Be Careful! Currency Correlations Change!

The forex market is like a schizophrenic patient suffering from bipolar disorder who constantly eats chocolates, experiences extreme sugar highs, and has volatile mood swings all day long.

We’re not even exaggerating.

Although currency correlations between currency pairs can be strong or weak for days, weeks, months, or even years, they do eventually change and can change when you least expect it.

The strong currency correlations you see this month may be totally different next month.

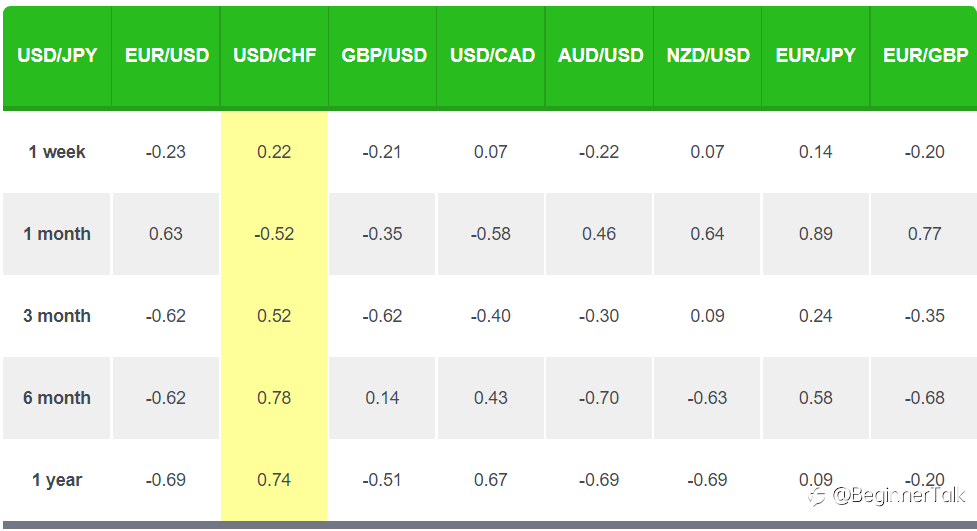

Have a look at the table below.

Compare the coefficients for a given pair across the different time frames.

Do you notice anything?

For the most part (thanks, USD/JPY!), they’re different across the board, changing from one time frame to another. And they change in all directions.

The lesson here is that currency correlations do change, and they change frequently.

And they can change by a drastic measure in a short time frame, as is apparent by looking at EUR/USD at the 1 Month and 3 Month interval.

That’s a big swing!

Because of the constant sentiment shifts of the currency market, make sure you’re aware of the current currency correlations.

For example, over a one-week period, the correlation between USD/JPY and USD/CHF was 0.22. This is a very low correlation coefficient and would indicate that the pairs have an insignificant correlation.

However, if we look at the three-month data for the same time period, the number increases to 0.52 and then to 0.78 for six months and finally to 0.74 for a year.

In this example, you can see that these two pairs had a “break-up” in their long-term correlation relationship. What was once a strongly positive association in the past has extremely weakened in the short term.

If they were a real couple and had only dated a month or less, they would’ve thought they were incompatible.

Little do they know, the passion will start heating up later!

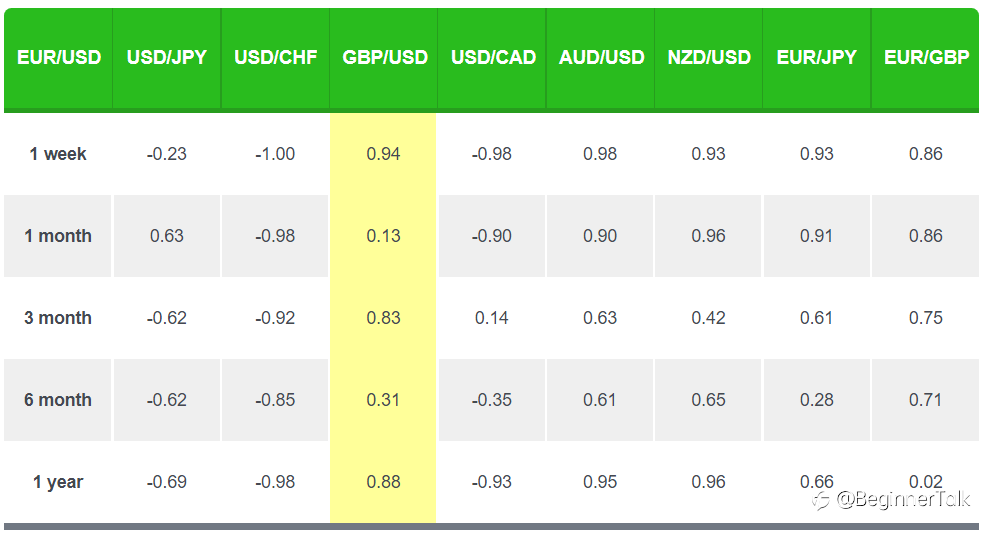

If you look at EUR/USD and GBP/USD, here’s an example of the extent to which currency correlations can change and jump around.

The one-week period shows a very strong correlation with a 0.94 coefficient!

…But this relationship severely deteriorates in the one-month period, dropping to 0.13, before improving again for its three-month period to a solid 0.83, then deteriorating again to a weak correlation in its six-month trailing period.

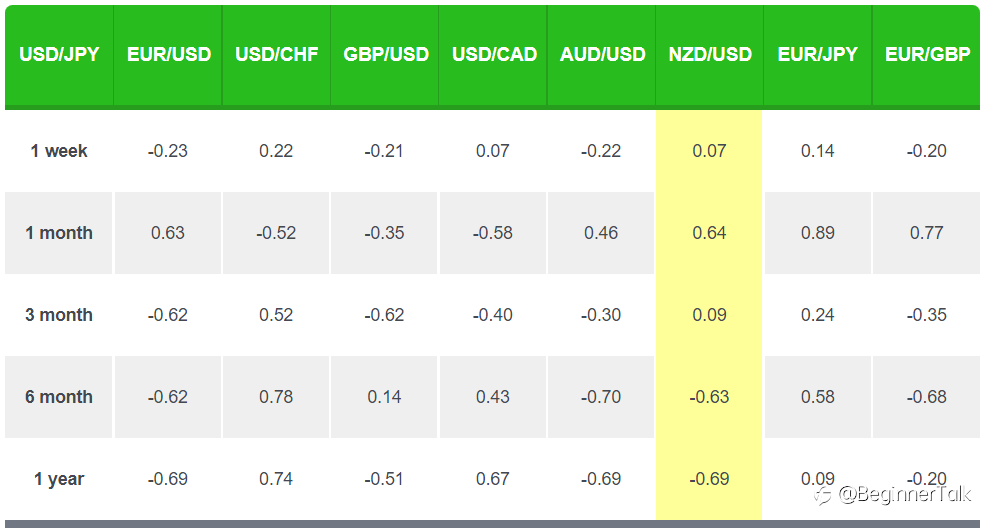

Here’s a crazy example of how dramatic currency correlations can change.

Let’s take a look at USD/JPY and NZD/USD…

Their one-year correlation coefficient was -0.69.

This indicates a moderate to strong correlation.

But if you look at their one-month correlation, the correlation coefficient essentially flip-flopped!

So be careful.

Currency correlations change for many different reasons.

These can include anything from a country changing interest rates, to shifting monetary policies, or any collection of economic or political events reshaping traders’ sentiment on a currency.

Reprinted from Babypips, the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.