Daily Market Report - 13th Jan 2021

Official Website: https://www.nooralmal.com/

EURUSD

The EUR/USD pair posted a modest intraday advance this Tuesday, consolidating its latest decline at around 1.2150 for most of the day. Demand for the greenback receded, but the shared currency was unable to recover the ground lost on Monday. Equities traded with a mixed tone, as despite optimism about possible fiscal stimulus in the US, investors were cautious. Upcoming US President Joe Biden is scheduled to speak next Thursday, and speculation points to an announcement on stimulus on that event.

Data wise, investors have little to take care of. The Union didn’t publish macroeconomic data, while the US released minor reports. The December NFIB Business Optimism Index contracted from 101.4 to 95.9, missing the market’s expectations, while the January IBD/TIPP Economic Optimism index improved from 49 to 50.1.

This Wednesday, the ECB will publish November Industrial Production, while ECB’s head, Christine Lagarde is scheduled to speak. The US will release December inflation figures, with core annual inflation foreseen steady at 1.6%.

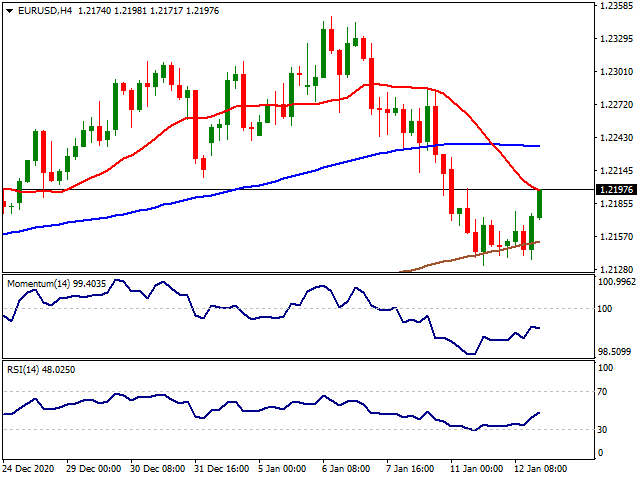

The EUR/USD pair is still at risk of falling, despite trading near its daily highs in the 1.2190 price zone. The 4-hour chart shows that a mildly bullish 200 SMA continues to provide dynamic intraday support, although the pair remains below a firmly bearish 20 SMA. Technical indicators have recovered further from oversold readings, but have lost directional strength within negative levels, indicating limited buying interest. Additional declines are more likely on a break below 1.2125, the immediate support level.

Support levels: 1.2170 1.2125 1.2080

Resistance levels: 1.2210 1.2250 1.2300

USDJPY

The USD/JPY pair spent most of the day consolidating its latest gains, helped by the persistent strength of government bond yields. The yield on the benchmark 10-year note peaked at 1.19%, amid prevalent hopes for additional fiscal stimulus in the US. It later retreated modestly, to end the day at 1.17%. Wall Street opened the day with gains, and despite an intraday knee-jerk, ended up in the green, weighing on the dollar and sending USD/JPY sub-104.00.

Japan published the November Trade Balance, which posted a surplus of ¥616.1 billion, below the previous ¥971.1 billion. The Eco Watchers Survey on current business conditions came in at 35.5, beating expectations although below the previous 45.6. This Wednesday, the country will publish November Machinery Orders and the December Producer Price Index.

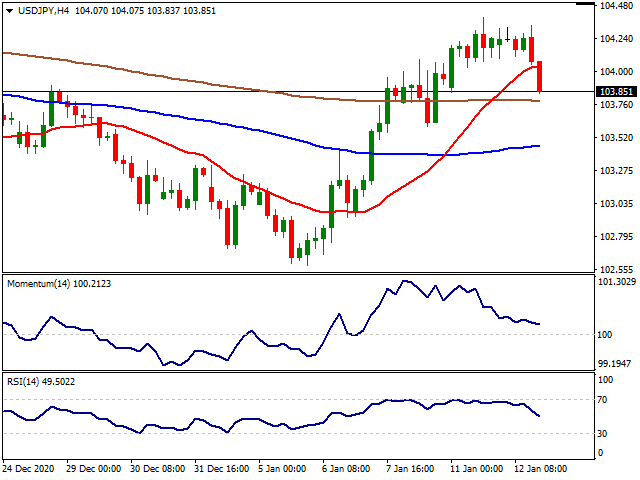

The USD/JPY pair is trading around 103.90 ahead of the Asian opening. In the 4-hour chart, the pair has broken below a still bullish 20 SMA, although it remains above directionless 100 and 200 SMAs. Technical indicators have eased from their daily highs, the Momentum now holding flat above its 100 level and the RSI approaching its midline. The risk of a steeper decline will increase on a break below 103.50.

Support levels: 103.50 103.15 102.70

Resistance levels: 104.15 104.50 104.90

GBPUSD

The British Pound was the best performer against the greenback this Tuesday, with GBP/USD hitting 1.3651, to close the day a handful of pips below the level. The sterling got boosted by Bank of England’s Governor Andrew Bailey, who cooled expectations of negative rates, after noting that they are a controversial issue. He also said that it’s too early to reach any conclusion about the need for future stimulus.

The UK published the December BRC Like-For-Like Retail Sales, which posted a modest 4.8%, missing the expected 7.9% advance and below the previous 7.7%. The country won’t release macroeconomic data this Wednesday.

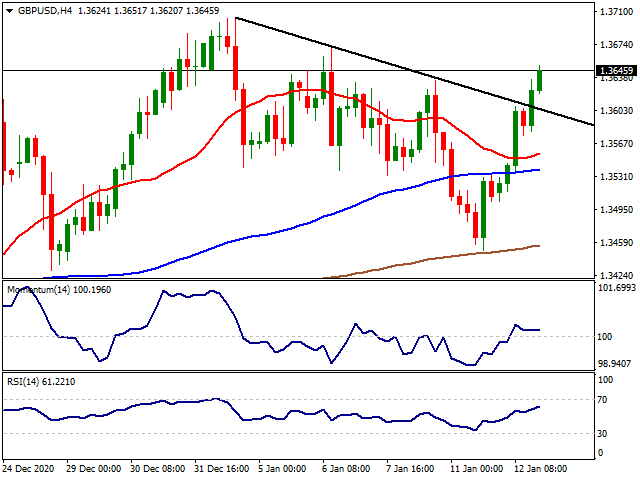

The GBP/USD pair is on its way to extend the latest advance. The 4-hour chart shows that it has broken above a descendant trend line coming from 1.3703, this month’s high. The pair advanced beyond all of its moving averages, which head just modestly up. The Momentum indicator lacks directional strength around its midline, but the RSI advances around 59, skewing the risk to the upside.

Support levels: 1.3590 1.3540 1.3495

Resistance levels: 1.3670 1.3715 1.3750

AUDUSD

The AUD/USD pair recovered towards the 0.7760 price zone, as the dollar came under selling pressure on Wall Street’s gains. The aussie was on the winning side for most of the day, as the market’s mood improved, although a certain caution prevailed. The greenback was pressured by rising US Treasury yields, while the positive tone of equities provided a late boost. The Australian macroeconomic calendar has nothing to offer these days.

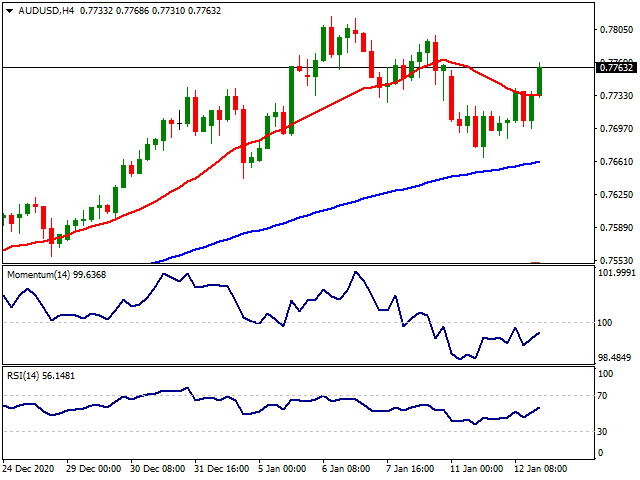

The AUD/USD pair is slowly recovering ground and its bullish stance. In the 4-hour chart, it has recovered above its 20 SMA, which remains flat. The longer moving averages maintain their bullish stance below the current level. Technical indicators advance, the RSI around 55 and the Momentum still below its midline, anyway favoring additional gains, mainly on an advance beyond 0.7770 the immediate resistance.

Support levels: 0.7670 0.7620 0.7580

Resistance levels: 0.7720 0.7770 0.7815

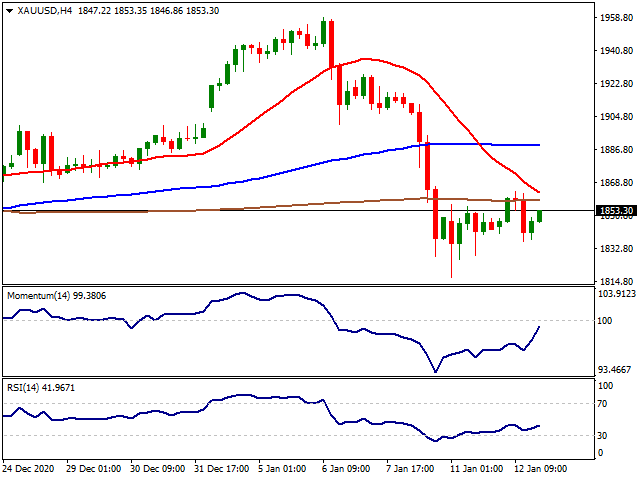

GOLD

Gold managed to gain some traction on Tuesday assisted by the retracement seen in the USD index DXY. The USD index DXY declined to 90.00 levels while the US 10-year yields lost a marginal portion of its incline sliding from its 10 months high of 1.15 to 1.13. Blue Wave in the US was expected to support precious metals in general. However, Gold failed to capitalise the Democrat victory so far as the traders are willing to focus more on the technical rather than fundamentals. Also, the rally seen in the real yields continues to pressure precious metals. Also, expected higher liquidity injection to markets will most likely generate inflation and precious metals are usually considered as a good hedge instrument against it.

From the technical point of view, below the $1,860 level, the supports can be followed at $1,800, $1,763 ($1,451-$2,075 61.80%) and $1,700 levels. Over the $1,860 level, the resistances can be followed at $1,900 with $1,956 ($1,451-$2,075 38.20%) and $2,000 levels.

Support Levels: $1,800 $1,763 $1,700

Resistance Levels: $1,900 $1,956 $2,000

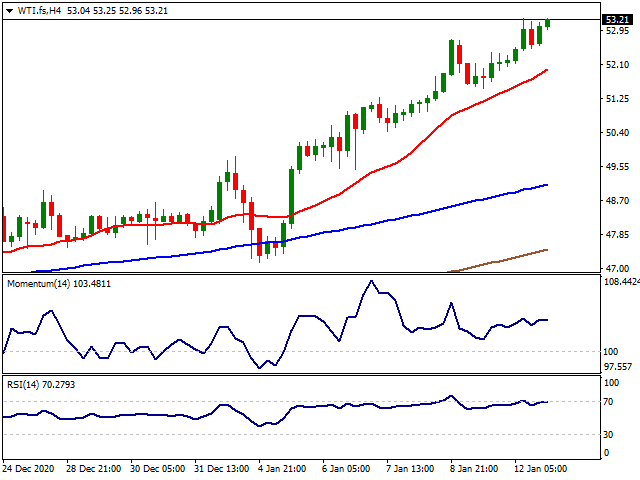

CRUDE WTI

After the technical correction seen on Monday, WTI found extra support on Tuesday with the decline seen in the USD index DXY. Also, the US 10-year yield stabilised and slowed its rally after hitting its highest level in 10 months with 1.15. On the other hand, the biggest positive catalyst came from Saudi Arabia by cutting their oil production voluntarily to balance the loss of demand due to pandemic restrictions. UBS expects the oil market to be undersupplied by 1.5M barrels per day in 2021 and Goldman Sachs upgraded their forecast for Brent, seeing the oil grade rally to $65 per barrel by mid-2021.

If WTI keeps its position below 52.00$ level, 51.03$ (October 2019 low), 50.60$ (June/August 2019 support) and 50.00$ levels can be followed as new targets. Over the 53.00$ level, the resistances might be followed at 53.93$ (63.33$-51.03$ %23.60), 55.73$ (63.33$-51.03$ %38.20) and 57.13$ (63.33$-51.03$ %50.00).

Support Levels: 51.03$ 50.60$ 50.00$

Resistance Levels: 53.00$ 53.93$ 55.73$

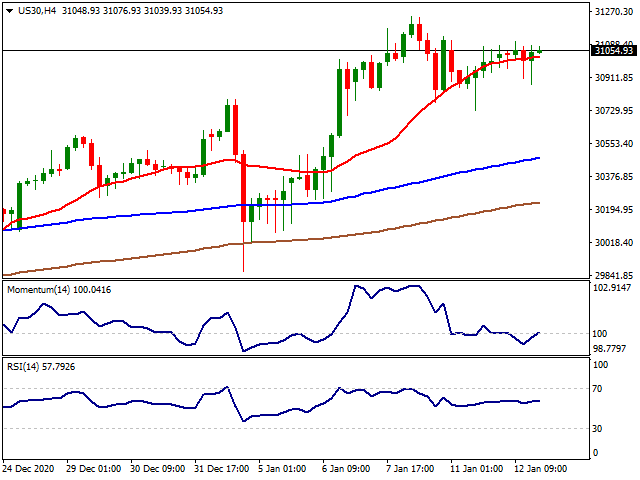

DOW JONES

Dow Jones entered into a wait and sees mode keeping almost the same trading range on Monday and Tuesday trading close to its all-time high at 31,193. The USD index DXY faced a technical correction while the rally in the US 10-year yield slowed down on Tuesday. President-elect Joe Biden's administration is, reportedly, set to unveil a large fiscal stimulus plan on Thursday. Media reports said the president was unlikely to resign and the invocation of the 25th amendment isn't an idea that's popular with Vice President Mike Pence. On the data side, the number of job openings on the last business day of November was 6.5 million, compared to 6.6 million in October, the US Bureau of Labor Statistics announced in its latest Job Openings and Labor Turnover Summary (JOLTS) on Tuesday. This reading missed the market expectation of 6.9 million indicating the slowdown in the labour market.

At this point, the rally seen in US 10-year yield is keeping the US indexes for further inclines. From the technical point of view, if the index stays over 31,000, 32,000 and 32,500 levels can be followed as new targets high while below the 31,000 level, 30,000 and 29,500 levels can be followed as supports.

Support Levels: 31,000 30,000 29,500

Resistance Levels: 32,000 32,500 33,000

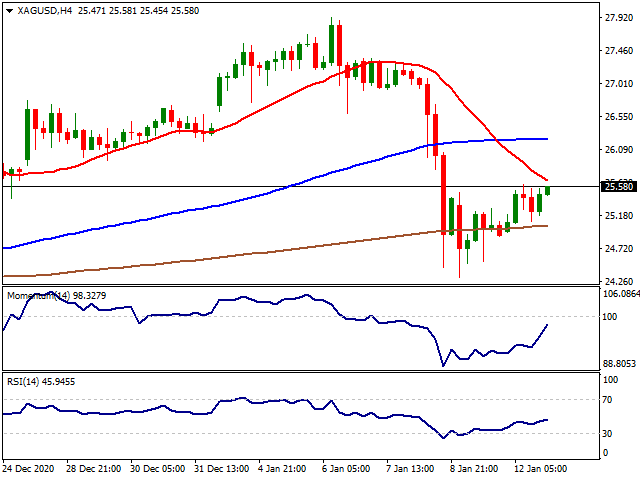

SSISLVLVERR

Silver also gained traction on Tuesday alongside Gold building a steady base around $25.50 levels. The decline seen in the USD index DXY and also the slowdown in the 10-year yield rally gave a room for precious metals to advance on Tuesday. After hitting its 2020 high at $29.86, Silver entered into a consolidation zone between $25.50 and $22.80. Also, Gold to Silver ratio is still far away from its normal levels hovering around 72.00 levels indicating Silver has further room to improve especially with the return of the manufacturing sector.

If Silver manages to stay over $27.00, next targets upside might be followed at $29.28 (March 2013 resistance) and $30.00 levels. Below the $27.00 level, the supports might be followed at $25.00, $24.00 and $23.38 levels.

Support Levels: $25.00 $24.00 $23.38

Resistance Levels: $27.00 $29.28 $30.00

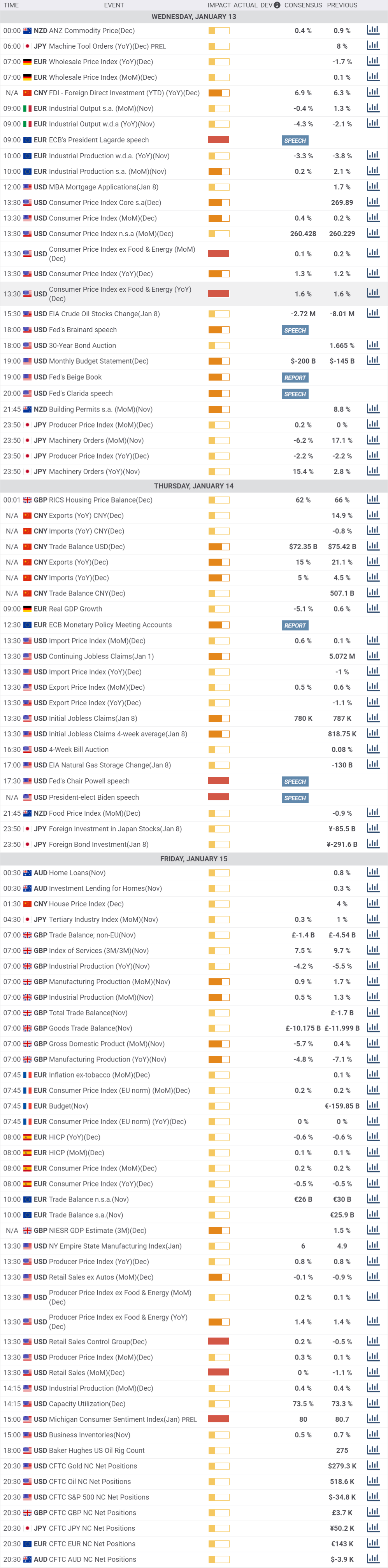

MACROECONOMIC EVENTS

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.