Carlisle (CSL) Gains From Solid Demand and Buyout Synergies

Carlisle Companies Incorporated (CSL - Free Report) manufactures and provides waterproofing and roofing products, finishing equipment, and engineered products. Its footprints are impressive in Africa, the United States, Asia, Europe, Canada, Latin America, Africa, and Mexico.

Solid growth opportunities and fundamentals have raised the company’s attractiveness. Presently, the Scottsdale, AZ-based company carries a Zacks Rank #2 (Buy). The company belongs to the Zacks Diversified Operations industry, which is in the top 28% (with a rank of 70) of more than 250 Zacks industries.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

What’s Making CSL an Attractive Investment Option?

In the first three quarters of 2021, Carlisle’s earnings beat estimates on all occasions. In the last reported quarter, its earnings were $2.99 per share, up 9.52% from the Zacks Consensus Estimate of $2.73. Then again, the bottom line in the quarter grew 54.1% year over year on the back of sales growth, partially hurt by high corporate expenses.

Notably, the Zacks Consensus Estimate for fourth-quarter 2021 (slated to report results on Feb 10, 2022) earnings of Carlisle is pegged at $2.63, suggesting an increase of 77.7% from the year-ago quarter’s reported figure.

Several factors are favoring the growth prospects of Carlisle. Products offered are diverse and demand is also healthy in the markets served. Also, the company benefits from acquired assets. It acquired California-based Henry Company last September. Other previous notable buyouts made by Carlisle include Providien, Petersen, Ecco Finishing and MicroConnex. Sound shareholder-friendly policies too add to the stock’s attractiveness. The acquisition of Henry Company is expected to add $1.25 per share to 2022 earnings.

For the Carlisle Construction Materials (“CCM”) segment, the strengthening business in the reroofing markets of the United States and Europe as well as growth in architectural metals and polyurethane platforms are proving advantageous.

Then again, focus on expanding the medical technologies platform, demand in the medical business, and improvements in the commercial aerospace business is favoring the Carlisle Interconnect Technologies (“CIT”) segment. The Carlisle Fluid Technologies (“CFT”) segment will gain from product introductions, focus on foam and powder, and sealants and adhesive platforms.

For 2021, Carlisle anticipates CCM’s revenues to grow in the mid-20 percentage range, while that of the CFT segment is to be in the mid-teens. Revenues of CIT, however, are likely to decline in the mid-single digits. Also, supply-chain restrictions, inflationary pressures, and raw materials are problematic.

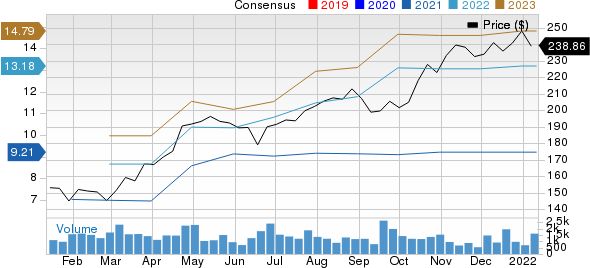

The Zacks Consensus Estimate for Carlisle’s earnings per share is pegged at $9.21 for 2021 and $13.18 for 2022, suggesting year-over-year growth of 56.6% and 43.2%, respectively. The consensus estimate for 2021 reflects no change and that for 2022 mirrors an increase of 1% from the 60-day-ago figures.

Carlisle Companies Incorporated Price and Consensus

Other Players From the Industry

Below we discussed three companies from the same industry that are slated/anticipated to release earnings results this month.

Danaher Corporation (DHR - Free Report) will release the results for fourth-quarter 2021 on Jan 27, before market opens. The company presently carries a Zacks Rank #2.

The Zacks Consensus Estimate for fourth-quarter earnings of Danaher is pegged at $2.50 per share, reflecting no change from the 60-day-ago figure. Also, estimates are pegged at $9.86 for 2021 and $10.27 for 2022, reflecting increases of 0.6% and 1.9% from the respective 60-day-ago figures.

3M Company (MMM - Free Report) is expected to report its fourth-quarter 2021 results on Jan 25. The company presently carries a Zacks Rank #3 (Hold).

The Zacks Consensus Estimate for 3M’s earnings is pegged at $2.05 per share for the fourth quarter of 2021, reflecting a 1% decrease from the 60-day-ago figure. Meanwhile, estimates for 2021 are pegged at $9.86 and for 2022 at $10.58. These estimates suggest a 0.1% decrease for 2021 and growth of 0.7% for 2022 from the respective 60-day-ago figures.

Crane Co. (CR - Free Report) will report its fourth-quarter 2021 results on Jan 24, after market close. The company presently carries a Zacks Rank #4 (Sell).

The Zacks Consensus Estimate for Crane’s earnings is pegged at $1.12 per share for the fourth quarter of 2021, reflecting a 2.6% decrease from the 60-day-ago figure. Meanwhile, estimates for 2021 are pegged at $6.42 and that for 2022 is pinned at $7.24. The estimates suggest a 0.2% decrease for 2021 and a 1% fall for 2022 from the respective 60-day-ago figures.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

© Zacks. Copyright and all rights therein are retained by authors.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.