Daily Market Report - 5th Jan 2021

Official Website: https://www.nooralmal.com/

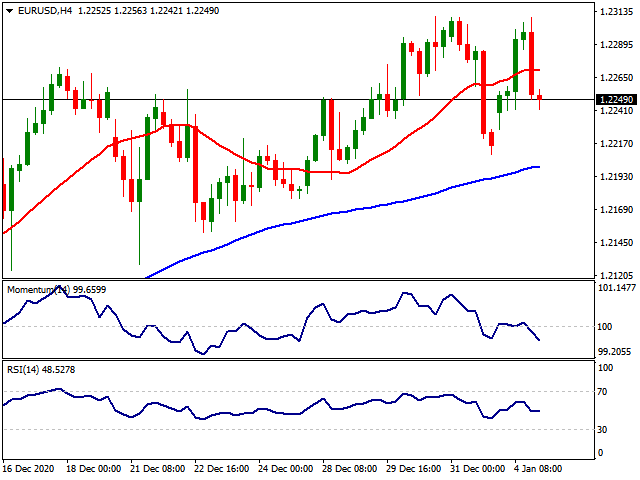

EURUSD

The EUR/USD pair surged to 1.2305 on the broad dollar’s weakness at the weekly opening, as equities soared to record highs in the US. The American dollar changed course during US trading hours as the market’s sentiment soured. Concerns came from the UK as the kingdom is set to announce a national lockdown. Also, doubts arise about vaccines’ effectiveness on a new coronavirus strain coming from South Africa, as it presents substantial changes in the structure of the virus’ spike protein. European indexes got to close in the green, but US indexes trimmed pre-opening gains and turned sharply lower to end the day in the red.

Data wise, Markit published the final readings of its December Manufacturing PMIs. The European ones were downwardly revised, with the German index was confirmed at 58.3 from 58.6 previously, while for the whole Union, the index resulted at 55.2. US manufacturing output, on the other hand, beat the previous estimate by printing 57.1. This Tuesday, Germany will publish November Retail Sales, while the US will unveil the official December ISM Manufacturing PMI, foreseen at 56.6 from 57.5 in the previous month.

The EUR/USD pair plummeted from the mentioned high to the current 1.2250 price zone, still holding above last week’s close at 1.2215. The 4-hour chart indicates that the current corrective decline may continue, as the pair has broken below its 20 SMA while still holding above the longer ones, which maintain their bullish slopes. Technical indicators head south with uneven strength within negative levels, favoring a bearish continuation in the near-term.

Support levels: 1.2210 1.2170 1.2125

Resistance levels: 1.2260 1.2310 1.2345

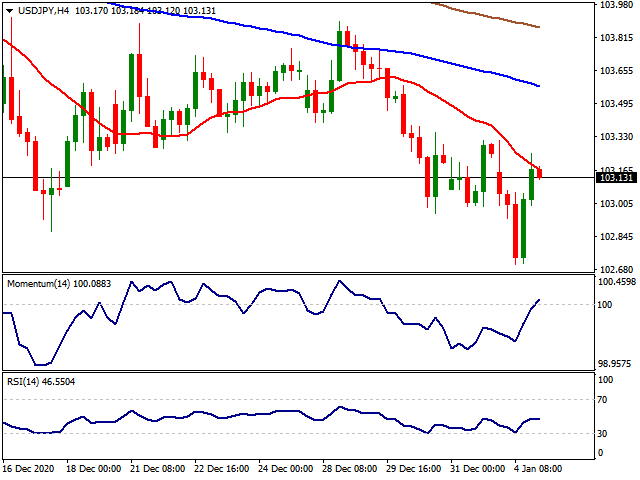

USDJPY

The USD/JPY pair fell to 102.70, its lowest since last March, amid persistent dollar’s weakness. It later recovered to the current 103.10 price zone as investors rushed into the safe-haven dollar on plummeting equities. The main market’s theme is rising coronavirus cases worldwide and new restrictive measures coming alongside. Japan announced a Tokyo’s curfew starting 8 pm, with bars and restaurants asked to close at that time, while people have been asked to stay in their homes unless urgent needs.

On the data front, Japan published the December Jibun Bank Manufacturing PMI, which came in at 50, improving from 49.7. The country will publish December Monetary Base early Tuesday, previously at 16.5% YoY.

The USD/JPY pair is still at risk of falling further, with the next bearish target being 101.17, the March 2020 monthly low. The 4-hour chart shows that a firmly bearish 20 SMA is capping advances while accelerating south below the larger ones. The Momentum indicator heads north just above its midline, but the RSI turned south below its 50 level after correcting oversold readings.

Support levels: 102.70 102.30 101.95

Resistance levels: 103.50 103.90 104.30

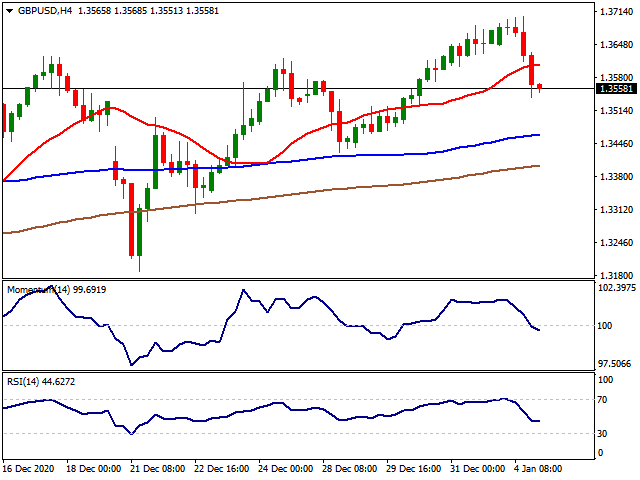

GBPUSD

The GBP/USD pair peaked at 1.3702 this Monday, its highest in over two years, but plummeted over 150 pips from such a high to settle near a daily low of 1.3541. Risk-appetite led the way at the weekly opening, but it quickly faded on coronavirus-related news. The latest on the issue came from Prime Minister Boris Johnson who announced a total lockdown starting mid-night. Concerns mounted after Professor of Medicine at Oxford University John Bell said that there are questions about vaccines’ effectiveness on the new South African strain, amid substantial changes in the structure of the virus’ spike protein.

The UK December Markit Manufacturing PMI resulted at 57.5, better than anticipated. The UK also published November November Mortgage Approvals, which improved to 104.969K. The country also reported 58,784 new coronavirus infections, a record high. The UK won’t publish relevant macroeconomic data this Tuesday.

The GBP/USD pair is poised to extend its decline, according to intraday technical readings. In the 4-hour chart, technical indicators retreated from overbought readings to fell into negative levels, although the bearish momentum eased. In the mentioned chart, the pair has fallen below its 20 SMA, which currently stands at 1.3605, providing dynamic resistance. The bearish case could accelerate on a break below the 1.3515, the immediate support level.

Support levels: 1.3515 1.3470 1.3420

Resistance levels: 1.3605 1.3660 1.3710

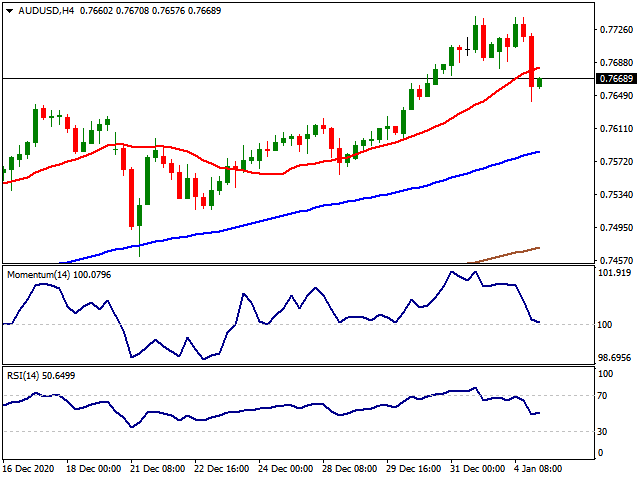

AUDUSD

The AUD/USD pair retreated from a daily high of 0.7740 during the American session, dragged by the sour tone of US equities. The pair fell to 0.7641, but as stocks pared their slides, the pair got to recover some ground, now trading around the 0.7670 level. Australia published at the beginning of the day the December Commonwealth Bank Manufacturing PMI, which resulted at 55.7, below the expected 56. The country also released the December RBA Commodity Index, which came in at 11.7% YoY. Australia won’t publish relevant data this Tuesday.

The AUD/USD pair has a limited bearish potential according to the 4-hour chart, as technical indicators pared their slides after approaching their midlines, holding above them. The pair has fallen below its 20 SMA, but the larger ones maintain their bullish slopes well below the current level, indicating a limited bearish interest at the time being. A steeper decline could be expected on a break below 0.7605.

Support levels: 0.7640 0.7605 0.7570

Resistance levels: 0.7700 0.7740 0.7785

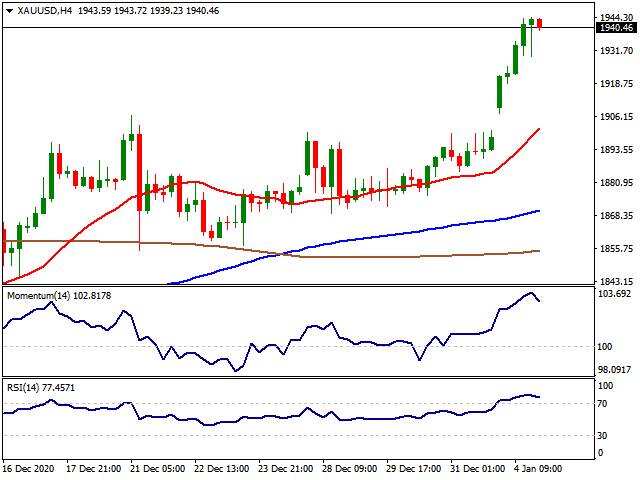

GOLD

Gold started the new year with an impressive rally printing an almost $45 gain on a daily basis. The move surprised investors as the USD index DXY held its level a tick below the 90.00 level. On the other hand, US indexes lost their charm on Monday as the capital flow favoured precious metals. At this point, Gold might be pricing a Democrat victory in the upcoming run-off election in Georgia. A Democrat victory is considered as more stimulus than initially agreed. Therefore, precious metals might find extra support in case of more liquidity injected into the markets. On the pandemic side, much-relieved vaccine roll-out seems to be lagging market expectations. The number of new cases and fatalities continues to break records forcing the UK to announce tier 5 level lockdown measures while the numbers in the US looks out of control. Also, it is reported that there are big logistics problems in the US to roll-out the vaccine due to discoordination from the Trump administration.

If Gold tests $1,950, the targets upside can be followed at $1,980, $2,000 and $2,040 levels. Below the $1,950 the supports can be followed at $1,920, $1,900 and $1,825 (2011 August close) levels.

Support Levels: $1,920 $1,900 $1,825

Resistance Levels: $1,980 $2,000 $2,040

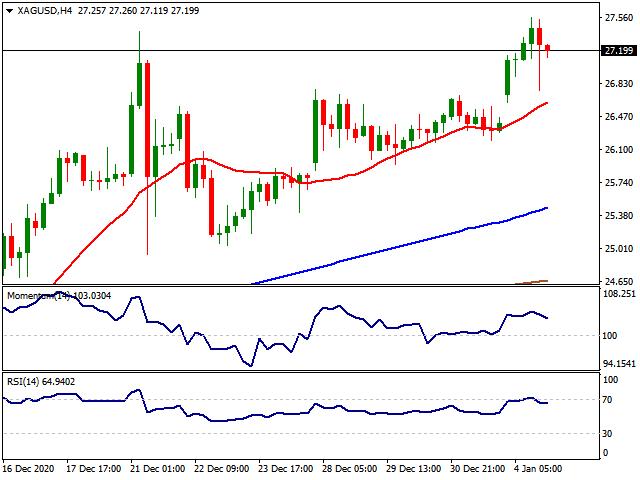

SILVER

Silver also benefited the precious metal rally seen on the first trading session of 2021 and tested mid-$27.00 levels. The white metal outperformed Gold pushing Gold to Silver ratio back to 71.00 levels. On the other hand, surprisingly, the USD index DXY was almost unchanged while the US indexes retraced from their all-time highs. The run-off election in Georgia today will play a critical role in Biden’s policies. In case of a Democrat sweep, more than agreed stimulus checks might be on the table and the USD might stay under further pressure. On the other hand, Silver is 50% down from its all-time high while Gold is around 10% down. Therefore, a balance movement between the two major precious metals might be on the table in the long run.

If Silver manages to stay over 27.00$, next targets upside might be followed at 29.28$ (March 2013 resistance) and 30.00$ levels. Below the 27.00$ level, the supports might be followed at 25.00$, 24.00$ and 23.38$ levels.

Support Levels: 25.00$ 24.00$ 23.38$

Resistance Levels: 27.00$ 29.28$ 30.00$

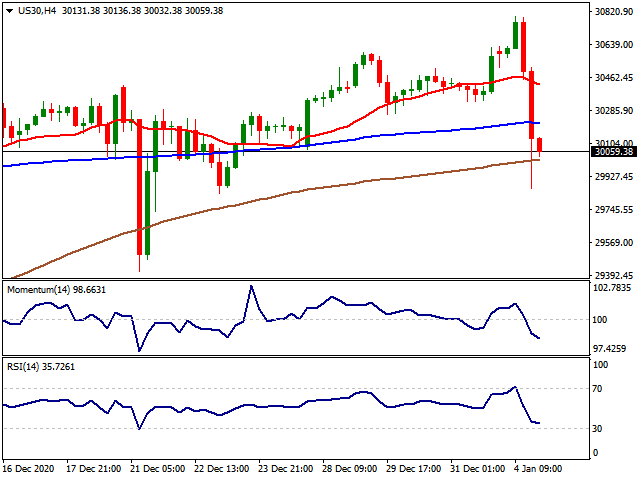

DOW JONES

The US indexes faced a sharp correction downside on Monday before the key senate election in Georgia. The senatorial election will determine who will lead the first part of the Biden administration. In case of a Republican victory, Senator Mitch McConnel will be the Senate majority leader and be able to block Biden’s political agenda. On the other hand, if Democrats win, it will lead to the possibility of more stimulus, regulations, and higher taxes. Apart from the usual election anxiety, the US president's Donald Trump's leaked audio of an hour-long phone call between him and Georgia's secretary of state shook the markets. The incumbent president was recorded begging the official to overturn his state's election results, which showed Biden winning by just under 12,000 votes. On the other hand, the constant surge in coronavirus cases continues to pressure the markets. Despite the vaccine roll-out, it has been reported that the Trump administration is failing to coordinate the logistics of the vaccination at the moment. Therefore, the vaccine optimism started to fade away as the effects in real life might take longer than expected. Despite the gloomy pandemic figures and election turmoil, the economic activity in the US' manufacturing sector expanded at its strongest pace since September 2014 in December with the IHS Markit's Manufacturing PMI climbing to 57.1 from 56.7 in November. This reading came in better than the flash estimate of 56.5 as well. However, strong data reading failed to save the markets on Monday.

From the technical point of view, if the index stays over 29,000, 29,500 and 30,000 levels can be followed as new targets high while below the 28,400 level, 28,000 and 27,770 can be followed as supports.

Support Levels: 28,400 28,000 27,770

Resistance Levels: 29,500 30,000 30,500

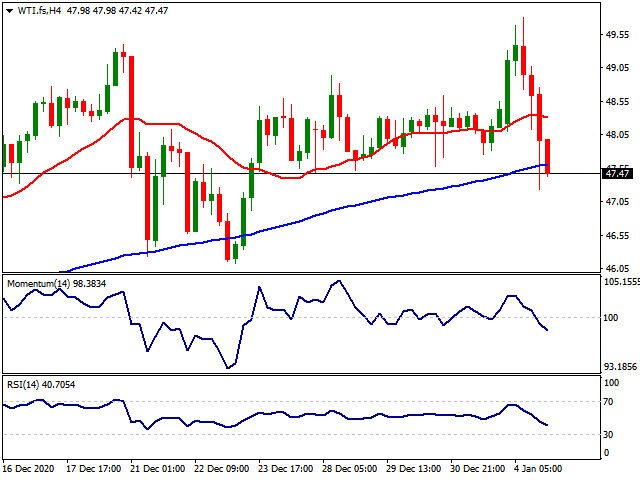

WWTITITIT

WTI tried to test $50.00 on Monday but failed to stay in the positive zone as sell-off intensified in the US indexes. On Monday, US stocks fell sharply over the concerns of the outcome of runoff elections in Georgia and the US president's Donald Trump's leaked audio of an hour-long phone call between Trump and Georgia's secretary of the state creating a risk event. On the other hand, OPEC+ raised opposition to increase oil output from February when they met on Sunday, according to Reuters. OPEC+ increased output by 500,000 barrels per day (BPD) this month, however, some of the members have questioned the need to increase more from February due to an upsurge in the COVID-19 pandemic.

From the technical point, next supports can be seen at $47.00, $45.00 and $43.88 respectively while the resistances can be followed at $48.00, $48.50 and $49.00 levels.

Support Levels: $47.00 $45.00 $43.88

Resistance Levels: $48.00 $48.50 $49.00

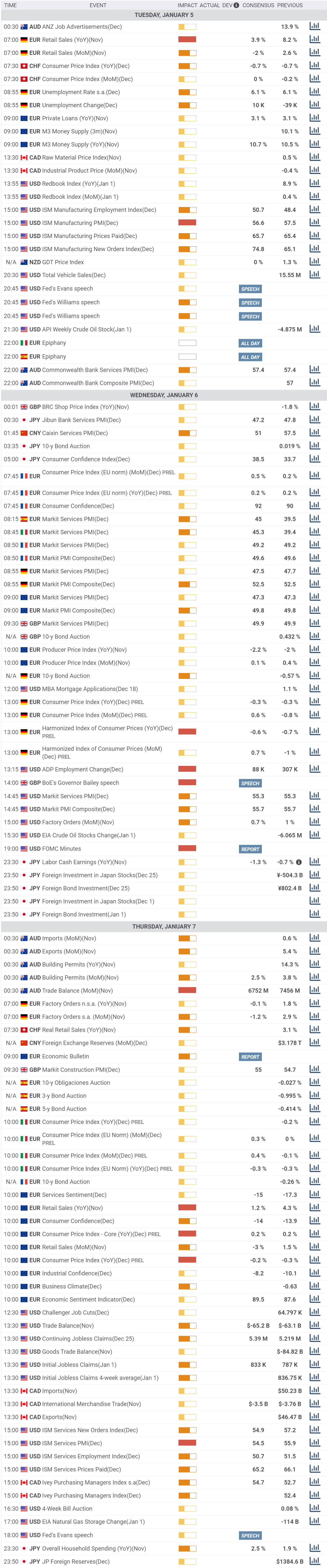

MACROECONOMIC EVENTS

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.