'Better Than Expected': Stock Market Update For The Week Ahead

The Past Week, In A Nutshell

What Happened: Last week ended positive alongside progress in stimulus talks.

Remember This: “Very rarely in the last 10 years have we seen earnings estimates moving higher after a quarterly reporting season,” said Art Hogan, chief market strategist at National Securities in New York, in a conversation regarding third-quarter earnings.

“That’s a very good sign. It’s a sign there’s a strong possibility this quarterly earnings season is now going to be better than expected,” he added. “The only problem is, now that we’ve entered the fourth quarter, a lot of the economic indicators are plateauing.”

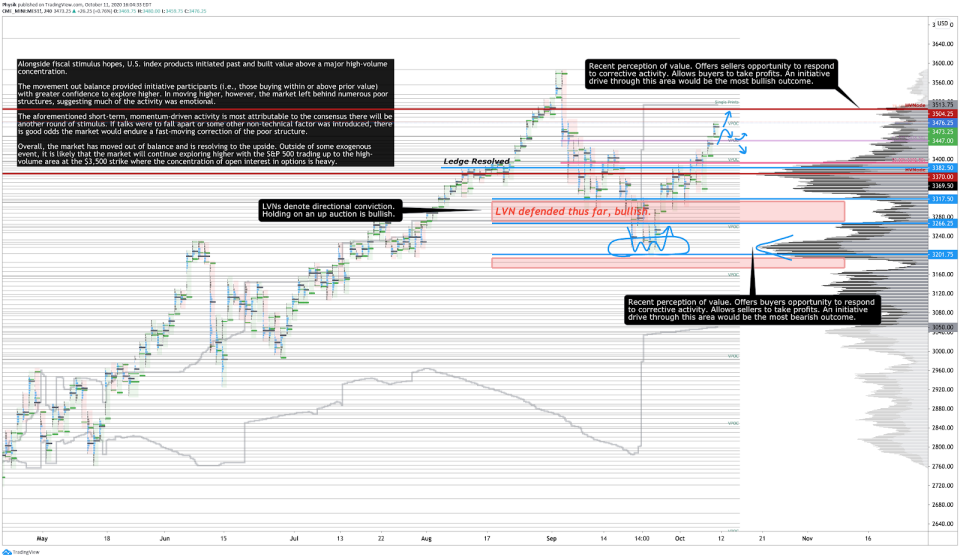

Pictured: Profile chart of the Micro E-mini S&P 500 Futures

Technical

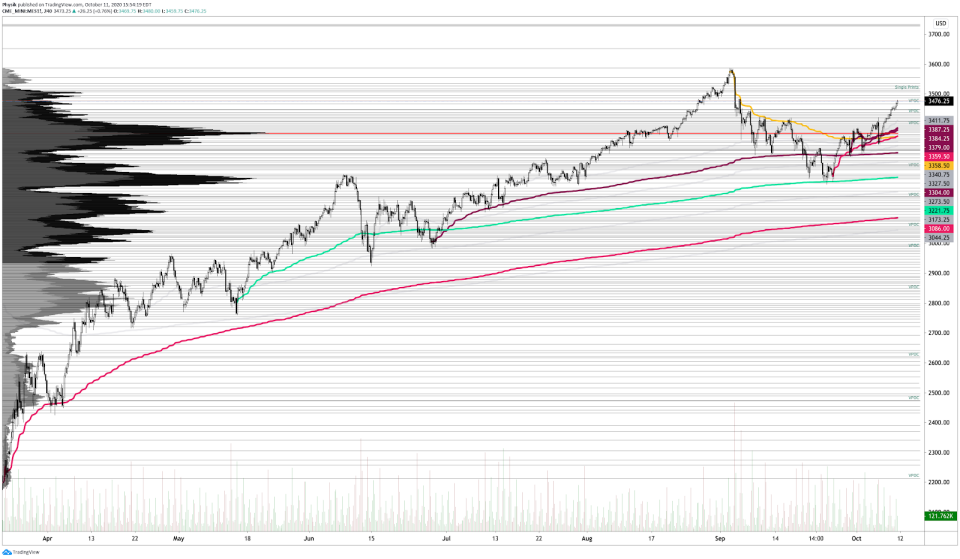

Broad-market equity indices ended the week higher with S&P 500 retracing more than 50% of its September sell-off.

During Last Week’s Action: Alongside fiscal stimulus hopes, U.S. index products initiated past and built value above a major high-volume concentration.

The movement out of balance provided initiative participants (i.e., those buying within or above prior value) with greater confidence to explore higher. In moving higher, however, the market left behind numerous poor structures, suggesting much of the activity was emotional.

The aforementioned short-term, momentum-driven activity is most attributable to the consensus there will be another round of stimulus. If talks were to fall apart or some other non-technical factor was introduced, there are good odds the market would endure a fast-moving correction of the poor structure.

Overall, the market has moved out of balance and is resolving to the upside. Outside of some exogenous event, it is likely that the market will continue exploring higher with the S&P 500 trading up to the high-volume area at the $3,500 strike where the concentration of open interest in options is heavy.

Scroll to the bottom of this story to view non-profile charts.

Fundamental

According to Evan Karson and Bridget Ryan of Moody’s Analytics, the economic recovery is facing two big downside risks.

“Two major downside risks loom over the road to recovery that could determine which path the labor market will follow: a spike in COVID-19 cases or a fiscal policy blunder. A double-dip recession will be unavoidable if widespread contagion slows business activity materially or sparks another round of nonessential business closures. The risk of a surge is increasing as the weather gets colder and people begin to socialize inside.”

Adding, a failure to deliver another round of direct stimulus payments or expand unemployment benefits would fail to buoy household spending and hit consumer-driven industries hardest. The most significant gains, though, would occur if and when a vaccine is made available.

Key Events

- Monday: No events.

- Tuesday: Core Inflation Rate, Inflation Rate.

- Wednesday: MBA Mortgage Applications, PPI MoM, Fed Clarida Speech, Fed Quarles Speech, Fed Kaplan Speech.

- Thursday: Jobless Claims, Philadelphia Fed Manufacturing Index, EIA Cushing Crude Oil Stocks Change, EIA Distillate Stocks Change, Fed Quarles Speech, Fed Kashkari Speech.

- Friday: Retail Sales, Industrial Production, Fed Williams Speech, University of Michigan Consumer Sentiment Preliminary, Business Inventories, Michigan Inflation Expectations Preliminary, Foreign Bond Investment, Overall Net Capital Flows.

Recent News

- Hurricane Delta deals the greatest blow to U.S. offshore energy production in 15 years.

- Demand for steel is expected to grow to meet rising social, economic welfare needs.

- BlackRock Inc (NYSE: BLK) sees election playing out in asset classes and sectors.

- Next administration to confront policy challenges with wide-ranging credit impact.

- White House urges Congress for interim coronavirus relief as negotiations continue.

- The pandemic economy carved up a deep divide between the haves and have-nots.

- Biden win could mean stricter enforcement for biggest four technology companies.

- Nasdaq Inc (NASDAQ: NDAQ) may transfer data centers to Texas, from New Jersey.

- Markets are sensing an upturn despite pockets of profound depression-like misery.

- International Business Machines Corp (NYSE: IBM) splitting into two companies.

- Saudi Arabia is considering cancelling plans for an oil output hike early next year.

- Boeing Co (NYSE: BA) cut its rolling 20-year forecast for airplane demand on virus.

- AMC Entertainment Holdings Inc (NYSE: AMC) plans to keep most theatres open.

- Tesla Inc (NASDAQ: TSLA) may have a chance to produce 500,000 cars, Musk said.

Key Metrics

- Sentiment: 34.7% Bullish, 26.3% Neutral, 39.0% Bearish as of 10/7/2020.

- Gamma Exposure: (Trending Higher) 8,490,294,012 as of 10/9/2020.

- Dark Pool Index: (Trending Neutral) 39.7% as of 10/9/2020.

Product Snapshot

S&P 500 E-mini Futures (ES) | SPDR S&P 500 ETF Trust (NYSE: SPY)

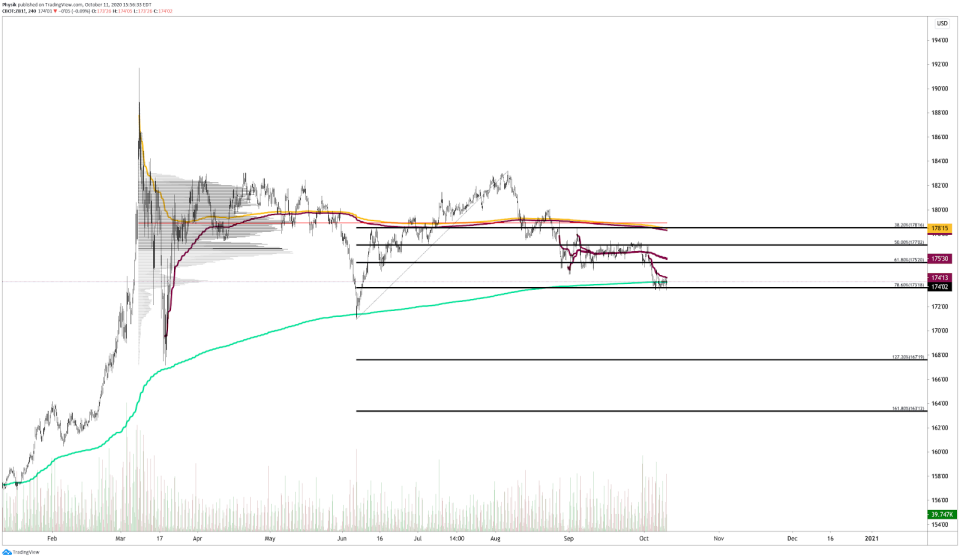

Gold Futures (GC) | SPDR Gold Trust (NYSE: GLD)

Crude Oil (CL) | United States Oil Fund LP (NYSE: USO) | Invesco DB Oil Fund (NYSE: DBO) | United States 12 Month Oil Fund (NYSE: USL)

Treasury Bonds (ZB) | iShares 20+ Year Treasury Bond (NASDAQ: TLT)

Photo by Karolina Grabowska from Pexels.

Reprinted from yahoofinance, the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.