Top 10 Forex Strategies for Profitable Trading in 2021

The estimated trading volume of the foreign exchange (Forex) market stands at $6.6 trillion, a figure that exceeds even the volume traded across all stock markets. That is one of the primary reasons why the profit-seekers are flocking to Forex day after day. But the statistics have it that the overwhelming majority of traders are losing money. Obviously, that happens due to the lack of time-tested Forex trading strategy and money management skills. The year 2020 has proven to be tough on Forex and all other financial markets, but it has also given an opportunity to revise many trading systems and approaches and come up with a list of the best Forex strategies for 2021 that have proven their efficiency even at such turbulent times.

VWAP - a solid foundation for an intraday trading strategy

VWAP stands for the volume-weighted average price - it’s an indicator that we deem to be superior to many other charting tools because it takes into account both the trading volume and the price of a currency. It is calculated by multiplying the sum of price by trading volume and then dividing that number by total volume.

The inclusion of volume in calculations is the trait that makes VWAP a very powerful indicator - and in our opinion, often underused - alternative to the 9-day and 25-day moving averages since VWAP is considerably slower, thus providing far less false Forex trading signals. The indicator’s other significant feature is that it’s often used as a guiding landmark for big market players like institutions and pension funds, whereas retail traders often disregard VWAP when devising the intraday Forex trading strategy while focusing on popular indicators that often lead them astray.

The rule of thumb for using VWAP is rather simple: a trader must give preference to long trades when the price action occurs above the indicator and consider taking short trades when the price dives below the line. But remember that it should be included in the currency trading strategy only for a single day of trading as it reboots every day prior to the market open, so avoid building the mid-term, and especially long-term trading strategies on Forex, on the basis of VWAP showings.

However, VWAP works best when used in combination with the actual volume indicator, the 9-period moving average, and a momentum oscillator like MACD since they provide sufficient confirmation for entering a trade. The EUR/USD chart above provides an example of how the Forex strategy that incorporates VWAP can be applied. Here we see the price dropping below 9MA and VWAP, signifying a strong selling pressure, which is confirmed by the bearish MACD and the mounting bearish volume. According to this trading strategy, you should make the first sell at 1.2175 and keep on selling if 9MA dives below VWAP, a move that is called the VWAP cross.

Support/Resistance and two Stochastics - a powerful combo for successful Forex trading

Trading Forex using support and resistance (S/R) zones is probably the oldest play in the book. Nevertheless, they remain one of the most efficient tools for building profitable Forex strategies around. draw these lines rather frivolously, which ultimately leads to losing trades.We are certain that there’s no need to teach you the basics of finding and plotting the lines of support and resistance, but we will give you some tips since many traders - even some seasoned ones - tend to

- Always consider the trading volume when plotting S/R lines. The price action zones on the charts that saw the largest volume spikes should always be taken into consideration as they indicate the areas of increased supply or demand;

- Remember that the horizontal support is considered more reliable than the diagonal one, especially when it comes to determining the pivot points.

- When determining S/R for your trading strategy, remember to start from the macro time frames (monthly, weekly) and gradually move down to the lower ones.

For this Forex trading strategy, we will employ horizontal support and resistance, combined with two Stochastics: the fast one, set at 9-3-3, and the slower version of the same indicator with the settings of 21-9-9. The idea behind this strategy is the following: determine a strong S/R level by analyzing the trading volume and then use the showings of Stochastics to determine the immediate and mid-term momentum and plan the trades accordingly. In this example, the fast Stochastic is bullish while the slow one is obviously bearish, so we might be looking at a spike to 1.369, followed by the pullback to 1.313. For this currency trading strategy, it’s immensely important to understand where the momentum is taking the price when it approaches the area of intense price interaction, as it hints at whether the S/R line would be able to hold.

Employing Parabolic SAR and MACD to maximize the profits

The Forex strategy that utilizes the Parabolic SAR and MACD is fairly simple and applicable to all timeframes higher than 15M, and to many currency markets. Besides, these two indicators are available on all Forex trading platforms for free, thus making it even more useful. It comes to show that your strategy doesn’t have to be overly complicated in order to be profitable. Oversaturating your strategy with complex trading tolls would oftentimes result in total discordance. At the same time, throwing SAR and MACD on top of candlesticks would keep the chart clean while providing enough signals for successful trading on Forex.

In our experience, EUR/USD and GBP/USD are the most suitable markets for this strategy since they are more volatile than some low-volume exotic pairs. In this instance, the MACD settings should be 12- 26-9, while the Parabolic SAR must be set at 0,02 -2.

Grid trading on Forex

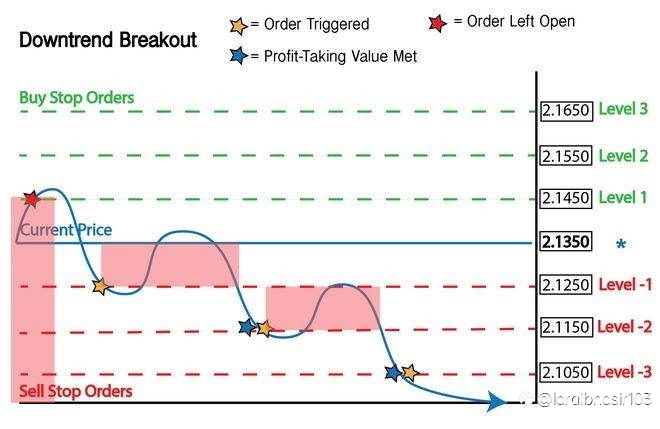

Arranging the buy/sell order in a grid with equal intervals has long been considered as one of the best Forex strategies, as well as a universal one since it can be applied to trading currencies on all timeframes and in both trending and ranging markets. The gist of this approach to trading is also rather simple. A trader has to place the corresponding orders above and below the predetermined price level at the same distance, ultimately creating a grid of orders, hence the name of the Forex trading strategy.

For instance, you can start the grid by placing the corresponding orders 20 pips higher for buy orders and 20 pips lower the set price for sell orders in the trending market conditions. This Forex strategy is also applicable to ranging markets, but in that case, a trader should set the buy orders underneath the price level - the buy order will go above the said zone.

The best thing about this method is that it rarely requires an extensive analysis of where a particular Forex market is going, making it one of the most automatable strategies of average complexity. Grid trading allows market participants to increase the position size while the market is either trending or ranging. But beware that this approach to Forex trading is most effective when the price is moving in a sustained direction. If the price action is volatile and choppy, it might travel up and down between the grid levels, while the trader incurs losses due to price hitting orders on both sides. That’s why it’s advisable to limit the grid to several orders; otherwise, it would require less position management and help mitigate the risks.

Monday open - trade Forex one day a week

Littering the trading panel with indicators might make a Forex trader look smart, but it would definitely do more harm than good for his performance since most of these tools are lagging and flashing false signals. However, there is a Forex strategy for positional trading that requires no indicators as it uses only a clear bar or candlestick chart. This method relieves traders of the necessity to stare at the screen throughout the weekdays as it implies the execution of one or a few trades a week on Monday, shortly after the market opens. Understandably, this strategy is suitable only for the daily time frame, and it probably works best in the EUR/USD market.

The concept behind this strategy for trading on Forex isn’t that complicated: on Monday, approximately 15 minutes after the market gets busy (this time interval is required to normalize the spreads), a trader should open the position in the direction opposite to the candlestick from last Friday. For example, if a trader had taken a long position on Monday in the EUR/USD market (as shown on the chart above), he or she would have scooped a profit of 125 to 205 pips the next Monday. For this strategy, use the highs or the lows of the last week’s candle to set up the stop-loss, but make sure that it’s located no closer than 30 pips and no further than 50 pips away from the buy/sell area, depending on the present volatility in the market. Also, this currency trading strategy requires meticulous money management and position sizing. Refrain from entering a trade if the market is in a state of uncertainty, which could come in the form of a candle with a small body and large wicks.

The Forex strategy built upon momentum oscillators and Bollinger Bands

Volatility is one of the key characteristics of the foreign exchange market. It causes large price swings during which time a trader must seize an opportunity for profit-making when the price is pulling back or reversing after a strong impulse to the upside or the downside. Apart from the Average True Range (ATR) indicator, Bollinger Bands (BBs) are the most reliable tool for gauging market volatility. The basic principle of trading Forex with BBs is simple: the expansion of the bands signals that the price action in the particular currency pair is growing increasingly volatile, whereas the contraction of the bands occurs during the consolidation period when the price is in the range. There is also the Bollinger Bands squeeze, the period when the bands are drawn very close to each other that usually precedes large price swings.

However, BBs are not a standalone element of this trading strategy for Forex because the only reversal signal it provides is when the price action stretches beyond the boundaries of a band. However, that particular signal always requires confirmation from a non-correlated Forex trading indicator - in our case, it’s the moving averages divergence/convergence (MACD) momentum oscillator. Here, when the MACD line crosses the signal line and/or the zero line to the downside, it’s considered a sell signal, and vice versa. The idea behind this Forex strategy is the following: a trader must assess the situation on the market with the help of MACD or other momentum indicators (RSI, Stochastic) to see whether there’s a bullish or a bearish bias to it. Then he could trade the price action within BBs or wait for a squeeze and take the trade in the direction of the momentum. This strategy can also be used for trading reversals. In that case, the perfect setup for a trade is when the price penetrates the BBs while the momentum oscillator makes a bullish of a bearish crossover.

Who to trade Forex successfully with Ichimoku Cloud

For some reason, not a lot of Forex traders are using the Ichimoku Cloud, or the Ichimoku Kinko Hyo,an indicator to develop trading strategies, probably because this tool is relatively new to mainstream and appears to be overly complicated at first. It might look like a total mess when you first plot it on the chart, but we reckon that it’s probably the only all-around useful technical indicator that allows traders to assess the momentum and the area of support/resistance at a glance. By the way, the Japanese word ‘ichimoku” literally means “a single glance.” This indicator consists of five elements, but it can do without the conversion and base lines, leaving only a lagging span, which provides confirmation, and two leading MAs that form that cloud.

What’s great about the Ichimoku Cloud-based Forex trading strategy is that this indicator pinpoints the high probability trades, and has proven to be reliable when determining trend reversal and entry/exit points. The market is considered to be in the bullish trend when the price action takes place above the Kumo cloud and bearish if the price descends below it. If the price is stuck inside the cloud, the market is indecisive, so refrain from taking any trades. The reason why no trades should be taken when inside the cloud is that this indicator is most accurate in a trending environment. Here’s a quick Forex strategy tip: in order to have an even clearer picture, it’s advisable to combine Ichimoku Cloud with a momentum oscillator like MACD.

In this particular example, the third entry was made after the bullish flag (continuation pattern) has been broken to the upside at 1.22096. Notice that all these entries were made after MACD entered the bullish control zone on the backdrop of a growing green histogram. Also, don’t forget to always confirm with the lagging span that accurately gauges the trend direction. According to this Forex strategy, the first exit point lies at 1.22364 (40 points profit); the second one should be at 1.22580 for a 61-pip profit.

Edited 06 Sep 2021, 02:36

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.