2021年9月美联储FOMC议息会议纪要

摘要:

没有Taper,但是认为Taper很近了,鲍威尔自己认为经济和就业已经达成了“实质性进一步进展”的(Taper)标准。

目前FOMC的共识是Taper将于明年中完成,按照每月1500亿的削减量以及12月启动的假设来计算,那就是明年7月完成Taper。

此后则是加息的问题了,加息就是实质性的货币政策收紧,此次点阵图显示加息预期有所前移(联储比料想更快加息)。

发布会又开始变得无聊了,Taper的话题性趋弱,而加息对于短视的市场而言又显得很遥远。

未来关注9月的就业数据(联储11月开会时还没有10月的非农)以及联储何时转向Forecast based,框架风险亦不容小觑。

配置型投资者应密切关注联储的加息时间点,YOLO投资者不用管这些有的没的。

声明措辞解读(粗体为此次会议重大变化)

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

美联储致力于在时下这个充满挑战的时期使用其全部工具来支持美国经济,从而促进其充分就业和价格稳定目标。

With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months, but the rise in COVID-19 cases has slowed their recovery. Inflation is elevated, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

在疫苗注射以及强有力政策支持的帮助下,经济活动与就业指标得以继续加强。受疫情不利影响最为严重的部门在近几个月已然有所改观,但是疫情的反复放缓了它们的复苏。通胀处于高位,主要反映了临时性因素。整体金融条件仍然宽松,部分反映了支持经济的政策措施和流向美国家庭和企业的信贷。

The path of the economy continues to depend on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.

经济的发展路径仍将取决于疫情的走向。疫苗接种的进展可能将继续削弱公共卫生危机对经济的影响,但经济前景的风险仍然存在。

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals. If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

委员会寻求在较长时期内实现充分就业和2%的通货膨胀率。由于通胀率持续低于这一长期目标,委员会将致力于在一段时间内实现通胀率适度高于2%,以便通胀率在一段时间内平均达到2%,长期通胀预期保持在2%。委员会预计,在实现这些结果之前,将保持货币政策的宽松立场。委员会决定将联邦基金利率的目标范围保持在0-1/4%,并预计在劳动力市场条件达到与委员会对充分就业的评估相一致的水平,以及通胀率上升到2%并在一段时间内适度超过2%之前,保持这一利率目标区间将是适当的。去年12月,美联储表态将每月至少增持800亿美元的国债和每月至少增持400亿美元的MBS,直到在实现委员会的充分就业和价格稳定目标方面取得实质性的进一步进展。自那时起,美国经济已经朝着这些目标取得了进展。如果进展可大致如预期般维持下去,委员会判断可能很快就需要放缓资产购买的步伐。这些资产购买有助于促进顺利的市场运作和宽松的金融条件,从而支持信贷流向家庭和企业。

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

在评估货币政策的适当立场时,委员会将继续监测所收到的信息对经济前景的影响。如果出现可能阻碍委员会目标实现的风险,委员会将准备酌情调整货币政策的立场。委员会的评估将考虑到广泛的信息,包括对公共卫生、劳动力市场状况、通货膨胀压力和通货膨胀预期以及金融和国际发展的解读。

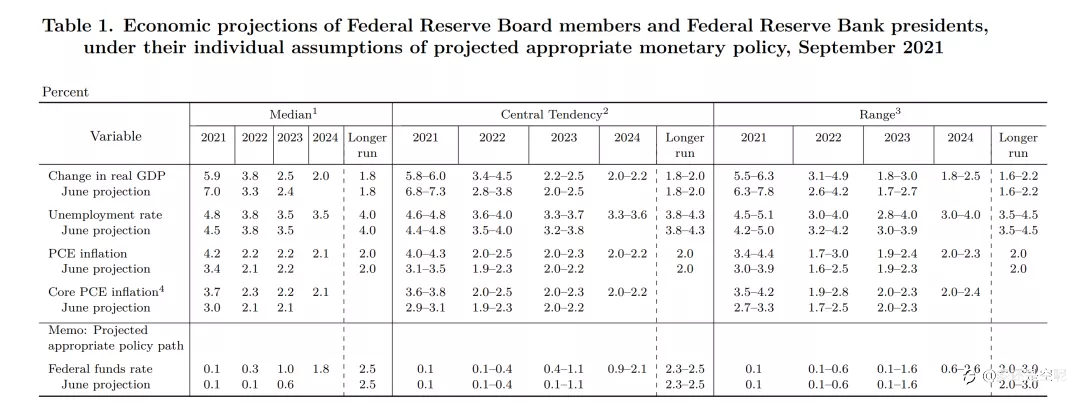

经济预测调整

相对于2021年6月的经济预测所做出的调整

下调2021年全年(7%→5.9%)的GDP增速预测,上调2022年(3.3%→3.8%)与2023年(2.4%→2.5%)的GDP增速预测。

上调2021年全年(4.5%→4.8%)的失业率预测,维持2022年与2023年的失业率预测不变。

上调了2021年(3.4%→4.2%)、2022年(2.1%→2.2%)、2023年的PCE通胀预测保持不变。

上调了2021年(3.0%→3.7%)、2022年(2.1%→2.3%)、2023年(2.1%→2.2%)的核心PCE通胀预测.

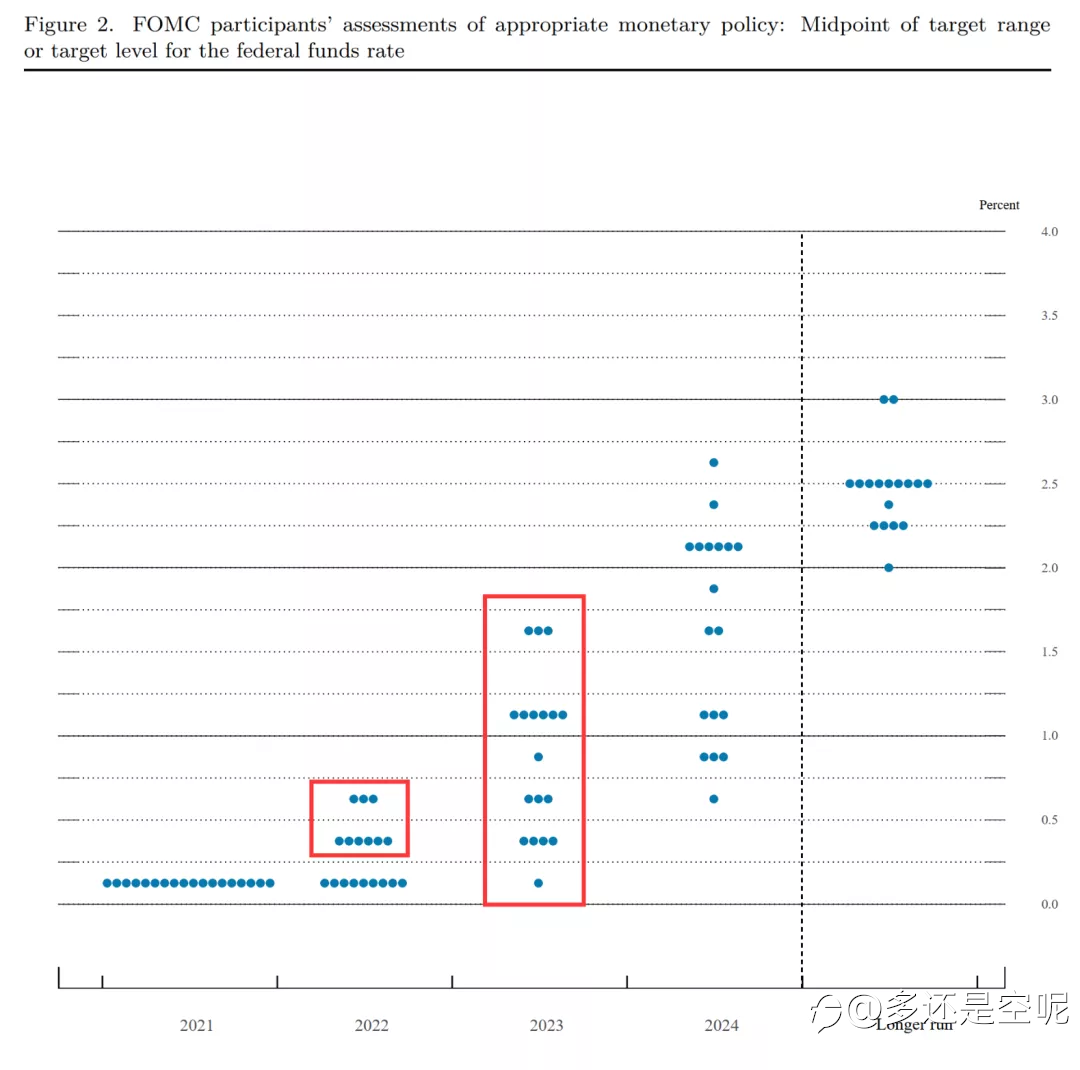

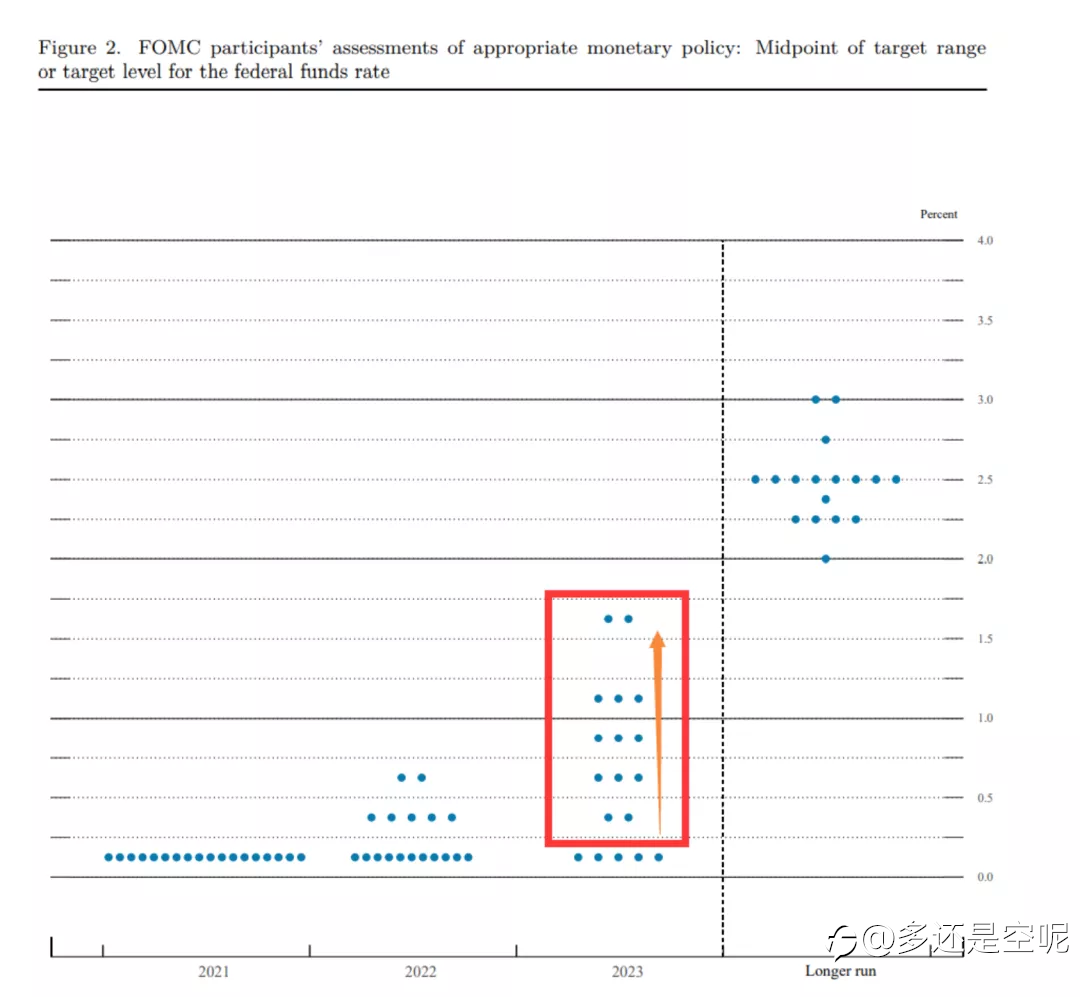

点阵图

本月点阵图↑

6月点阵图↑

对比来看,本次会议有9位联储官员认为2022年将启动加息(6月时仅为7位),在明年启动加息还是保持利率不变这一问题上,FOMC形成了9比9的平票。

对2023年的利率预期进一步上调,目前只有一位FOMC委员认为到2023年都不会加息了。9位委员认为2023年时利率将提升到1%以上(即加息4次),与认为利率利率将低于1%的委员数量持平。

首次公布的2024年利率预测中,有8位委员预测届时的利率水平处于2%以上。

发布会亮点(注意粗体)

陈述时鲍威尔提到明年年中时完成Taper是适当的。(如果我们以2021年6月/7月基准推算,那么自今年12月起每个月削减1500亿的资产购买量,至明年7月时完成Taper)

同时,鲍威尔强调,Taper的时间节点与推进节奏和加息进程无关——加息所需的经济条件更为严苛。

While no decisions made, participants generally view that so long as the recovery remains on track, a gradual tapering process that concludes around the middle of next year is likely to be appropriate.

The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate lift off which we have a more stringent test for.

发布会记者亮点问题1:有关触发Taper的“Substantial Further Progress”到底达到了没?

鲍威尔提到,相较于2020年12月(提出实质性的进一步进展时),就业市场复苏已经行程过半(50%-60%),对于他和许多FOMC委员来说,这已经符合了SFP的标准,但还有一部分委员认为只是接近而非达到。

50 or 60% of that road has been traveled. That could be substantial further progress. Many on the committee feel that substantial further progress test for employment has beenmet. Others feel it's close. They want to see a little more progress. There is a range of perspectives. I guess my own view would be the substantial furthered progress test for employment is all but met.

发布会记者亮点问题2:有关Taper的节奏

再次强调Taper很近了,明年中完成Taper似乎是共识。一些委员认为应该更快Taper。

资产购买现在有用但没疫情开始时有用了。

You are correct there are some who would prefer to gone sooner. They made their arguments publicly for financial concern. For others it's for other concerns they can make their own arguments. It will put us completed our taper somewhere around the middle of next year which seems appropriate.

Now we are in a situation where they still have a use, but it's time for us to begin to taper them. Their usefulness is much less as a tool than it was at the very beginning.

发布会记者亮点问题3:有关Taper之后加息的问题

鲍威尔表示劳动力市场目前还是存在结构性问题(因此加息条件远没有达到),但通胀目标已经达到了(前提是明年通胀还能达标)。

while we have interesting signs that in many ways the labor market is very tight, we also have lots of slack in the labor market. We think those inbalances will sort itself out.

Inflation at 2% and on track to achieve moderately higher inflation over 2%. That depends on the path of inflation. If inflation remains higher during the course of 2022 we may have already met that test by the time we reach lift off.

发布会记者亮点问题4:联储官员炒股你怎么看?

鲍威尔拿自己持有市政债举例子,认同不应该持有自己可以决定购买的资产。有很多记者问了相关问题。

发布会记者亮点问题5:就业和框架问题,(8月的非农)数据不支持你对就业的看法,你怎么看?

承认就业市场存在结构性问题——“空缺岗位多,企业招不到人,但是就业增长却还是不行”

认为是Delta的问题,重复了下8月非农的问题——服务业疲软。

从鲍威尔的修辞来判断,未来9月和10月只要有50万的增速就可达标。

It's accumulated progress. For me, it wouldn't take a knockout great super strong employment report. It would take a reasonable good employment report for me to feel like that test is met.

发布会记者亮点问题6:债务上限

表态美国绝对不能违约,债务上限必须上调,违约带来的恶性后果联储也是没辙的,根本不应该考虑这种事情发生的可能性。

It's just very important that the debt ceiling be raised in a timely fashion so the United States can pay its bills when it comes due.

The failure of that can result in severe damage to the economy and to the financial markets and it's just not something we can contemplate or we should contemplate.

发布会记者亮点问题7:HENGDA的问题,你怎么看待企业债的问题?

鲍叔明白人,认为银行没那么大风险,但是可能会影响到市场信心。

The everygrand situation seems particular to China which has very high debt for an emerging market economy.

The Chinese banks are not tremendously exposed, but you would worry it would effect global around confidence channels.

发布会记者亮点问题8:Taper可能同时加息吗?缩表有考虑吗?

鲍叔对两位记者的问题表现出一定的黑人问号。

一边买资产一边加息很蠢,因为买资产是在宽松,加息是在紧缩,所以不必想Taper没结束就加息。

现在想缩表更是脑子秀逗了。

发布会记者亮点问题9:央行数字货币问题

这个月会发讨论报告。“团队在做事”,同时强调有必要加强监管并参与竞争。

#风险管理# #视频点评# #EBCGroup# #交易高手与新手的区别# #当基本面和技术面冲突时# #专题|美联储决议#

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.