Daily Market Report - 28th Dec 2020

Official Website: https://www.nooralmal.com/

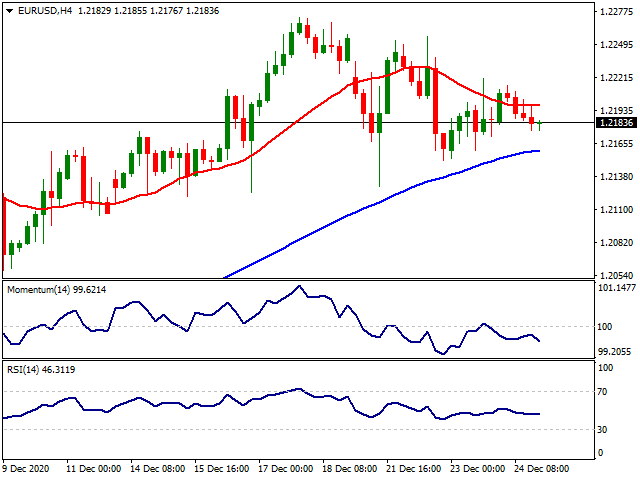

EURUSD

The EUR/USD pair finished a shortened week in the 1.2180 price zone, unchanged for the day amid low volumes on Christmas Eve. Profit-taking gave modest support to the greenback, although uncertainty about the US stimulus bill kept its bullish potential limited. After the US Congress approved an almost $900 billion package, President Donald Trump refused to sign it and asked for an amendment on direct payments to Americans from $600 to $2000.

These upcoming days will see a scarce macroeconomic calendar and low activity persisting amid the Year-End holiday. Financial markets will continue to move alongside sentiment, this last motorized by the post-Brexit agreement and a US coronavirus-relief package developments. On Monday, the US will publish the December Dallas Fed Manufacturing Business Index.

The EUR/USD pair keeps consolidating yearly gains. The daily chart shows that the 20 SMA maintains its bullish slope, providing dynamic support around 1.2130, and well above the longer ones. Technical indicators turned flat within positive levels, reflecting limited trading instead of suggesting decreased buying interest. In the near-term and according to the 4-hour chart, the risk is skewed to the downside, as the pair trades below a flat 20 SMA, while technical indicators head south below their midlines, although with limited directional strength.

Support levels: 1.2130 1.2085 1.2040

Resistance levels: 1.2220 1.2275 1.2310

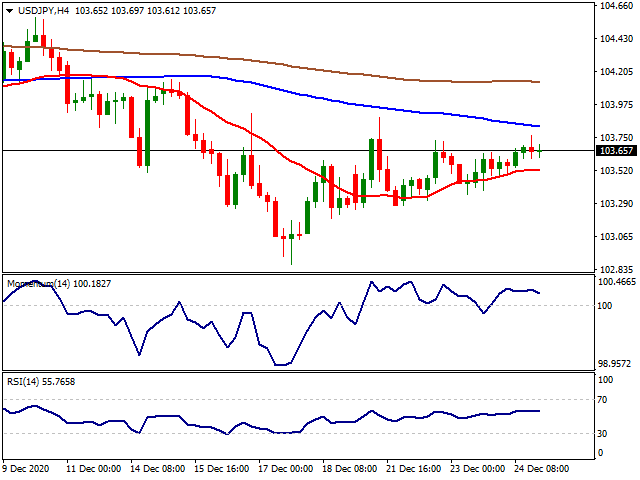

USDJPY

The USD/JPY pair closed the week at 103.65, posting some modest weekly gains, although confined to familiar levels. Investors were mostly optimistic after the UK and the EU clinched a post-Brexit deal, resulting in European and American equities closing in the green. Activity, however, was restricted amid winter holidays in the northern hemisphere.

Christmas is not a national holiday in Japan, and the country released multiple macroeconomic figures on Friday. December Tokyo inflation was confirmed at -1.3% YoY, while November Retail Trade resulted in 0.7% YoY, missing expectations of 1.7%. This Monday, the country will publish the preliminary estimate of November Industrial Production.

The USD/JPY pair is bearish, as, in the daily chart, it continues to develop below a bearish 20 SMA, while the longer ones maintain their downward slopes far above the shorter one. Technical indicators remain within negative levels, without clear directional strength. In the near-term, and according to the 4-hour chart, the pair is neutral, trading above a flat 20 SMA while below a bearish 100 SMA, as technical indicators consolidate just above their midlines.

Support levels: 103.15 102.70 102.20

Resistance levels: 103.50 103.90 104.30

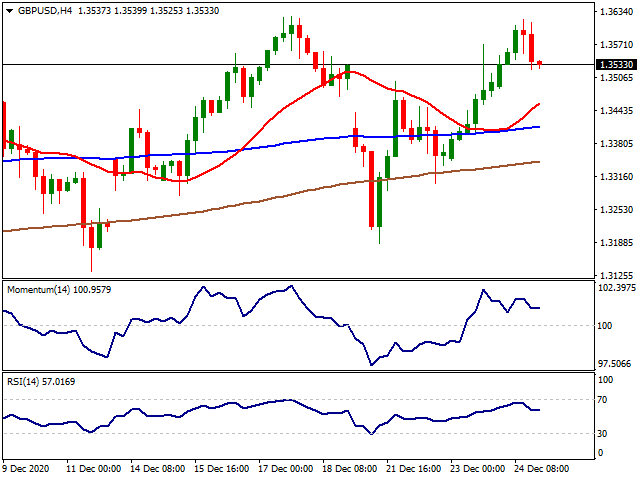

GBPUSD

The GBP/USD pair peaked at 1.3618 as hopes for a post-Brexit trade deal continued to underpin the pound. The pair retreated to settle in the 1.3550 price zone after an agreement was finally reached on Christmas Eve. During the weekend, the EU and the UK published the full text of their post-Brexit arrangement, which includes details on trade, law enforcement, and dispute settlement among other things.

The accord needs to be ratified by the respective parliaments. On fisheries, the most controversial issue, both parts agreed on a five-and-a-half-year transition period, in which EU fishing vessels will still have full access to UK waters, with a 25% cut gradually imposed to its fishing quota. The UK will celebrate Boxing Day this Monday, with local markets closed and no major developments expected in the kingdom.

The GBP/USD pair retains its bullish stance. The daily chart shows that the price holds above bullish moving averages, while technical indicators have bounded from their midlines, maintaining a moderate upward strength within positive levels. In the 4-hour chart, the risk is also skewed to the upside, as technical indicators stabilized within positive levels after correcting extreme overbought conditions, as the pair develops well above all of its moving averages.

Support levels: 1.3515 1.3470 1.3420

Resistance levels: 1.3580 1.3630 1.3675

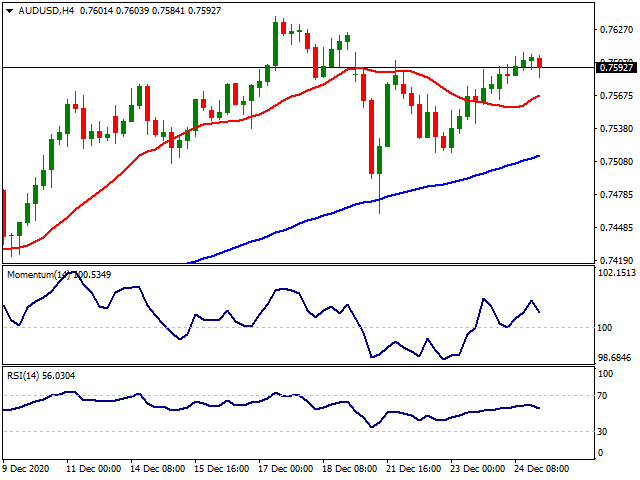

AUDUSD

The AUD/USD pair trades a handful of pips below the 0.7600 threshold, underpinned by the market’s positive mood. Limited volumes and a shrinking trade surplus maintained the pair below the year’s high at 0.7639. A prolonged holiday in Australia last week will be followed by an empty macroeconomic calendar in the country throughout the last trading days of the year.

The AUD/USD pair retains its bullish stance in the daily chart, developing above a bullish 20 SMA, which provides dynamic support around 0.7495. Technical indicators have resumed their advances within positive levels after correcting extreme overbought conditions. The 4-hour chart shows that the pair is developing above all of its moving averages, while technical indicators lost their bullish momentum but hold well above their midlines.

Support levels: 07540 0.7495 0.7450

Resistance levels: 0.7600 0.7640 0.7680

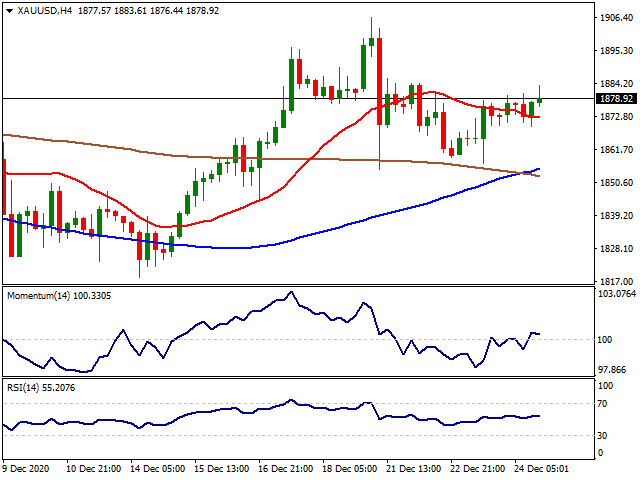

GOLD

Gold managed to erase most of its losses after testing $1,900 last week in the aftermath of the stimulus deal which was later rejected by Trump. On the other hand, the deal was highly-priced by the markets while the virus variation developments weighed on the markets last week. Despite the thin holiday markets scheme, further developments regarding the stimulus deal and the virus variation might create extra volatility this week. On the other hand, finally, Brexit is a done deal which includes details on trade, law enforcement and dispute settlement among other things. The accord needs to be ratified by the respective parliaments. On fisheries, the most controversial issue, both parts agreed on a five-and-a-half-year transition period, in which EU fishing vessels will still have full access to UK waters, with a 25% cut gradually imposed to its fishing quota. As the traders are getting ready for 2021, the Fed’s appetite for inflation by injecting a massive amount of cash into the pandemic hit US markets will be the main driver for Gold apart from the pandemic developments.

Markets will be most likely to be dull this week due to new year holidays as the most important data release will be NBS Manufacturing PMI (Dec) and Non-Manufacturing PMI (Dec) in China will be followed on Thursday apart from the weekly labour data set in the US.

From the technical point of view, below the $1,860 level, the supports can be followed at $1,800, $1,763 ($1,451-$2,075 61.80%) and $1,700 levels. Over the $1,860 level, the resistances can be followed at $1,900 with $1,956 ($1,451-$2,075 38.20%) and $2,000 levels.

Support Levels: $1,800 $1,763 $1,700

Resistance Levels: $1,900 $1,956 $2,000

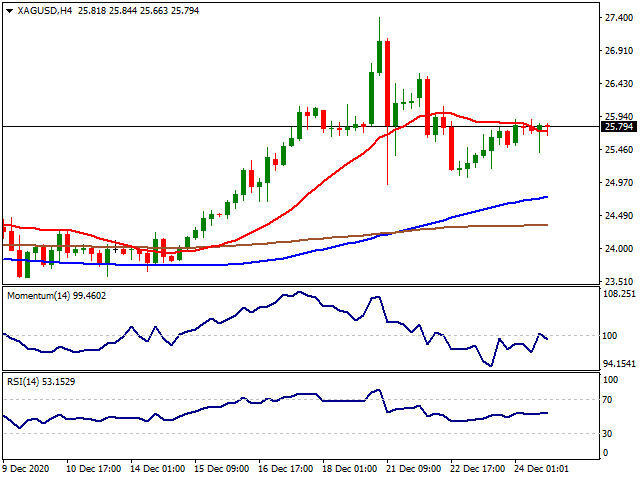

SILVER

Silver also tried to erase virus variation losses before the Christmas holiday despite the surprise refusal from President Trump on the stimulus deal. The USD index DXY kept its down foot hovering just over 90.00 levels. Virus variation panic was short-lived as the vaccine developers all announced that their solutions will be valid for the new variation of the virus. Extreme liquidity injected into the markers will most likely drive precious metals further. The Fed’s balance sheet was $4.2 trillion at the start of the year. Today, it’s $7.3 trillion and still growing. Also, this year the U.S. Federal deficit will be triple that of 2019. On the other hand, this balance sheet expansion will drive inflation higher while the Fed promised near-zero interest rates until 2023. In general terms, precious metals still look promising for the new year as Silver clearly outperformed Gold with a 44% gain over the year.

Below the $22.90 level ($11.63-$29.86 38.20%), the supports can be followed at $20.75 ($11.63-$29.86 50.00%) and $18.42 ($11.63-$29.86 61.80%). Over the $22.90 level, the targets up can be followed at $25.21 ($11.63-$29.86 23.60%), $26.00 (August-September support), $27.00 and $28.00 levels.

Support Levels: $22.90 $20.75 $18.42

Resistance Levels: $25.21 $26.00 $27.00

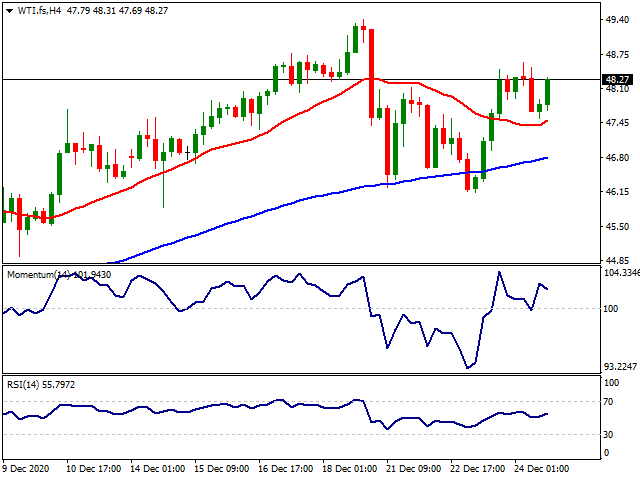

CRUDE WTI

WTI managed to end the short week over the $48.00 level after the virus variation panic decline. Crude Oil Stocks Change in the US was -0.6 million barrels in the week ending December 18, the weekly report published by the US Energy Information Administration (EIA) revealed on Wednesday. Analysts estimate was for a decrease of 3.1 million barrels. On the other hand, the UAE sees gradual oil recovery in 2021, Energy Minister Suhail Al-Mazrouei said in a statement on Thursday. Both OPEC+ production balancing and vaccine developments managed to lift WTI to its highest level since the major fall seen by the end of February.

From the technical point, next supports can be seen at $47.00, $45.00 and $43.88 respectively while the resistances can be followed at $48.00, $48.50 and $49.00 levels.

Support Levels: $47.00 $45.00 $43.88

Resistance Levels: $48.00 $48.50 $49.00

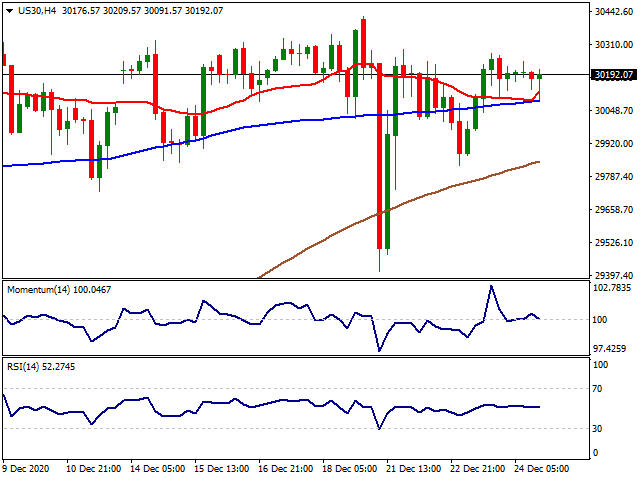

DOW JONES

As the markets were closed due to the Christmas holiday, President Trump managed to create some level of action as he refused the long-debated stimulus deal. Trump called the package “a disgrace,” Trump said the current plan distributed funds to “wasteful” items and recommended increasing the cheques for individuals from $600 to at least $2,000 per person. Also, late on Wednesday, President Trump vetoed the Defense Authorization Act, saying it "fails to include critical national security measures" and challenging Republicans who may work with Democrats next week to override the order. On Monday, the House will take up the veto override with bipartisan support, House Speaker Nancy Pelosi said in a statement. Republicans who oppose overriding the president's veto could drag out the process by forcing a so-called cloture vote, requiring the override effort to initially get 60 votes.

The week ahead will be short due to the New Year holiday leaving a little time to overcome Trump’s refusal. On the other hand, virus variation panic was short-lived as Dow Jones managed to stay over the 30,000 levels close to its all-time high. Apart from the virus and monetary developments, Britain and the European Union clinched a free trade deal, while a global gauge of stocks edged upward amid investor optimism toward economic growth. Also, due to the short week, there will be no major macro-data releases in the US apart from the weekly labour data release on Thursday.

From the technical point of view, if the index stays over 29,000, 29,500 and 30,000 levels can be followed as new targets high while below the 28,400 level, 28,000 and 27,770 can be followed as supports.

Support Levels: 28,400 28,000 27,770

Resistance Levels: 29,500 30,000 30,500

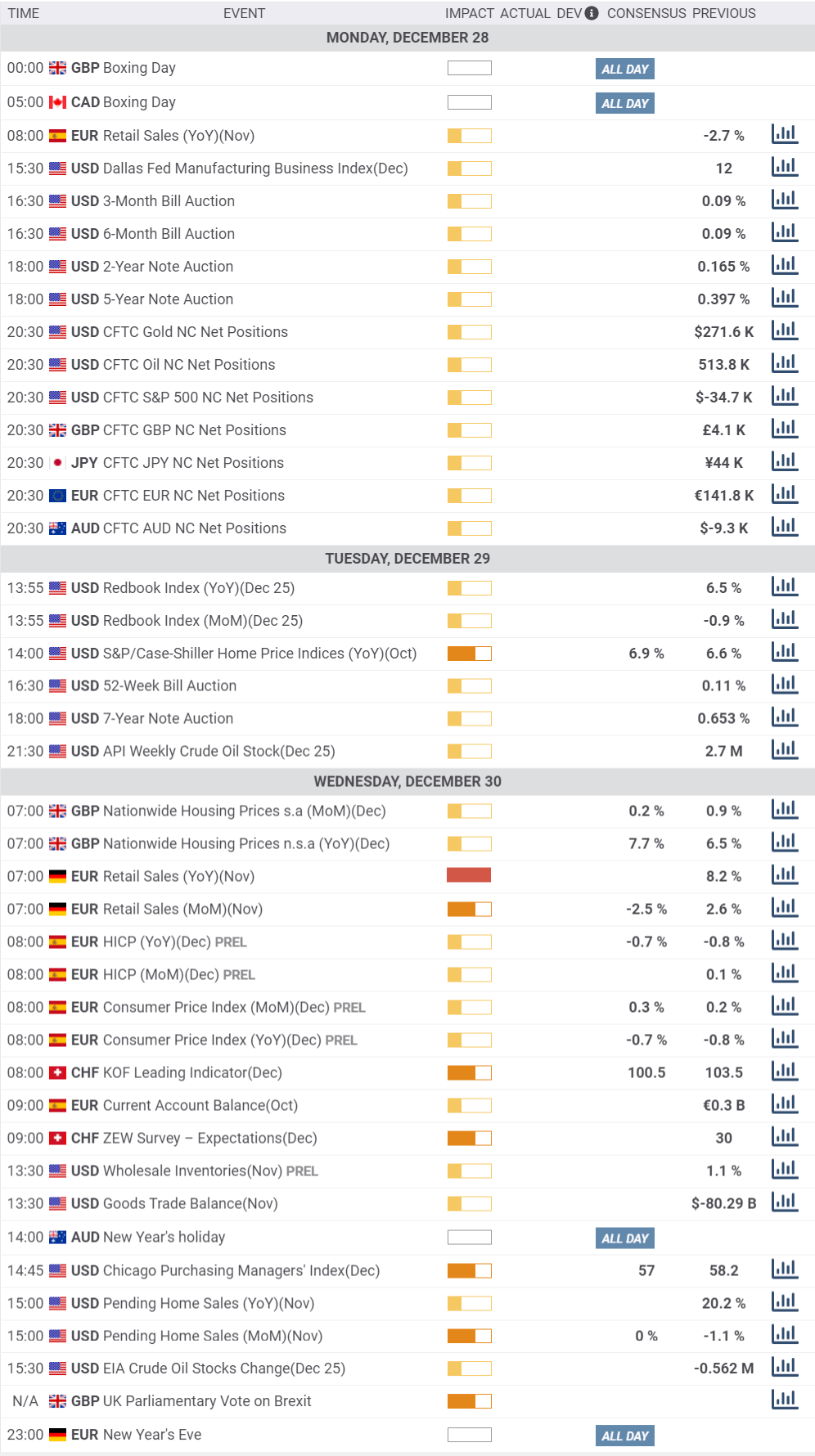

MACROECONOMIC EVENTS

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.