Digital Revolution: Will Cryptocurrencies Take Over the World? Part I

Part I: Are Cryptocurrencies Really “Money”?

Summary

The form that money takes has evolved over the centuries. Most recently, fiat money and bank deposits replaced gold and other precious metals as the predominant form of money. Will cryptocurrencies (a.k.a. digital currencies) supplant paper money and bank deposits?

- According to most economics textbooks, money has three main functions: it is a medium of exchange, a unit of account and a store of value.

- Digital currencies are already being used as a medium of exchange, but their use as a unit of account is more limited at present. That is, prices of most goods and services continue to be expressed in national currencies, not in terms of digital currencies per se.

- Cryptocurrencies can offer a store of value, at least in a long-run sense. However, the extreme price volatility of many digital currencies implies that individuals and businesses can experience meaningful short-term losses. Furthermore, there has been no issuance to date of crypto-denominated securities (i.e., stocks and bonds), to the best of our knowledge.

- There are a number of benefits of digital currencies. Payments can be made essentially instantaneously via cryptocurrencies, and these transactions can be made secretly. They can also be a good inflation hedge.

- But digital currencies also possess a number of notable drawbacks. Secrecy can enable illicit activities, and their limited supply could potentially lead to a deflationary situation.

- Stablecoins, which are digital currencies whose prices are essentially tied to another asset such as the U.S. dollar, may offer some of the benefits of cryptocurrencies without some of their notable drawbacks. We will discuss so-called “stablecoins” in Part II before turning our focus to central bank digital currencies in Part III. We will offer conclusions in the fourth and final report in this series.

Will National Currencies Go the Way of the Horse & Buggy?

Humans have been engaging in voluntary and welfare-enhancing exchange of goods and services for millennia. Initially, these exchanges were transacted via barter. For example, an individual in ancient Mesopotamia may have been willing to trade three lambs to another individual for two bushels of wheat. If the other individual agreed to those terms, the trade was made. But barter is an inefficient form of exchange, because the terms of each and every transaction need to be negotiated. Eventually, people invented “money,” to serve as a medium of exchange. Instead of exchanging lambs for wheat directly, individuals could sell their lambs for money and then use money to subsequently buy wheat either at that time or sometime in the future. Gold and other precious metals were used as some early forms of money.

Gold and other precious metals have intrinsic value. That is, these metals can be used to make goods, such as jewelry, that individuals value. But a disadvantage of precious metals is their weight which limits their transportability. A gold bar could conceivably be used to buy goods and services, but a standard gold bar weighs 27 lbs. Gold coins weigh significantly less than an entire bar, but it is not always practical to carry around numerous coins. So fiat currencies (i.e., paper money that is issued by governments and central banks of sovereign nations) gradually came into use. During the Gold Standard era, paper money was “backed” by gold. Individuals and businesses could exchange the paper bills they possessed for an equivalent value of gold. But the U.S. government stopped gold convertibility in 1971. Today, paper money is not “backed” by anything that has intrinsic value.

Indeed, there is little intrinsic value to paper money; the paper itself is essentially worthless. But what gives paper money its value is the trust that people have that other individuals will accept it as a means of payment. And these recipients of paper money are willing accept it as payment for goods and services because they trust that other people will do so as well. In short, paper money is backed by trust: trust that other people will accept it in exchange for goods and services. But if this trust breaks down, then paper money becomes worthless.

Modern monetary systems have evolved further and include more than just paper money. There currently is more than $2 trillion of paper notes and coins that are denominated in U.S. dollars in circulation today. These physical forms of money can be considered as “public” money because they are liabilities of the U.S. government (coins) or the Federal Reserves (paper notes). But there is nearly $5 trillion in demand deposits (i.e., plain vanilla checking accounts) in U.S. financial institutions, and the value of other liquid deposits, which can easily be converted into cash or demand deposits, exceeds $13 trillion. These deposits can be considered as “private” money because they are liabilities of privately-owned financial institutions. However, the value of these deposits are guaranteed by the federal government, up to a limit, and they can be used to purchase goods and services.

This brings us to 21st century and the advent of cryptocurrencies (a.k.a, digital currencies.). Bitcoin, which was introduced in 2009, was the first cryptocurrency. But the number of digital currencies has mushroomed in recent years. According to coinmarketcap.com there currently are more than 16,000 digital currencies, although many of these cryptocurrencies are little used at present. Just two cryptocurrencies (Bitcoin and Ether) together account for about 60% of the $2 trillion worth of digital currencies that are in circulation today. Although coins and paper bills, which have physical forms, comprise a part of most nations’ money supplies, cryptocurrencies exist only in electronic form that has even less intrinsic value than paper.

As discussed above, the form that money takes has evolved over the centuries, and there are no properties inherent in paper money and bank deposits that necessarily make them the final step in the evolutionary chain of monetary systems. The explosive growth in the amount of outstanding digital currencies, from nonexistent a few short years ago to roughly $2 trillion today, raises an interesting question: will cryptocurrencies such as Bitcoin and Ether eventually replace national currencies such as the U.S. dollar and the euro? We will attempt to provide an answer to that question is a series of four reports.

This series is organized as follows: we focus on the benefits and drawbacks of digital currencies in this first report. In the second report, which we plan to publish shortly, we will focus on privately-issued “stablecoins.” As their name implies, one of the benefits of stablecoins is the relative stability in their value. Are there any notable drawbacks to stablecoins? Although issuance of cryptocurrencies is largely confined to the private sector at present, the public sector is starting to get in on the act. We will focus on the future of central bank digital currencies in Part III, and we will offer conclusions in the fourth and final report.

What Functions Does Money Serve?

Let’s start by asking if cryptocurrencies are in fact “money.” According to most economics textbooks, money has three main functions: it is a unit of account, a medium of exchange, and a store of value. In terms of the first function, cryptocurrencies are not used much as a unit of account at present. Prices of most goods and services are largely expressed in terms of national currencies such as U.S. dollars and euros and not in terms of cryptocurrencies per se. In other words, national currencies continue to serve as the numéraire—the common benchmark in which the values of goods and services are measured—in their respective economies. Unless one of the thousands of digital currencies that currently exists becomes completely dominant, cryptocurrencies likely will not become units of account anytime soon.

Despite their limitations as units of account, digital currencies fulfill the function of mediums of exchange. That is, individuals can use cryptocurrencies to buy goods and services, provided the sellers agree to accept them as payment at the prevailing exchange rate between a specific digital currency and a specific national currency (e.g., the prevailing U.S. dollar/Bitcoin exchange rate). Bitcoin is presently used in roughly 250,000 or so transactions daily on a global basis, although this amount is just a fraction of the U.S. dollar-based transactions that occur every day. The reluctance to date of governments, except for El Salvador, to designate cryptocurrencies as legal tender clearly restrains their wider adoption as mediums of exchange.4 Furthermore, China’s central bank announced in September 2021 that any transactions conducted in the country in privately-issued cryptocurrencies would henceforth be illegal. This move by the world’s second largest economy also splashes some cold water on the wider adoption of digital currencies as mediums of exchange. That said, the number of crypto-based transactions could clearly increase further in coming years given that there are more than 16,000 cryptocurrencies that already exist.

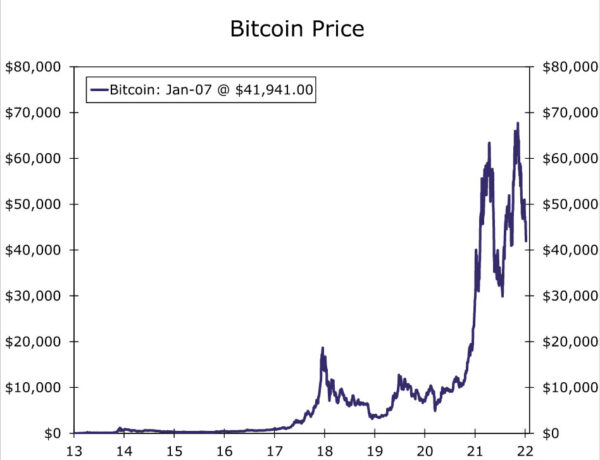

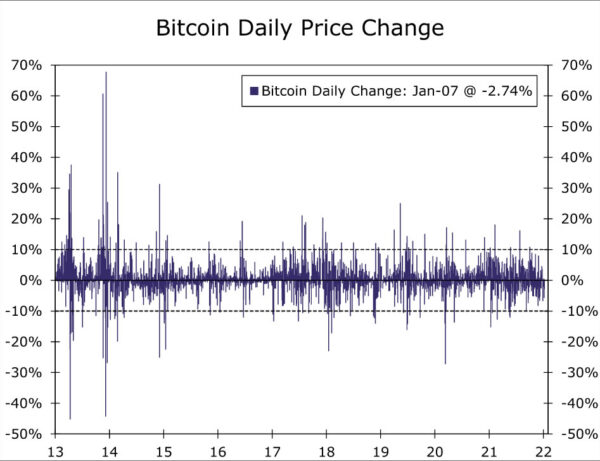

Are cryptocurrencies “stores of value”? Yes, at least in a long-run sense. The price of one bitcoin on December 30, 2011 was $4.25, and it ended 2021 at roughly $46,000. If an individual had remained in possession of that token over that ten-year period, then he or she would have realized an average return of more than 150% per annum (Figure 1). But this incredible rate of return over the past ten years has been associated with stomach-churning volatility. For example, the price of Bitcoin slumped more than 80% between December 2017 and December 2018. More recently, Bitcoin has dropped roughly 40% from its November 2021 peak of nearly $70,000. The average daily price fluctuation of Bitcoin since January 2012 has been 3%, with day-to-day swings in excess of 10% not uncommon (Figure 2). Clearly, Bitcoin has been an outstanding store of value since its inception, but individuals and businesses that may need to hold it for short periods of time to meet cash flow needs could have incurred significant losses. The same holds true for many other cryptocurrencies.

Individuals who own U.S. dollars can hold them in the simple form of coins, currency and bank deposits. There is no price volatility associated with these forms of money, although their purchasing power can erode over time due to inflation. But individuals can also invest those dollars in numerous fixed income and equity securities. The S&P 500 index has risen significantly less than Bitcoin—about 14% on an average per annum basis since 2012—but without the same degree of volatility. In that regard, the average daily price fluctuation of the S&P 500 has been only 0.7% since 2012, with just one daily price swing (daily close-to-daily close) in excess of 10%. The price volatility of investment grade debt securities tends to be even lower. These dollar-denominated securities tend to be good stores of value because they generally pay dividends (stocks) or coupons (bonds), and equities generally appreciate over time.

In contrast, the investment options of cryptocurrencies are more limited at present. Crypto saving accounts have been developed recently whereby owners of digital currencies can place their holdings into these accounts and the funds are then lent to borrowers. These saving accounts typically offer attractive rates of interest, but borrowers could potentially default and the value of the accounts are not government guaranteed.

Furthermore, to the best of our knowledge, no government or company has yet issued a crypto-denominated security. Bitcoin exchange-traded funds (ETFs) have recently been created, but the prices of these ETFs simply mirror the price of Bitcoin. Digital asset securities also have been created, whereby an individual can trade shares of stock digitally. The investor may be able to use a cryptocurrency to buy these securities, but the underlying assets (e.g., shares of Apple or Amazon) are denominated in national currencies such as U.S. dollars and not in cryptocurrencies per se. In sum, investors who want cryptocurrencies to be part of their portfolios but without the associated price volatility have few options currently.

Will crypto-denominated securities become part of the investment landscape anytime soon? In our view, corporate treasurers likely will remain hesitant to issue crypto-denominated securities, at least for the foreseeable future. Corporate revenues and assets are currently denominated in national currencies, but any company that issued a crypto-denominated security would have exposure to that digital currency on the liability side of its balance sheet. The company could quickly find itself in financial stress from an asset-liability mismatch if the price of the digital currency were to rocket higher.

This mismatch could be reduced if companies held crypto-denominated assets and/or they could hedge their crypto-denominated debt payments but, as noted previously, there are no crypto-denominated securities that corporate treasurers can buy at present. Some companies hold digital currencies as part of their cash balances, but the extreme price swings associated with cryptocurrencies likely make treasurers reluctant to make digital currencies a significant component of those cash balances at this time. Whereas a deep and liquid market exists where corporate treasurers can swap their U.S. dollar-denominated floating rate liabilities into fixed rate liabilities and vice versa (i.e., the swaps market), the ability to hedge crypto-denominated liabilities is currently quite limited. Bitcoin futures contracts have recently come into existence, but contracts that mature more than a month or two in the future are not actively traded at present.

In theory, issuance of crypto-denominated securities could potentially ramp up in coming years, which would enhance their ability to serve as a store of value. But until goods and services are more widely priced in terms of cryptocurrencies (i.e., cryptocurrencies become more widely used as units of account) and/or the extreme price volatility of many digital currencies subsides, we believe that many corporate treasurers will remain hesitant to issue crypto-denominated securities. In short, the ability of digital currencies to serve as stores of value without extreme price volatility likely will remain limited, at least for the foreseeable future.

The Pros and Cons of Cryptocurrencies

There are a number of benefits to cryptocurrencies. First, digital currencies exist only in electronic form, and payments between individuals and businesses can be made essentially instantaneously. In contrast, an individual or business can wait days to receive payment while a check “clears.” Cryptocurrencies could also be used to make costless payments for “unbanked” individuals.5Because these individuals do not have access to checking accounts, they often must rely on costly alternatives such as money orders to make payments. Unbanked individuals would need just a mobile phone to make payments with digital currencies. Digital currencies are generally secure, in contrast to physical cash which can be misplaced or stolen. That said, there is some probability, albeit small, that digital wallets can be hacked.

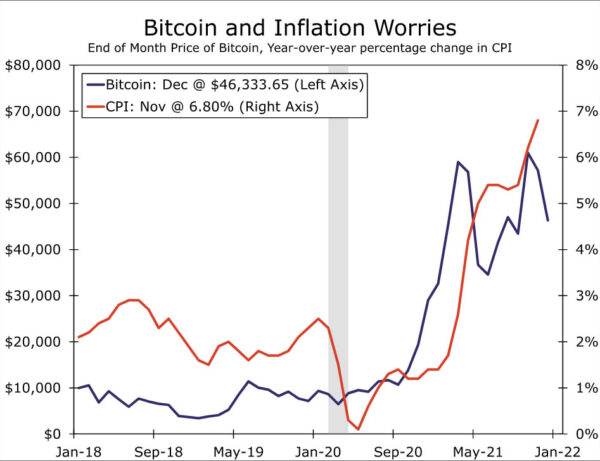

Additionally, cryptocurrencies are not issued by governments, and they largely exist outside the regulatory framework today. So transactions with digital currencies can be made largely in anonymity. And the supply of individual digital currencies are generally limited, so they can be a good inflation hedge. As shown in Figure 3, the recent rise in the rate of CPI inflation has been associated with a sharp increase in the price of Bitcoin.

But there are some notable drawbacks to digital currencies as well. First, the anonymity that some individuals treasure in crypto transactions can help facilitate illicit activities, although the absolute amount of illicit payments is generally small at present.6 Second, the limited supply of digital currencies, which give them properties as an inflation hedge, has some serious drawbacks. For starters, the generally inelastic supply of cryptocurrencies contributes to their price volatility. As the demand curve for digital currencies shifts back and forth along an inelastic supply curve, prices can fluctuate markedly.

Furthermore, the limited supply of digital currencies that causes their prices to explode when demand increases sharply can pose a potential economic risk. Nearly 19 million bitcoins have been “mined” since its inception in 2009, but Bitcoin has a maximum supply of only 21 million coins. It is only a matter of time before this limit is reached. There is not a maximum supply associated with Ether, the second most prevalent digital currency, but new “issuance” of this digital currency is limited to only 18 million coins per year. If the global supply of goods and services grows faster than the global supply of all cryptocurrencies in the years to come, then prices of goods and services will fall relative to the prices of cryptocurrencies. In other words, deflation will set in if privately-issued cryptocurrencies were to replace national currencies as the predominant units of account.

This dynamic occurred during the heyday of the Gold Standard in the late 19th century. Economic historians estimate that the general price level in the United States fell by more than 20% between 1873 and the turn of the 20th century.7 The deep and long-lasting economic contraction that started in 1873 had a role to play in depressing the price level, but prices continued to slide even after the economy had found its footing again in the 1880s. Because the global supply of gold was limited, prices of goods and services fell as their supply increased. Long periods of deflation can eventually lead to prolonged periods of high unemployment, and it was this period of deflation that led politicians of the period such as William Jennings Bryan to call for the use of silver as another component of the money supply.

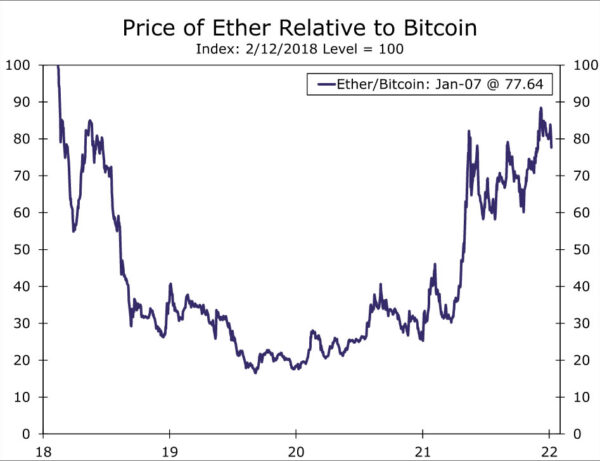

As noted previously, there are more than 16,000 cryptocurrencies in existence today, and many more likely will be introduced in years to come. So the overall supply of cryptocurrencies likely will continue to grow, which should limit prospects for a prolonged period of deflation. But individual cryptocurrencies are not perfect substitutes, and the value of one digital currency can fluctuate widely vis-á-vis another one. For example, Ether lost 80% of its value against Bitcoin between early 2018 and early 2020, although it subsequently has recouped much of those losses (Figure 4). This volatility may prevent individuals from shifting seamlessly from one cryptocurrency to another one, which would keep the use of individual digital currencies siloed.

What the world needs is an elastic supply of a digital currency(ies) that have less price volatility. Stablecoins, which are digital currencies whose prices are essentially tied to another asset such as the U.S. dollar, may offer some of the benefits of cryptocurrencies without some of their notable drawbacks. We will discuss stablecoins in more detail in the next report in this series.

Conclusion

The form that money takes has evolved over the centuries, and there is no reason to suspect that its current form—paper bills and bank deposits—necessarily has any permanence. In that regard, the use of cryptocurrencies has mushroomed in recent years, and they threaten to overtake paper bills and bank deposits in coming years as the predominant form of money in the world. The ability to make payments essentially instantaneously is an attractive feature of digital currencies as is their properties as an inflation hedge.

But there are also some serious drawbacks to cryptocurrencies, at least at present. Investors who want digital currencies to be part of their portfolios must be willing to tolerate high degrees of price volatility and the lack of crypto-denominated securities. In addition, the limited supply of digital currencies could potentially exert deflationary pressures on the global economy if they ever superseded national currencies. A prolonged period of deflation is a problem because debt is generally fixed in nominal terms. Therefore, a business’ or individual’s relative debt burden would grow as prices and wages fall, potentially leading to widespread bankruptcies and unemployment.

But there is a class of digital currencies, which are known as stablecoins, that do not have some of these drawbacks. The values of stablecoins are essentially tied to another asset such as the U.S. dollar, which keeps values more or less “stable.” Additionally, supplies of stablecoins are not limited. Could stablecoins be the digital currencies that eventually supersede national currencies? We will discuss the outlook for stablecoins in Part II of this series.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-