How To Calculate Currency Correlations With Excel

As you’ve read, correlations will shift and change over time. So keeping on top of current coefficient strengths and direction becomes even more important.

Lucky for you, currency correlations can be calculated in the comfort of your own home, just you and your most favorite spreadsheet application.

For our explanation, we’re using Microsoft Excel, but any software that utilizes a correlation formula will work.

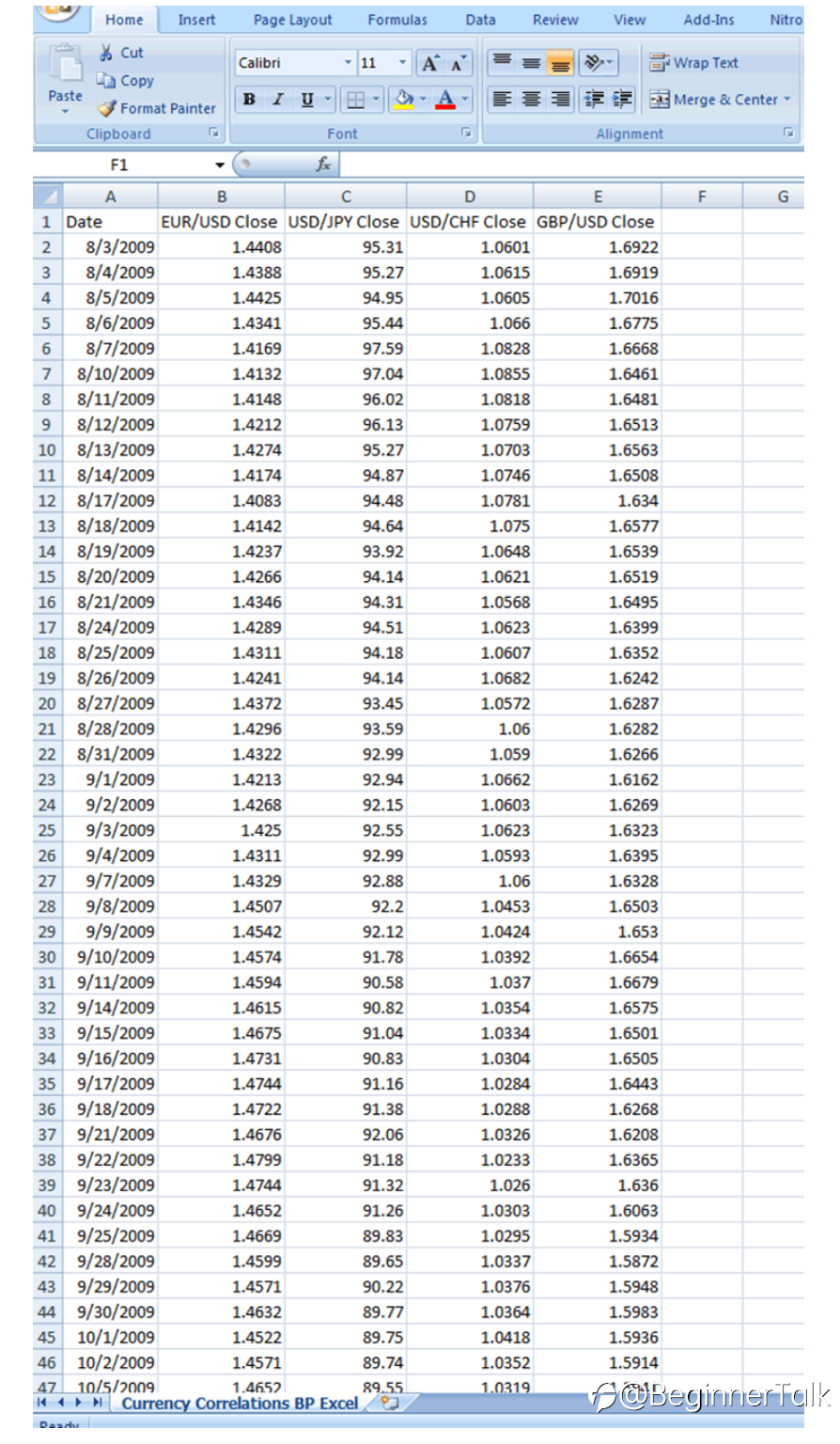

Step 1: We’re assuming that you won’t be magically creating the daily price data out of thin air, but rather, will be getting it somewhere online. One source is from the Federal Reserve.

Step 2: Open Excel.

Step 3: Copy and paste your data into an empty spreadsheet or open the exported data file from Step 1. Get the last 6 months!

Step 4: Now arrange your data to look like the following or something similar. Colors and fonts are up to you! Have fun with this. Yellow might not be the best option though!

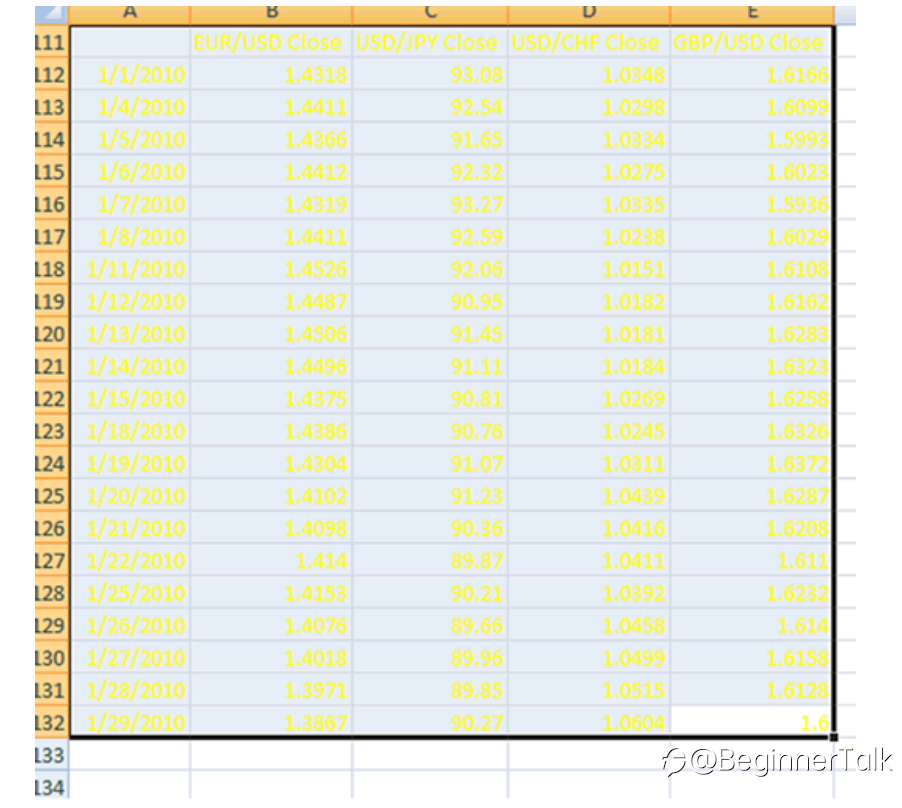

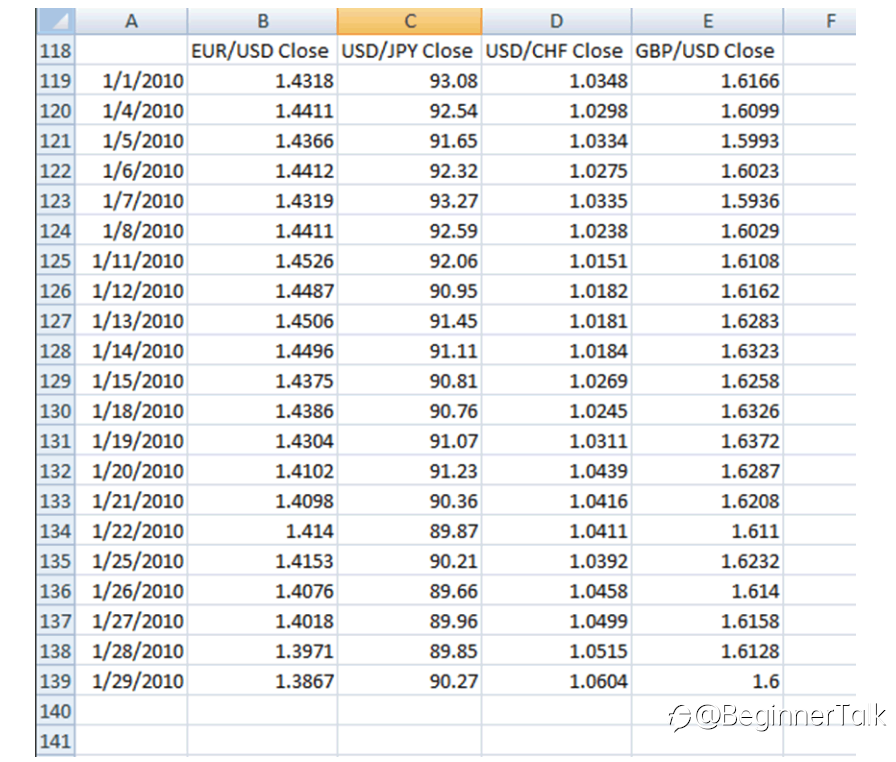

Step 5: It’s time to decide on a time frame. Do you want last week’s currency correlation? Last month? Last year?

The amount of price data you have will dictate this, but you can always get more data. For this example, we’re using the last month.

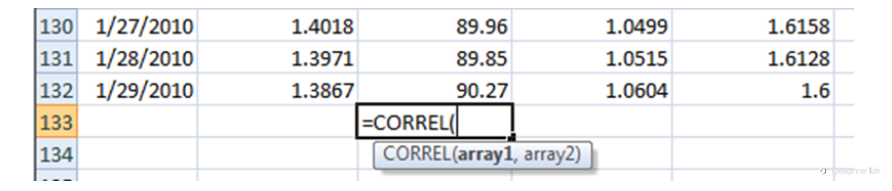

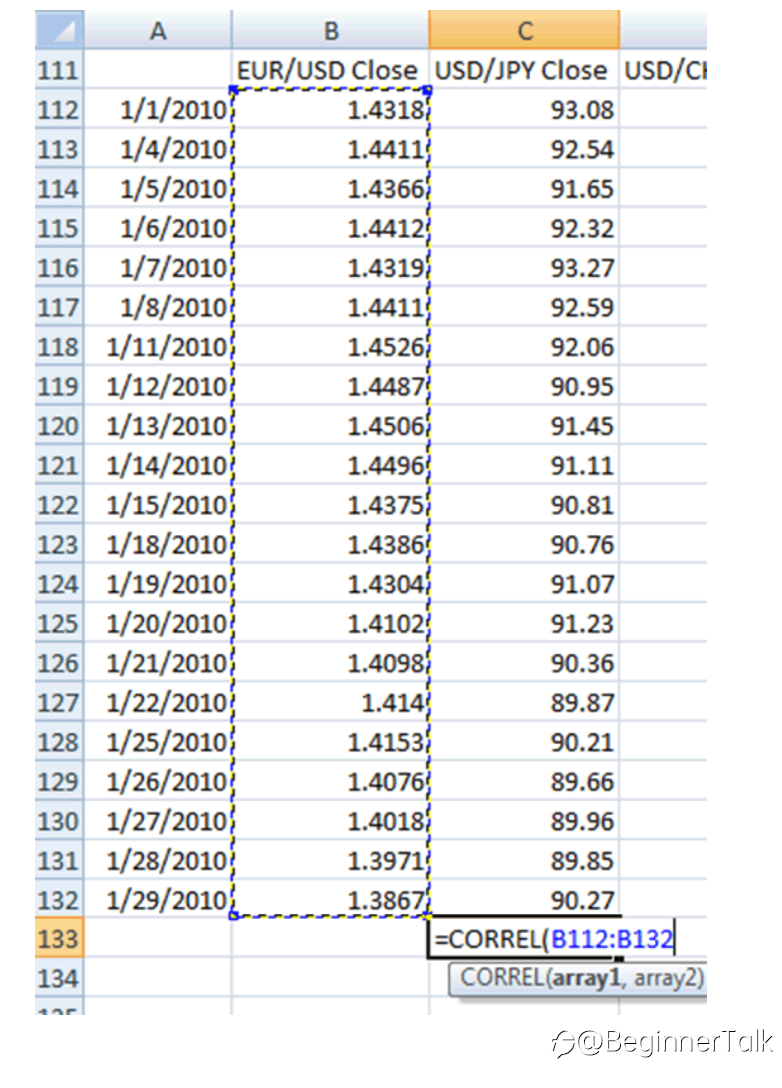

Step 6: In the first empty cell below your first comparison pair (I’m correlating EUR/USD to the other pairs, so I’m starting with EUR/USD and USD/JPY), type: =correl(

Step 7: Next, select the range of cells for EUR/USD’s price data, followed by a comma. You’ll be surrounding this range with a box.

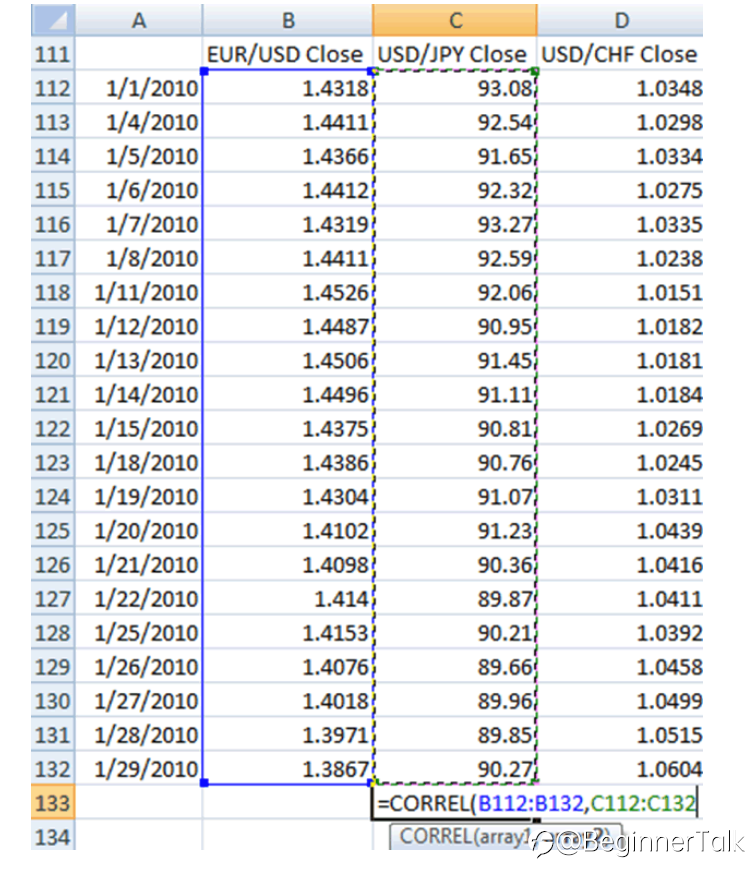

Step 8: After the comma, select USD/JPY’s price data range just like you did for EUR/USD.

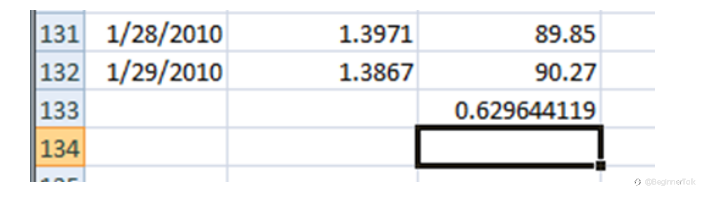

Step 9: Click the Enter key on your keyboard to calculate the correlation coefficient for EUR/USD and USD/JPY.

Step 10: Repeat Steps 5-9 for the other pairs and for other time frames.

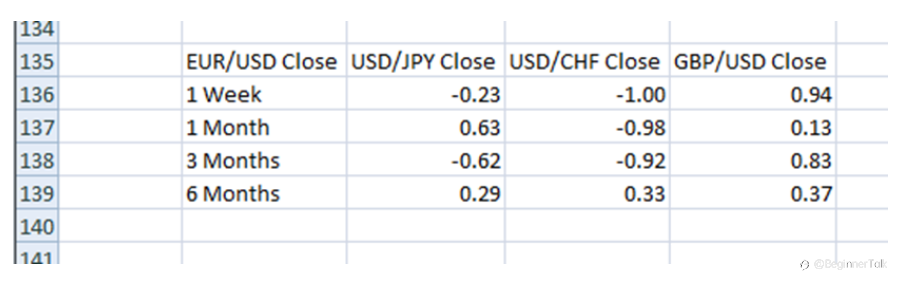

When you’re done, you can take your new data and create a cool looking table just like this. Man, that’s pro-status!

The one-week, one-month, three-month, six-month, and one-year trailing periods provide the most complete view of the correlations between currency pairs.

But it’s up to you to decide which or how many time periods you want to wish to analyze.

While it might be overkill to update your numbers every single day, unless you’re a currency correlation addict, updating them at least every other week should be enough.

If you find yourself manually updating your currency correlation tables every hour on Excel, you might need to get out more and pick up a hobby.

Reprinted from Babypips, the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.