Daily Market Report - 7th Jan 2021

Official Website: https://www.nooralmal.com/

EURUSD

The EUR/USD pair soared amid an upbeat market mood, with equities rallying and Treasury yields trading at levels not seen since March 2020. The pair hit 1.2349, turning south during US trading hours as the dollar finally got to run with local indexes. The pair retreated but later recovered the 1.2300 threshold as Wall Street hit fresh all-time highs. The mood got boosted by Georgia elections, which granted Democrats control of the chambers.

Data wise, Markit published the final figures of the September PMIs. Services output further contracted into negative territory for a second consecutive month in December, although the latest decline was far softer than that recorded in November, according to Markit. The final EU Services PMI resulted in 46.4, while the Composite index shrank to 49.1. Germany published the preliminary estimate of December inflation, which remained at -0.3% YoY. The US published a terrible ADP survey showing that the private sector lost 123K positions in December. Finally, the Fed published the Minutes of its latest meeting. The document had a limited impact on currencies, as it showed that some members are in favor of expanding stimulus.

This Thursday, Germany will publish November Factory Orders, while the EU will unveil December Retail Sales, inflation data, and Consumer Confidence. The focus during the American session will be on employment data, ahead of the Nonfarm Payroll report to be out on Friday, and the December ISM Services PMI, foreseen at 54.5 from 55.9 in the previous month.

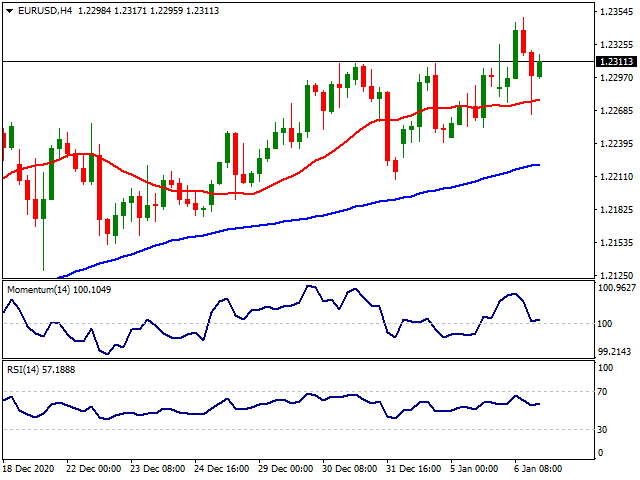

The EUR/USD pair holds on to its bullish stance, despite having lost momentum. The 4-hour chart shows that buyers surged around a flat 20 SMA, while the longer moving averages maintain their bullish slopes below it. Technical indicators eased from near overbought readings but lost their bearish strength after nearing their midlines, indicating limited selling interest. The pair has room to extend its advance, mainly on a break above 1.2345, the immediate resistance level.

Support levels: 1.2265 1.2220 1.2170

Resistance levels: 1.2345 1.2390 1.2420

USDJPY

The USD/JPY pair jumped from a fresh multi-month low of 102.58 to 103.44, rallying alongside Wall Street, but mostly supported by US Treasury yields. The yield on the benchmark 10-year note jumped to 1.05%, above 1.0% for the first time since March. Democrats victory in Georgia fueled risk-appetite as upcoming US President Joe Biden’s party will dominate both chambers.

Japanese data released at the beginning of the day was mixed, as the Jibun Bank Services PMI beat expectations in December, printing at 47.7, although below the previous estimate of 47.8. The Consumer Confidence Index in the country contracted to 31.8 in December, missing the market’s forecast of 38.5. During the upcoming Asian session, the country will publish November Labor Cash Earnings.

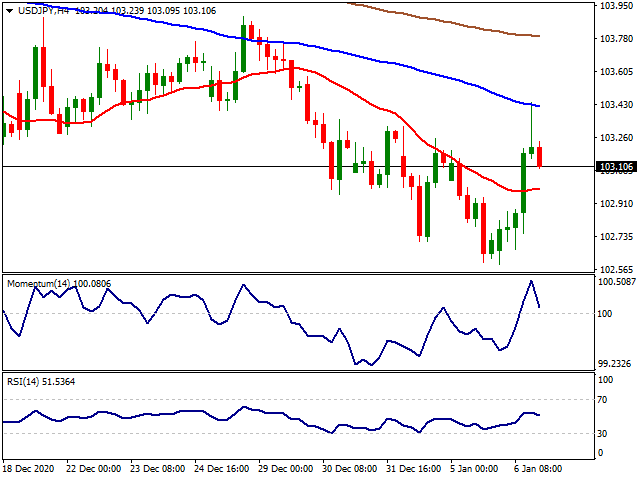

The USD/JPY pair trades around 103.10 heading into the Asian session, but its bullish potential still seems limited. In the 4-hour chart, the pair recovered above a now flat 20 SMA, but it met sellers around a firmly bearish 100 SMA. Technical indicators have entered positive territory, but the Momentum turned sharply lower, and the RSI tuned flat around 53. Bulls will have better chances on a break above the mentioned 100 SMA, which provides dynamic resistance around 103.45.

Support levels: 103.00 102.60 102.20

Resistance levels: 103.45 103.80 104.10

GBPUSD

The GBP/USD pair fell to 1.3537, a fresh weekly low, on the back of the resurgent dollar’s demand during US trading hours. The pair bounced as risk appetite also returned, trading around the 1.3600 level as the day comes to an end. The pound remains pressured by coronavirus developments in the kingdom, as the number of cases in the UK keeps reaching highs daily basis, menacing the health system. New contagions over the last 24 hours reached 62,5K, while the death toll hit 1,041.

The UK calendar had little to offer this Wednesday. The country published the November BRC Shop Price Index, which matched its previous reading by printing at -1.8%. The December Markit Services PMI contracted to 49.4 from 49.9. The kingdom won’t publish macroeconomic figures on Thursday.

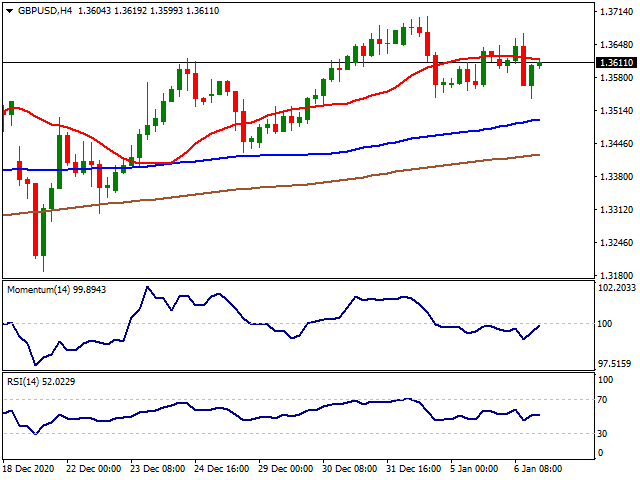

The GBP/USD pair trades a few pips above the 1.3600 level, with its bullish potential still limited. The 4-hour chart shows that the pair keeps developing below a mildly bearish 20 SMA. The Momentum indicator advances below its 100 level, while the RSI is flat around 50. The pair is finishing the day unchanged and near a multi-year high, indicating that, despite a weaker pound, a steeper decline seems limited by reduced dollar’s demand in the longer run.

Support levels: 1.3565 1.3515 1.3470

Resistance levels: 1.3660 1.3710 1.3750

AUDUSD

The aussie reached 0.7807 against the greenback this Wednesday, paring gains just ahead of the monthly high from April 2018 at 0.7812. The pair retreated just modestly with the resurgent greenback’s demand during US trading hours, but quickly regained the upside and trades around 0.7800 as the day comes to an end. The pair ignored falling gold prices, as the bright metal shed over $40.00 per troy ounce. Instead, it found support in US equities, as the DJIA flirted with the 31,000 level.

Australian data released early Wednesday missed expectations, as the December Commonwealth Bank Services PMI printed at 57, anyway indicating expansion in the sector. The Composite PMI shrank to 55.6 from a previous estimate of 57.

On Thursday, Australia will publish its November Trade Balance. The surplus is foreseen at 6200 million, down from 7456 million in the previous month. The country will also publish Building Permits for the same month, expected to have risen by 2.5%.

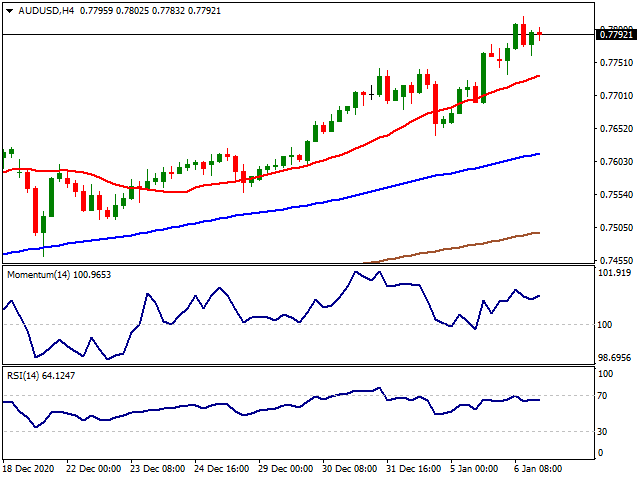

The AUD/USD pair is holding near the mentioned daily high, bullish in the near-term. The 4-hour chart shows that the pair is firmly developing above a bullish 20 SMA, which keeps advancing beyond the larger ones. The Momentum indicator resumed its advance within positive level while the RSI indicator consolidates near overbought readings, favoring another leg north towards the 0.7900 price zone.

Support levels: 0.7780 0.7740 0.7700

Resistance levels: 0.7815 0.7850 0.7890

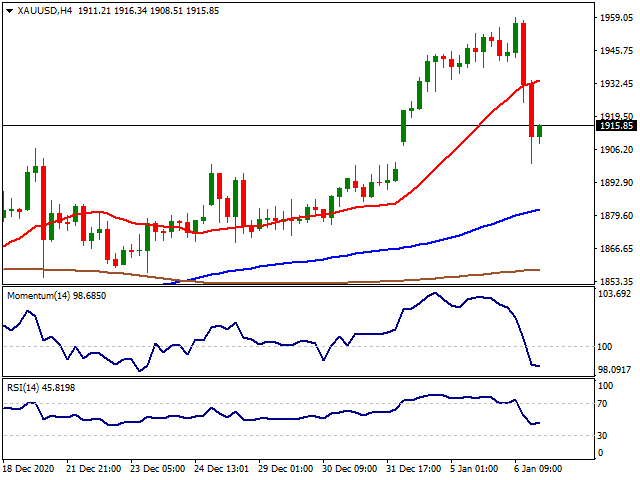

GOLD

Gold had an extremely volatile trading session on Wednesday as Democrats declared victory in Georgia confirming the blue wave taking control of the Senate, Congress and Presidency. 10-year yields printed fresh highs since February 2020 at 1.051% printing a whopping 10.02% gain on a daily basis fueled with balance sheet deficit and inflation expectations. Democrat win looks like priced already on the precious metals front as both Gold and Silver had a strong start to 2021. A clear Democrat win means more liquidity, regulations and stimulus to markets. Also, it is widely expected that the USD will continue to lose ground in 2021. Despite the expectations, the USD index DXY managed to gain a little ground hovering a tick over 89.50 levels.

Gold managed to test $1,950 before the US session but then reversed its course testing $1,900 level. From the technical point of view, below the $1,860 level, the supports can be followed at $1,800, $1,763 ($1,451-$2,075 61.80%) and $1,700 levels. Over the $1,860 level, the resistances can be followed at $1,900 with $1,956 ($1,451-$2,075 38.20%) and $2,000 levels.

Support Levels: $1,800 $1,763 $1,700

Resistance Levels: $1,900 $1,956 $2,000

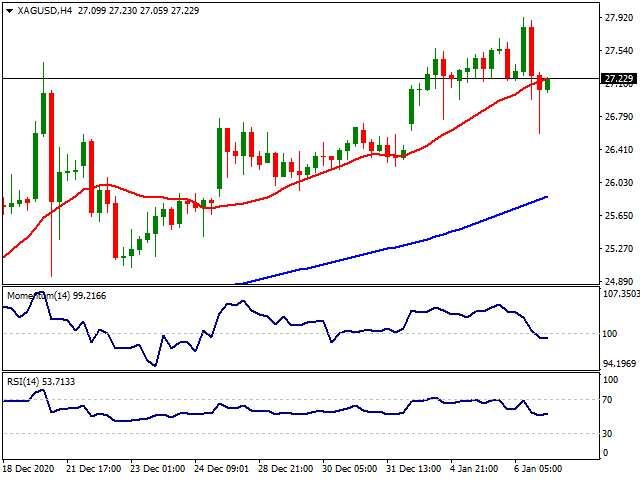

SILVER

Silver also had a volatile day on Wednesday alongside Gold. However, despite the sharp decline, Silver managed to outperform Gold with a tight margin pushing Gold to Silver ratio to 70.00 levels. As the Democrats won the majority in the Senate alongside the Congress and Presidency, it is expected that 5% of the US GDP will be injected into the markets. Therefore, precious metals will most likely benefit the expected decline in the USD. However, the USD index DXY managed to lift itself with marginal gains to 89.50 levels putting pressure on precious metals. As the big picture is still promising for precious metals, in the long run, retracements can be seen as a buying opportunity.

If Silver manages to stay over 27.00$, next targets upside might be followed at 29.28$ (March 2013 resistance) and 30.00$ levels. Below the 27.00$ level, the supports might be followed at 25.00$, 24.00$ and 23.38$ levels.

Support Levels: 25.00$ 24.00$ 23.38$

Resistance Levels: 27.00$ 29.28$ 30.00$

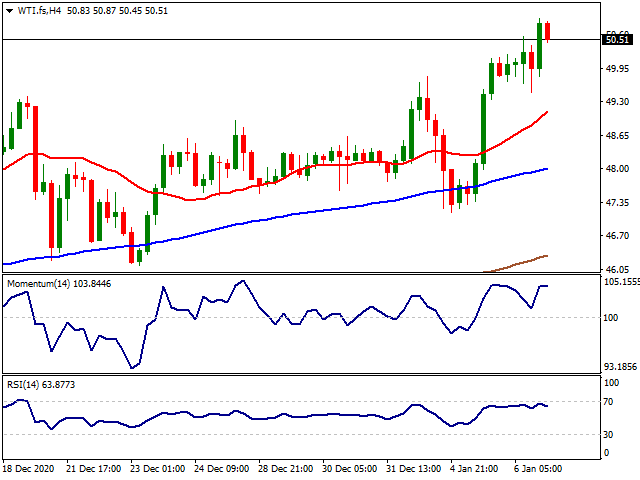

CRUDE WTI

WTI continued its move up on Wednesday after OPEC+ agreed on voluntary production cuts. The Saudi Arabians announced at the end of Tuesday’s OPEC+ meeting that they would be voluntarily cutting oil production by 1M barrels per day in February and March. The cut more than makes up for OPEC+ allowance for Russia and Kazakhstan to increase output by a combined 75K barrels per day in order to meet higher seasonal domestic demand. On the other hand, better than expected EIA inventory figures also supported WTI combined with Democrat controlled Senate and Congress. More than expected stimulus check with the Democrat win is keeping the spending expectations alive despite the pandemic figures continuing to grow in the US.

If WTI stays below 50.00$ level, the support levels can be followed at 46.96$ and 44.66$ levels. Over the 50.00$ level, the upside targets can be followed at 51.03$ (October 2019 low) and 53.00$ levels.

Support Levels: 46.96$ 44.66$ 44.47$

Resistance Levels: 50.00$ 51.03$ 53.00$

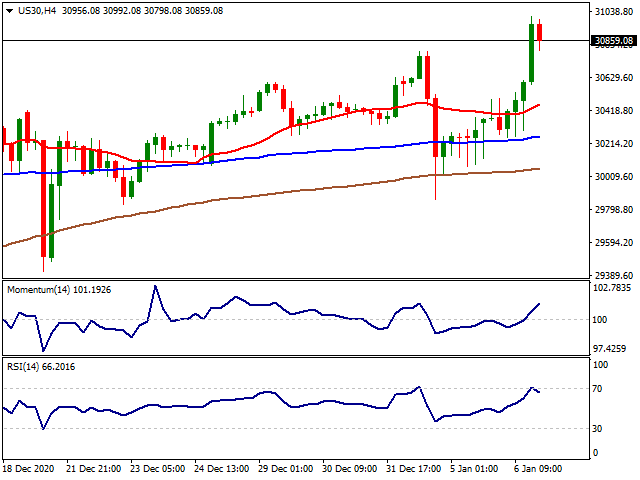

DOWOWWW

The US indexes cheered the Democrat win in Georgia which let them control the Senate but faced a retracement by the end of the session as protests escalated. The victory means the Senate is split, handing an effective majority to the Democrats who now control all three chambers. On the other hand, Trump continues to decline the election results while his supporters raided the Congress. Despite the blue wave and Trump supporter’s protests, Dow Jones printed a new all-time high at 31,000. Also, curfew announced in Washington by the end of the session as the protests escalated. On the data side, ADP's employment change in November rose 307,000, less than the consensus estimate of 430,000 and lower than the revised prior reading of 404,000. Apart from the Georgia election noise, The minutes of the Dec. 15-16 FOMC meeting show that all participants supported adding further guidance regarding future asset purchases, particularly noting the objectives needed to be reached before the pace of those purchases is slowed. In their statement following the meeting, the committee said that they will continue to expand its asset purchase program until "substantial further progress has been made toward the committee's maximum employment and price stability goals," providing some guidance to markets looking for a time frame for a taper to begin. It seems like the noise will continue until Biden’s inauguration on 20th of January. On the other hand, markets are gearing into the NFP data set on Friday apart from the current developments about the election results.

From the technical point of view, if the index stays over 29,000, 29,500 and 30,000 levels can be followed as new targets high while below the 28,400 level, 28,000 and 27,770 can be followed as supports.

Support Levels: 28,400 28,000 27,770

Resistance Levels: 29,500 30,000 30,500

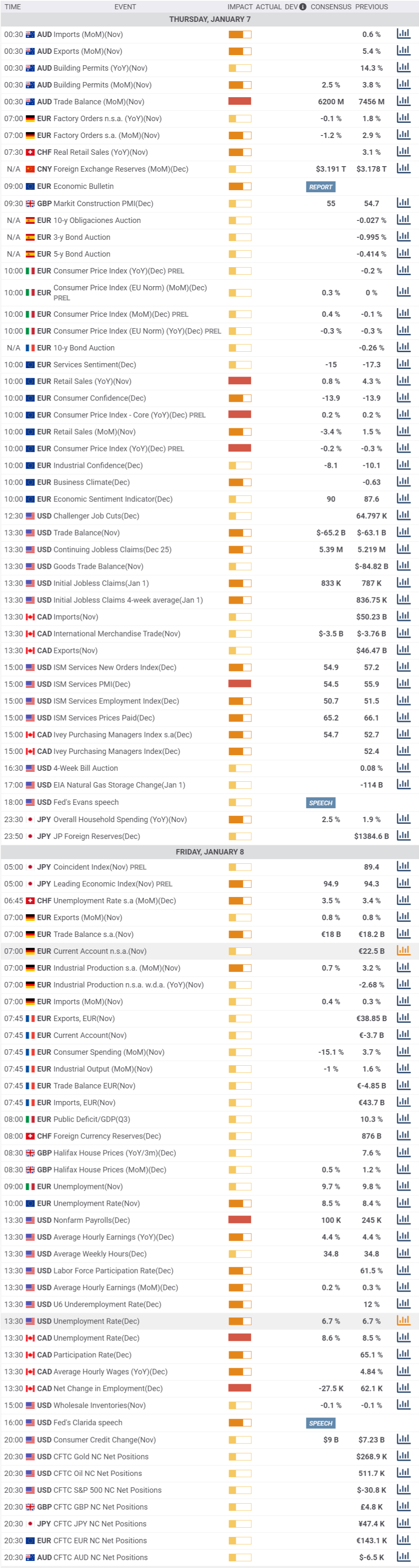

MACROECONOMIC EVENTS

Edited 07 Jan 2021, 08:59

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.