EUR/USD Trend Analysis

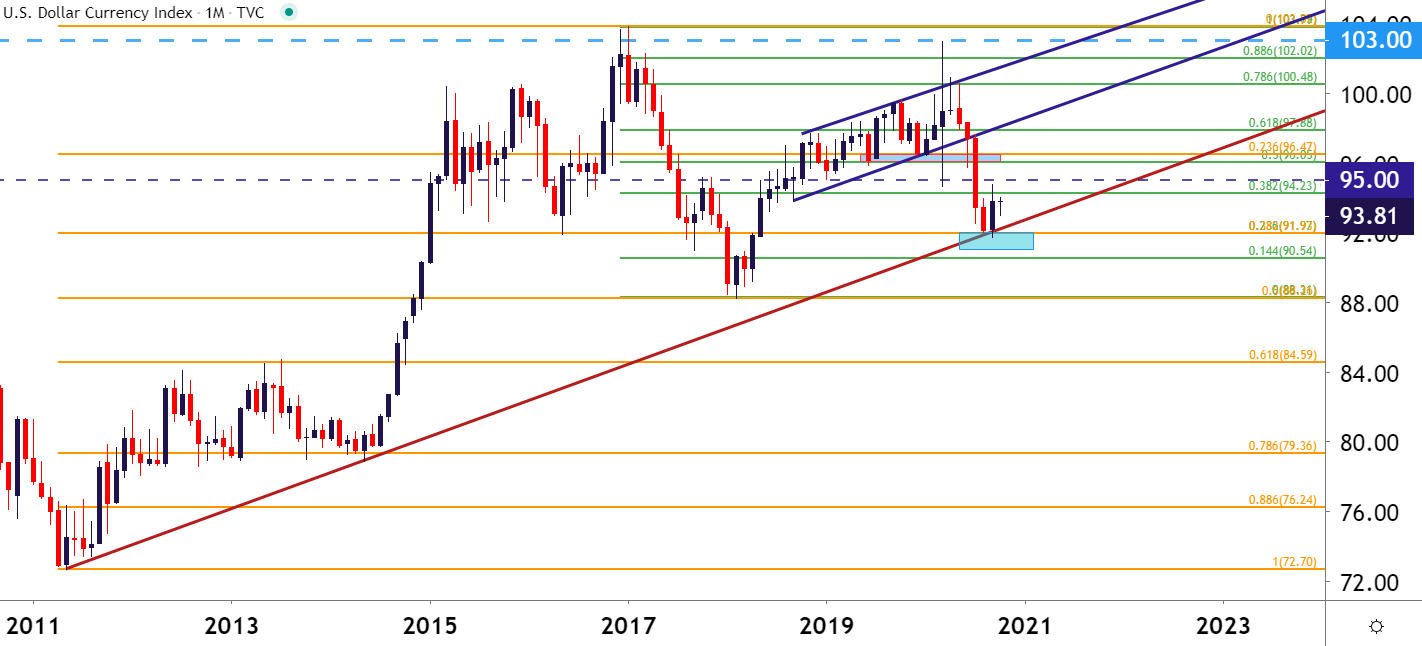

U.S. Dollar currency Index

The U.S. dollar index performed strongly in September, but the trend in October was more uncertain.

In the first half of October, it is expected that the trend of the US dollar index may become more chaotic in the short term, the Euro/Dollar turned lower after rising to 1.1831. Opened the door for the short-term downturn, the GBP/USD trend is concerned about the gains and losses of the support level.

The market's hope for more stimulus measures has provided the bears with an attraction, and technical traders are paying close attention to the long-term support trend line in September and the bullish engulfing candle chart constructed in September.

But so far in October, the dollar price trend is still quite chaotic. In the first half of October, the dollar index formed a doji candlestick.

EUR/USD

The U.S. dollar is currently hovering below the October high, while the EUR/USD refreshed its monthly low in late yesterday. The lower support level focuses on the August lows of 1.1694 and 1.70, and the upper potential resistance level focuses on the 1.1736-1.1750 range, which served as a support range last week. The Euro/Dollar rose to 1.1831 at that time. But since then, the situation has changed. EUR/USD has seen a series of lower lows and highs, opening the door for the bearish continuation.

Edited 16 Oct 2020, 10:20

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.