How To Scale In Positions

In the previous lesson, we discussed how to scale OUT of a trade. Now, we show you how to scale IN a trade.

The first scenario we’ll cover involves adding to your positions when your trade is going against you.

Adding more units to a” losing” position is tricky business and in our view, it pretty much should never, ever be done by a new trader.

If your trade is clearly a loser, then why add more and lose more??? Doesn’t make any sense right?

Now we say “pretty much” because if you can add to a losing position, and if the combination of risk of your original position and the risk of your new position stays within your risk comfort level, then it is ok to do so.

To make this happen, a certain set of rules has to be followed to make this trade adjustment safe. Here are the rules:

- A stop loss is necessary and MUST be followed.

- The levels of position entry must be pre-planned before the trade was put on.

- Position sizes must be pre-calculated and the total risk of the combined positions is still within your risk comfort level.

Trade Example

Let’s take a look at a simple trade example of how to do this:

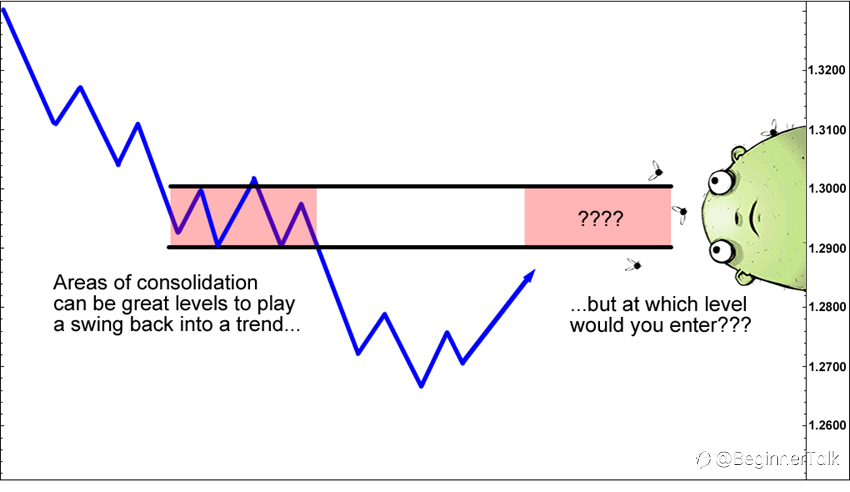

From the chart above, we can see that the pair moved lower from 1.3200, and then the market saw a bit of consolidation between 1.2900 to 1.3000 before breaking lower.

After bottoming out around 1.2700 to 1.2800, the pair retraced to the area of recent consolidation.

Now let’s say you think that the pair will return to the downside, but you’re not confident of picking an exact turning point.

There are a few scenarios of how you could enter the trade:

Entry Option #1:

Short at the broken support-turned-resistance level of 1.2900, the bottom of the consolidation level.

The downside of entering at 1.2900 is that the pair may move higher, and you could have potentially gotten in at a better price.

Entry Option #2:

Wait until the pair reaches the top of the consolidation area, 1.3000, which also happens to be a psychologically significant level – potentially great resistance level.

But if you do wait to see if the market reaches 1.3000, then you run the risk of the market not making it all the way up there and it drops back down lower, and you’d miss the return to the downtrend.

Entry Option #3:

You can wait until the pair tests the potential resistance area, then moves back below 1.2900 into the downtrend before entering.

This is probably the most conservative play as you get a confirmation that sellers are back in control, but then again you miss out on getting in the downtrend at a better price.

Entry Option #4:

What to do? Why not enter at both 1.2900 and 1.3000? That’s doable, right? Sure it is! Just as long as you write this all down before the trade and follow the plan!

Determine Trade Invalidation Point (Stop Loss)

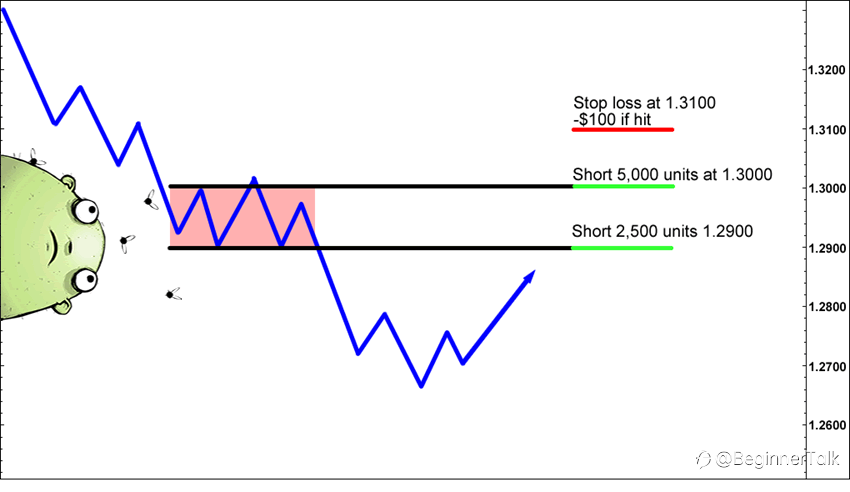

Let’s determine our stop level. For simplicity, let’s say you pick 1.3100 as the level that signals you were wrong and that the market will continue higher.

That is where you exit your trade.

Determine Entry Level(s)

Second, let’s determine our entry levels. There was support/resistance at both 1.2900 and 1.3000, so you’ll add positions there.

There was support/resistance at both 1.2900 and 1.3000, so you’ll add positions there.

Determine Position Size(s)

Third, we will calculate the correct position sizes to stay within the comfortable risk level.

Let’s say you have a $5,000 account and you only want to risk 2%. That means you are comfortable risking $100 ($5,000 account balance x 0.02 risk) on this trade.

Trade Setup

Here is one way to set up this trade:

Short 2,500 units of EUR/USD at 1.2900.

According to our pip value calculator, 2,500 units of EUR/USD means your value per pip movement is $0.25.

With your stop at 1.3100, you have a 200 pip stop on this position, and if it hits your stop that is a $50 loss (value per pip movement ($0.25) x stop loss (200 pips)).

Short 5,000 units of EUR/USD at 1.3000.

Again, according to our pip value calculator, 5,000 units of EUR/USD means your value per pip movement is $0.50.

With your stop at 1.3100, you have a 100 pip stop on this position, and if it hits your stop that is a $50 loss (value per pip movement ($0.50) x stop loss (200 pips)).

Combined, this is a $100 loss if you are stopped out.

Pretty easy right?

We have created a trade where we can enter at 1.2900, and even if the market went higher and created a losing position, we can enter another position and stay safely within normal risk parameters.

And just in case you were wondering, the combination of the two trades creates a short position of 7,500 units of EUR/USD, with an average price of 1.2966, and a stop loss spread of 134 pips.

If the market went down after both positions were triggered, then a 1:1 reward-to-risk profit ($100) would be achieved if the market hit 1.2832 (1.2966(avg. entry level) – 134 pips (your stop)).

Because the bulk of your position was entered at the “better” price of 1.3000, EUR/USD doesn’t have to fall too far from the resistance area to make a great profit. Very nice!!!

Reprinted from Babypips, the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.