Daily Market Report - 25th Dec 2020

Official Website: https://www.nooralmal.com/

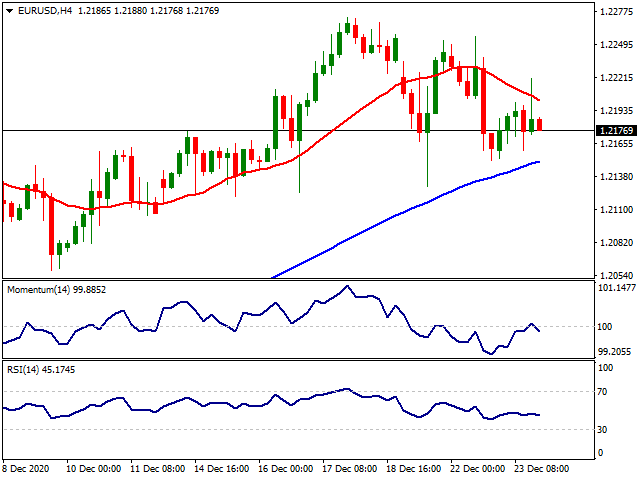

EURUSD

The dollar edged lower against its major rivals on the last full trading day of the week. The EUR/USD pair peaked at 1.2220 and settled just below the 1.2200 figure, holding within familiar levels throughout the day. The greenback seesawed between gains and losses as investors tried to digest the latest on the US stimulus program. After the US Congress passed a coronavirus-relief bill, US President Donald Trump urged lawmakers to amend it and hasn’t signed it yet. He said that the package is full of “wasteful” items and said that the $600 payment should be $2,000.

The EU didn’t publish relevant data, while the US released encouraging figures. The country published November Durable Goods Orders, which beat expectations by rising 0.9% MoM. Initial Jobless Claims improved to 803K in the week ended December 18. Personal Income, however, decreased by 1.1% in November while Personal Spending was down 0.4%. Most countries celebrate the Christmas holiday on Thursday, and the macroeconomic calendar will remain empty.

The near-term picture for the EUR/USD pair is neutral-to-bullish. The 4-hour chart shows that the pair remains below a mildly bearish 20 SMA, while a bullish 100 SMA keeps providing support. Technical indicators continue to lack directional strength around their midlines. Trading will likely remain choppy during the upcoming sessions, although Brexit-related headlines may trigger some wild movements, exacerbated by thin market conditions.

Support levels: 1.2120 1.2080 1.2030

Resistance levels: 1.2220 1.2275 1.2310

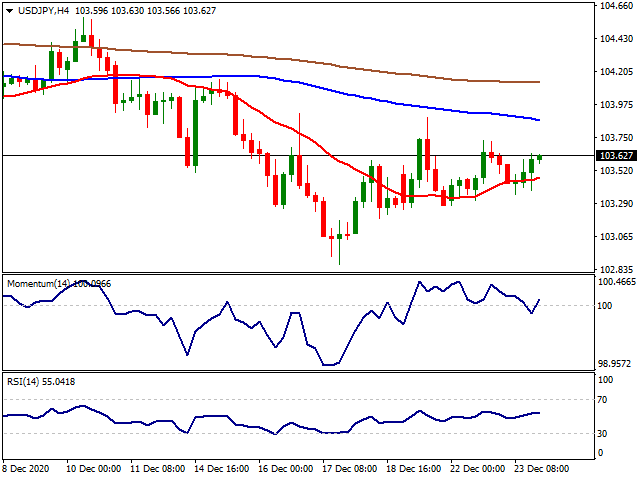

USDJPY

The USD/JPY pair is trading around 103.60, unchanged daily basis. The pair started the day on the back foot, falling within range, and recovered during US trading hours amid the renewed dollar’s demand. The positive tone of Wall Street and higher US Treasury yields provided support.

On Wednesday, the Bank of Japan published the Minutes of its latest meeting. The document showed that policymakers could consider tweaking its current bond-buying program to “enhance sustainability” in the longer-run. The country published the October Leading Economic Index, which improved to 94.3, while the Coincident Index contracted to 89.4. Japan will have its markets open this Thursday, and the country will publish the November Corporate Service Price Index.

The USD/JPY pair is neutral-to-bearish according to intraday charts, but holding above the 103.15 support, a line in the sand, as below it, bears will likely increase their bets. In the 4-hour chart, the pair has been consolidating above a flat 20 SMA, while the longer ones maintain their bearish slopes. Technical indicators remain around their midlines without clear directional strength.

Support levels: 103.15 102.70 102.20

Resistance levels: 103.50 103.90 104.30

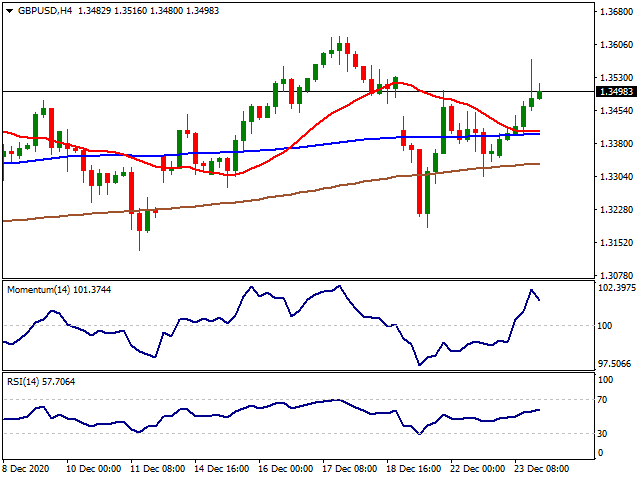

GBPUSD

The GBP/USD pair jumped to 1.3570 but trimmed a good bunch of its intraday gains afterwards. Back and forth surrounding a post-Brexit trade deal have kept the pair in wide intraday ranges pretty much since the month started. Contradictory headlines keep coming, but at this point, there has been no official announcement. A deal seems closer, but there’s a good chance that EU’s Ursula von der Leyen and UK PM Boris Johnson will keep on talking tomorrow if they can’t reach an agreement this Wednesday. If they reach an agreement, they are expected to announce it probably during the upcoming Asian session.

The GBP/USD pair is trading around 1.3500 as the American session comes to an end, holding on to its positive stance. The 4-hour chart shows that the pair is well above all of its moving averages, which anyway have limited directional strength. The Momentum indicator is retreating just modestly from overbought readings, while the RSI maintains its bullish slope around 58.

Support levels: 1.3460 1.3410 1.3365

Resistance levels: 1.3570 1.3620 1.3665

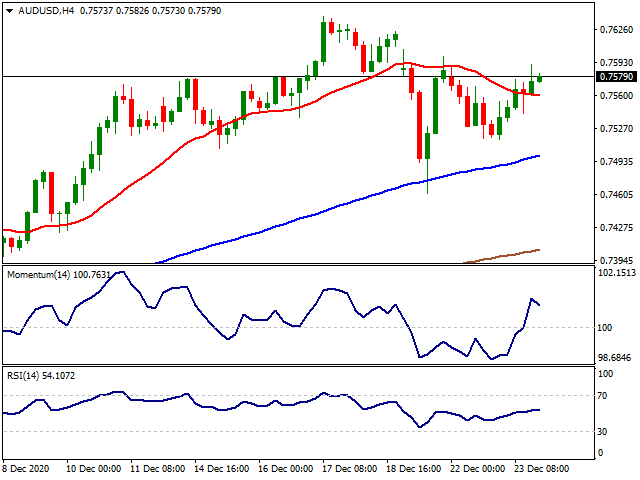

AUDUSD

The AUD/USD pair has edged higher this Wednesday, helped by persistent dollar’s weakness and the better tone of equities, amid hopes for a Brexit deal. The aussie advanced despite the Australian trade surplus came in at A$1,958 million, a drop from the previous month's A$7,456 million, according to November’s preliminary estimate. Imports were up by 11%, while exports increased by a modest 1%. The country also published November Private Sector Credit, which printed at 0.1% MoM. Australian markets will remain close on Thursday.

The AUD/USD pair is bullish in the near-term. The 4-hour chart shows that it has advanced above a mildly bearish 20 SMA, while the longer ones keep advancing below the shorter one. Technical indicators remain at daily highs well into positive territory, favoring another leg higher, mainly if the pair regains the 0.7600 threshold.

Support levels: 07550 0.7515 0.7470

Resistance levels: 0.7600 0.7640 0.7680

GOLD

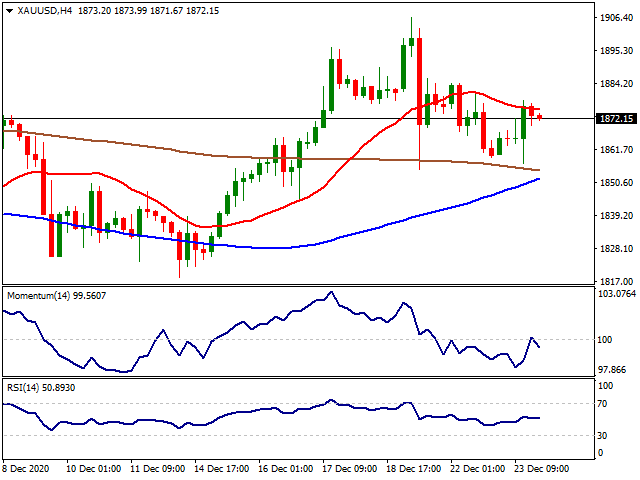

Even though Trump threatened to not sign the relief bill and asked for a $2,000 check instead of $600, the USD index DXY continued its decline and precious metals gained traction on Wednesday. On the other hand, worse than expected consumer confidence in the US also weighed on the USD while the initial jobless claims on a weekly basis were better than expected. At the other side of the pond, Brexit hopes to continue as the deadline comes closer on the 31st of December while France eased travel restrictions against the UK after the big chaos followed at the French border. Apart from the stimulus deal and Brexit, markets seem to forget the virus variation which shook the markets on Monday. Despite the thin market conditions expected due to the Christmas holiday, Trump’s surprise move to ask for a bigger check as opposed to the pre-election period might create extra volatility in the coming term.

From the technical point of view, below the $1,860 level, the supports can be followed at $1,800, $1,763 ($1,451-$2,075 61.80%) and $1,700 levels. Over the $1,860 level, the resistances can be followed at $1,900 with $1,956 ($1,451-$2,075 38.20%) and $2,000 levels.

Support Levels: $1,800 $1,763 $1,700

Resistance Levels: $1,900 $1,956 $2,000

SILVER

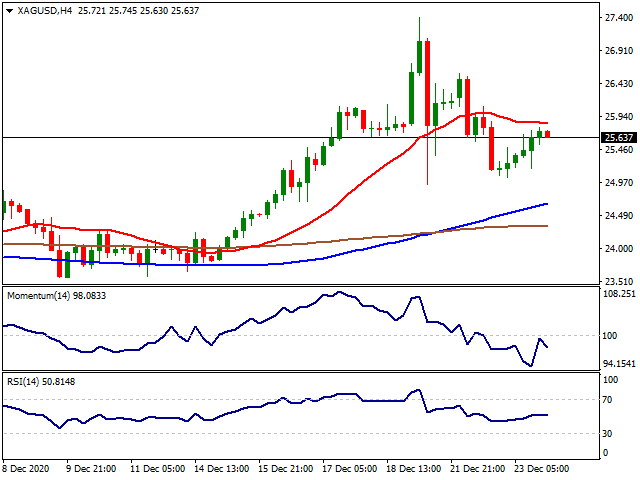

Silver also had a positive day on Wednesday as the risk appetite came back to markets. The USD index DXY slid sub-90.50 levels while the precioıs metals and global indexes managed to move up. On the other hand, after finding support near the $22 per ounce level late last month, silver rallied more than 20% throughout December to reach over $27.50, before pulling back to the $25 area on Tuesday. Last-minute refusal from President Trump regarding the relief bill surprised the markets. Trump asked for a bigger check around $2,000 with a surprise move which helped precious metals to advance further. Apart from possible unusual developments, thin volume holiday trading is expected to be in play for the rest of the year.

Below the $22.90 level ($11.63-$29.86 38.20%), the supports can be followed at $20.75 ($11.63-$29.86 50.00%) and $18.42 ($11.63-$29.86 61.80%). Over the $22.90 level, the targets up can be followed at $25.21 ($11.63-$29.86 23.60%), $26.00 (August-September support), $27.00 and $28.00 levels.

Support Levels: $22.90 $20.75 $18.42

Resistance Levels: $25.21 $26.00 $27.00

CRUDE WTI

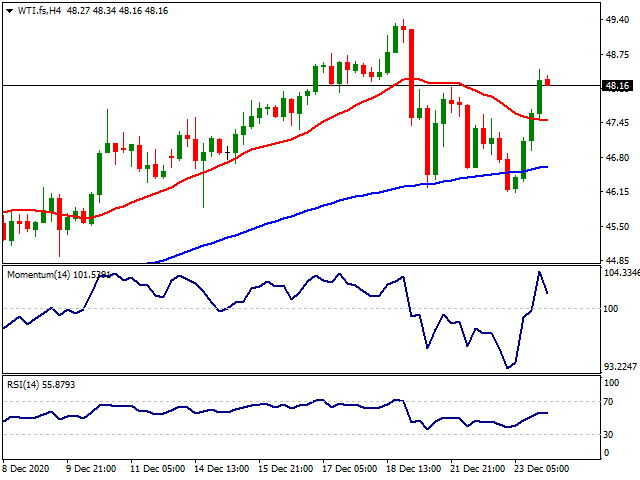

WTI managed to erase its losses made on Tuesday as the virus variant worries ease. Both AstraZeneca and Pfizer&BioNTech stated that their vaccines will most likely compile with the new variation of the virus. Apart from the virus developments, the US crude inventories fell by 562,000 barrels in the week to Dec. 18 to 499.5 million barrels, the Energy Information Administration said on Wednesday which also supported the black gold. Gasoline stocks fell by a surprise 1.1 million barrels in the week to 237.8 million barrels, the EIA said, while distillate stockpiles fell by 2.3 million barrels in the week to 148.9 million barrels, more than expected. Also, Trump’s proposal to lift the relief bill to $2,000 surprised the markets but considered as positive for risk appetite due to possible bigger spending expectations.

From the technical point, next supports can be seen at $47.00, $45.00 and $43.88 respectively while the resistances can be followed at $48.00, $48.50 and $49.00 levels.

Support Levels: $47.00 $45.00 $43.88

Resistance Levels: $48.00 $48.50 $49.00

DOW JONES

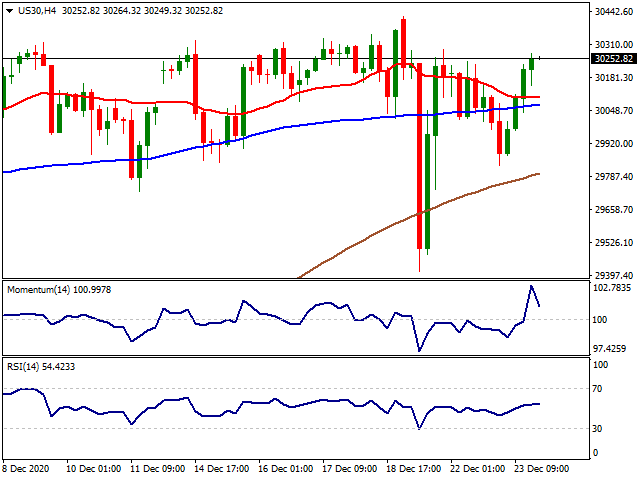

As the risk appetite returned to markets, Dow Jones managed to erase its losses made on Tuesday before the Christmas holiday. Trump took the stage with a surprise tweet saying that the stimulus bill, agreed upon after months of wrangling in Congress, was "a disgrace" and that he wanted to increase "ridiculously low" $600 payments for individuals to $2,000. The move surprised the markets as this statement belonged to Democrats before the elections. The deadline to pass the bill is on the 28th of December while the done-deal is in doubt at the moment. On the other hand, markets tend to forget the new variant of the virus as vaccine developers stated that their products will most likely be effective against the new version of the coronavirus. The government is asking for 100 million additional doses from April to June while Pfizer&BioNTech has already signed a contract to deliver 100 million doses by the end of March. That deal was signed at the end of July 2020. Due to the short trading week, weekly labour data readings were released on Wednesday instead of Thursday. There were 803,000 initial claims for unemployment benefits in the US during the week ending December 19, the data published by the US Department of Labor (DOL) revealed on Wednesday. This reading followed last week's print of 892,000 (revised from 885,000) and came in much better than the market expectation of 885,000. Markets will be closed half of the day in the US on Thursday and a full day on Friday due to the Christmas holiday. Trading volumes are expected to be thin until the end of the year while a new development on the stimulus deal might move the market for the last time in 2020.

From the technical point of view, if the index stays over 29,000, 29,500 and 30,000 levels can be followed as new targets high while below the 28,400 level, 28,000 and 27,770 can be followed as supports.

Support Levels: 28,400 28,000 27,770

Resistance Levels: 29,500 30,000 30,500

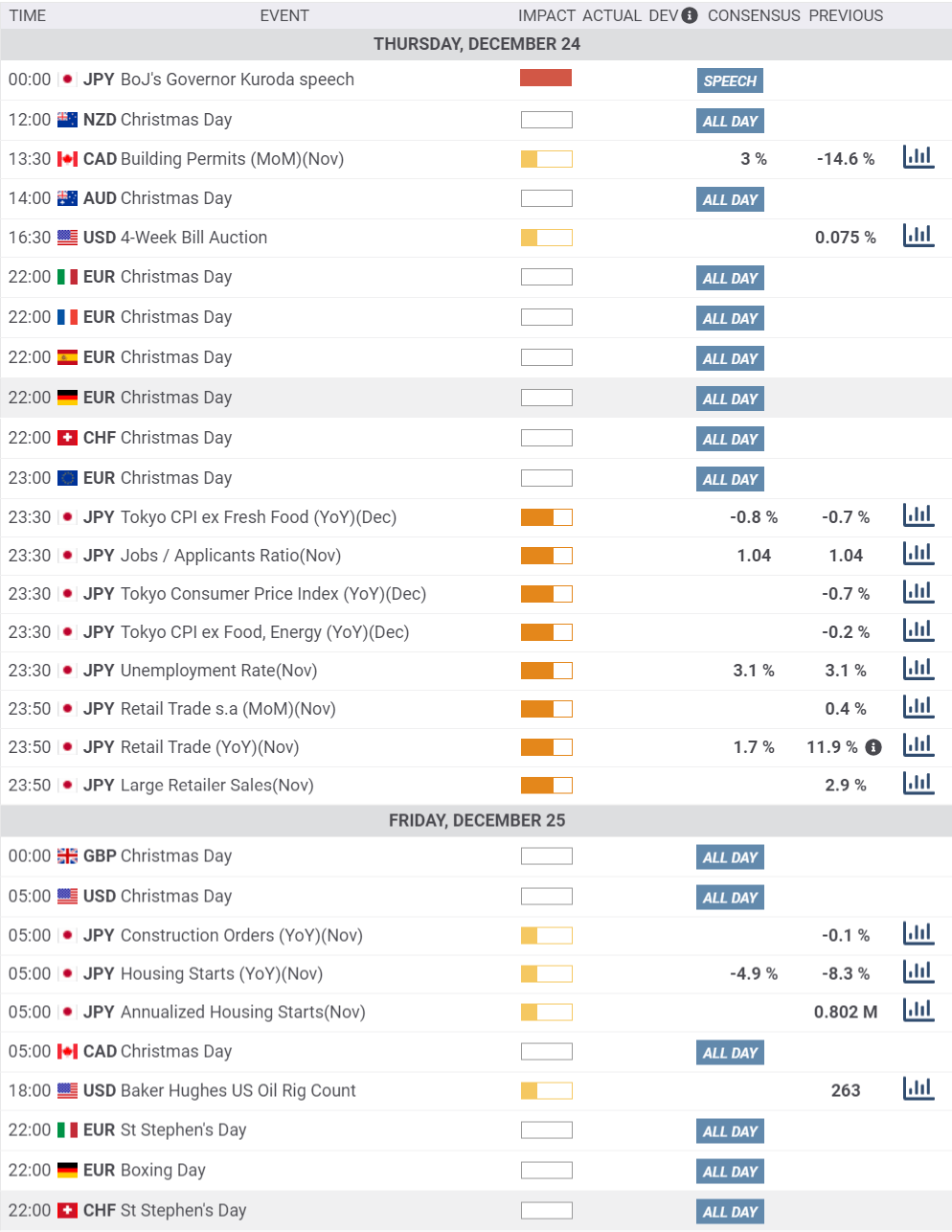

MACROECONOMIC EVENTS

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.