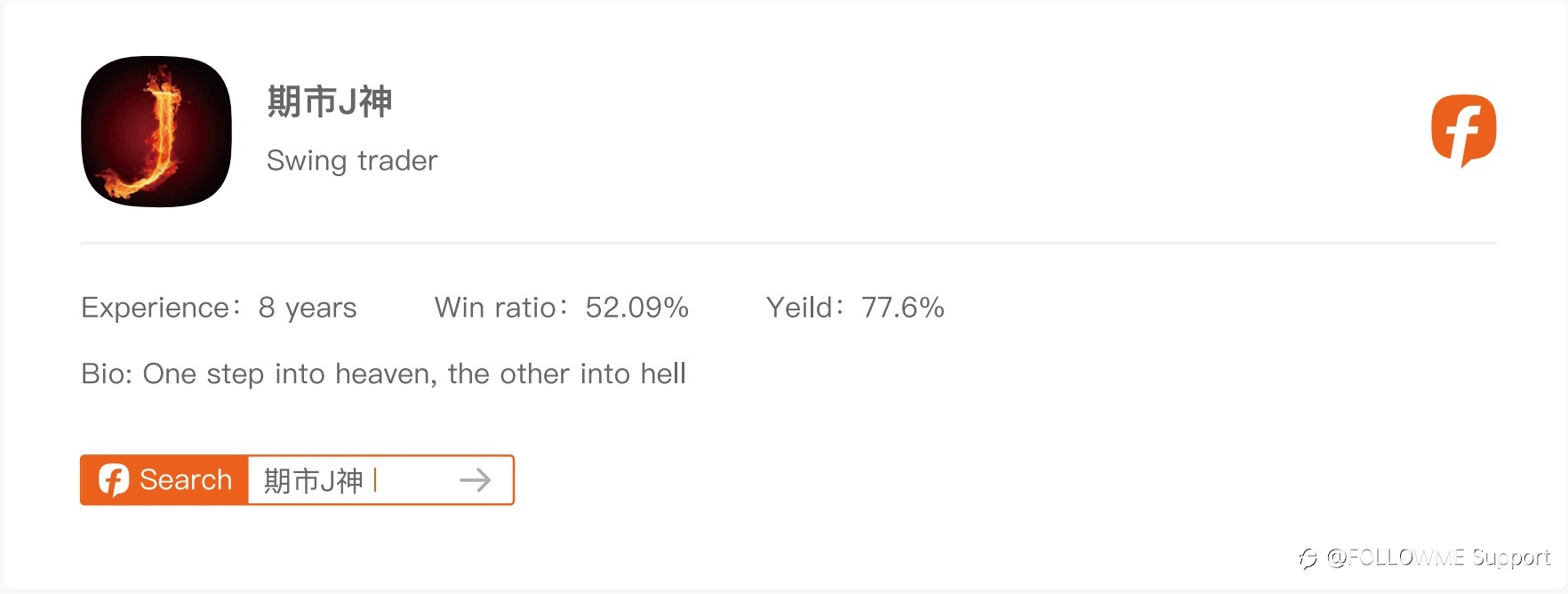

FOLLOWInterview | @期市J神 - With a half-year profit of 660,000 U.S. dollars, the sniper is well-known!

@期市J神 is known in the community for swing trading. At the beginning of 2021, he shorted gold with a single 20-lot position. After holding the position for a month, he closed the order and successfully made a profit of 200,000 US dollars. In his case, the dream of becoming a millionaire seems to be just a matter of order. The legend continued till February. @期市J神 once again predicted the shift of swings. He shorted two 10-lot of gold in 1825 and made a profit of 250,000 US dollars. At the same time, he won the community's highest-profit ranking of the week.

Of course, his order is fast and accurate. With a 52.09% win rate and an average profit level of 2,357.13 USD, @期市J神 achieved a profit of 660,000 US dollars within half a year. But the rocket-soaring yield curve and the trading style of hundreds of thousands of dollars in one go have also exposed greed. After withdrawing 250,000 US dollars, he suffered a 50% drawdown after a misjudgment. Looking back at his mistakes, he said, "Wrong judgment results from the market, but holding the position is my own fault. I think people should admit our incompetence in the face of risks."

Trading experience

FOLLOWME: Thank you for accepting the interview and sharing your trading ideas. You started from November 2020, the #2 account closed a profit of 660,000 U.S. dollars. What was your secret to such a profit at that time?

期市J神: After the market has proven that your order is correct, holding it still is the secret. For example, after an hourly order is profitable, you rise to the four-hour, and then to the daily level. The big profit comes from big volatility.

FOLLOWME: Did you catch a good market at that time?

期市J神: It cannot be said that the right judgment is a good market. Looking back now, it can only be said that the current prediction of the market move is accurate. If you ask me if I am confident to seize the swing, I would say my confidence comes from the floating profit of the position. You will not stop the profit before the market reaches the target, because once the profit is stopped, you stand in the opposite of the trend.

FOLLOWME: Later on, your #2 account has also experienced an 87% drawdown. How do you control this risk? How to adjust the mentality at that time?

期市J神: In fact, the account withdrawal was nearly half at that time, which means that the drawdown was about 50% of the original total funds. The risk this time is still the act of carrying orders after one’s judgment is wrong. Judging errors are market risks, and carrying orders is their own risk. I think people should admit their incompetence in the face of risks, and the realm of recognition is higher than control. Then they will be in awe of risk, and will not enter the market if they are not sure about it so that they will reduce the position to a bearable extend, and plan all "what-if" into risk management and.

FOLLOWME: Your profit in the trading market amazed us, but many advanced traders paid for their knowledge. Have you ever paid any price in the trading market?

期市J神: You must pay for your growth. Only when you lose real money will it hurt, and when you are in pain, you will reflect on the process and improve. This is something that cannot be exercised in demo trading. In the past, trading was very subjective. I often traded full positions and then lost them. Afterward, I keep depositing. Every day, I was looking for opportunities in the market eagerly to profit. I didn’t want to let go of any volatility, trading massively. Yet the result is the more I want to regain my capital, the more losses I suffered. This is a vicious circle, which many people have experienced. Of course, some people do not reflect but blame the market, then he must still be paying the price.

FOLLOWME: How many years have you been trading? What is your most important insight?

期市J神: I have been trading full-time for eight years. I think trading is the epitome of human life. A trader can experience the ups and downs of an ordinary person's whole life in one month or even one day.

Investment philosophy

FOLLOWME: In the trading market, there will always be a myth of becoming a billionaire overnight. What do you think of this short-term profiteering?

期市J神: Dozens of times and hundreds of times of profit are the results, and we cannot directly copy the results of others. What we need to pay attention to is the secret behind their success, as well as the trading philosophy, and to learn the good aspects. An overnight billionaire in the leveraged market is normal, and there are dozens of times of risk behind those profits. Successful traders dance with risks instead of blindly avoiding them. After a huge profit, the trader’s psychology should also be improved, otherwise, it’s very likely he will lose what he got.

FOLLOWME: Obviously you attach great importance to technical analysis. In specific trading, how should technical and fundamentals be effectively combined?

期市J神: I think the fundamentals should be greater than the technicals. The market is constantly changing, and the technical aspects will also change over time, but the fundamentals generally do not change easily, such as the Federal Reserve's fiscal policy. Therefore, for long-term trading, pay more attention to the fundamentals, and for short-term, refer to technical mostly.

FOLLOWME: In trading, which one do you think is more important, "trading skills" or "trading psychology"? Why?

期市J神: Trading psychology is the foundation, and the trading technique is the pavilion. Without a foundation, a building will collapse no matter how high it is built.

FOLLOWME: What is your plan for trading? What kind of results do you want to achieve after trading in full-time?

期市J神: At present, I don’t have any clear goals. After achieving financial freedom, the first task is to maintain the vested profits and to trade with reasonable funds. After my own trading is relatively successful, I also hope to do some sharing of insights to help beginner traders improve their trading skills.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.