Stock Market Seeks Direction: Expert Sees This Factor As Positive News For Economic Recovery

Larry Adam, CIO of the private client group at Raymond James, joined the "Investing with IBD" podcast this week to discuss the stock market correction and why he thinks we're in a K-shape recovery. He also explained why investors need to analyze news headlines as we approach Election Day.

Stock Market Correction: Indexes Try To Hold Up After Losses

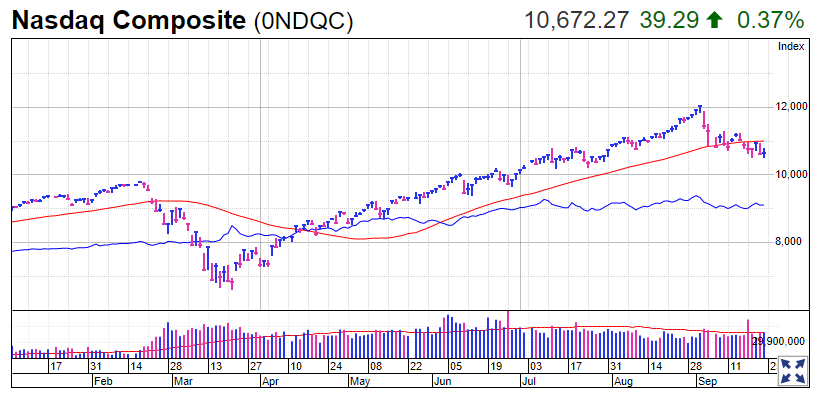

Stocks tried to find their footing Thursday after sharp declines the prior session. The Nasdaq composite is trying to hold its Sept. 21 low. But it faces an uphill battle in terms of resistance at the 50-day line and the 11,000 level.

Meanwhile, the S&P 500 did not hold its Sept. 21 low but is seeking support at the 3,200 level. IBD's Stock Market Today column notes the market outlook was lowered to "market in correction" on Wednesday as major indexes continued to decline this week.

"I think part of this is part of the natural pullback that we're having," Adam said. "We've had the quickest bounce-back. And it's ironic, as we sit here today — even after record volatility — we are back to basically where we started the year."

He said the recent stock market correction is a good reminder to investors to not get carried away by their emotions and to follow their buy and sell rules.

"You've got to be careful in these markets and not make these panic-driven decisions," Adam said of the stock market correction. "Because if you would have gotten out at the lows earlier this year, you would have missed out on that big, big rally."

Stock Research: Headlines Vs. Reality

In addition to the current stock market correction, Adam discussed why it's important for investors to keep news headlines in context as they evaluate their portfolios. He says this is especially important as we head into the final phase of the 2020 presidential election.

"A lot of the things that people generally accept are not necessarily the truth," Adam said. He pointed to several examples of this in action, including common myths on corporate tax rates and GDP figures.

His take-away for investors: do your research on news headlines before making any moves in your portfolio.

"Look underneath the surface to see what's important," Adam said. "Don't change your sectors based on who's in the White House because that's never worked."

Is The Economy In A K-Shape Recovery?

Finally, Adam discussed why he thinks the economy might be in a K-shape recovery. He says the K-shape better illustrates the disparity between certain sectors and sub-industries in the coronavirus market recovery.

"If you just think about a K, and you go straight up the K, those are the sectors of the market that did not skip a beat," Adam said. He explained that technology stocks, including e-commerce and cloud services names, fall into that category. "That was good because there was a lot of pent-up demand for different supplies and services and goods."

Adam explains the bottom part of the K-shape recovery includes laggards like airlines and leisure services that continue to be affected by the pandemic.

"Whether that's because of psychological barriers or because the new protocols ... that's going to take some time for them to fully recover," Adam said.

Listen to the full podcast to hear more of Adam's thoughts on the K-shape recovery.

Stock Market Correction: Maintain Your Watchlist

In a stock market correction, big or small, it's always a good idea to keep your watchlist fresh. If you're looking for the next top stocks primed to make big moves, check out IBD's Stock Lists page.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.