Gold Price Futures (GC) Technical Analysis – Trader Reaction to $1966.90 Sets the Tone

Gold futures rose to their highest level in nearly two weeks on Tuesday, propelled by a softer U.S. Dollar and expectations the U.S. Federal Reserve will reinforce its accommodative monetary policy. The dollar fell against a basket of major currencies, making gold more attractive for buyers holding other currencies, as participants awaited the Fed’s two-day policy meeting ending on Wednesday.

On Tuesday, December Comex gold settled at $38.93, up $0.94 or +2.47%.

“The dollar weakness is playing its part but also some anticipation of continued support from the FOMC (Federal Open Market Committee) has helped the market,” said Saxo Bank analyst Ole Hansen, adding that gold lacked an immediate catalyst to push it higher.

Investors widely expect the central bank to maintain its downbeat stance on the economy.

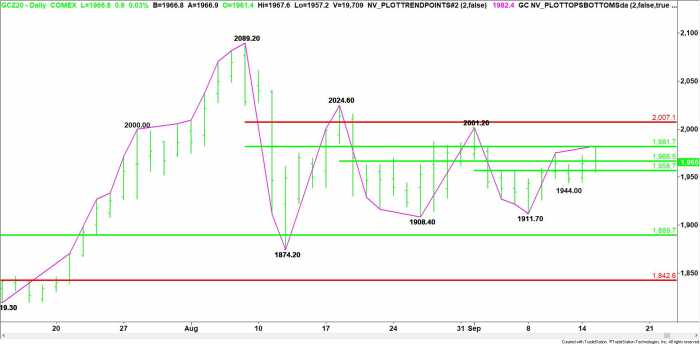

Daily December Comex Gold

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart. A trade through $2001.20 will signal a resumption of the uptrend. The main trend will change to down on a trade through $1911.70.

The minor trend is also up. The trend changes to down on a move through $1944.00. This will also shift momentum to the downside.

The first minor range is $2001.20 to $1911.70. Its 50% level at $1956.70 is support.

The second minor range is $2024.60 to $1908.40. Its 50% level at $1966.50 is also support.

The short-term range is $2089.20 to $1874.20. Its retracement zone at $1981.70 to $2007.10 is potential resistance. It stopped buyers at $2001.20 on September 1. On Tuesday, the rally stopped at $1982.40, or slightly above the short-term 50% level.

If the main trend changes to down then the main retracement zone at $1889.70 to $1842.60 will become the primary downside target.

Daily Swing Chart Technical Forecast

The price action on Tuesday suggests the near-term direction of the December Comex gold futures contract is likely to be determined by trader reaction to the 50% levels at $1956.70 and $1981.70.

Bullish Scenario

A sustained move over $1981.70 will indicate the presence of buyers. This could trigger an acceleration to the upside with $2001.20 to $2007.10 the next likely upside targets.

Bearish Scenario

A sustained move under $1956.70 could trigger a break into $1944.00. This is a potential trigger point for an acceleration to the downside with $1911.70 the next likely downside target. #gold##FX#

Reprinted from FXEmpire,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-