yield to track valuation, but a downturn could make these rock-solid names even more attractive for those with a deeper value bent.

10 stocks we like better than 3M Company

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and 3M Company wasn't one of them! That's right -- they think these 10 stocks are even better buys.

© MotleyFool. Copyright and all rights therein are retained by authors.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.