Daily Market Report - 27th Aug 2020

$50 Free Margin Account Campaign:

https://www.nooralmal.com/cc19...

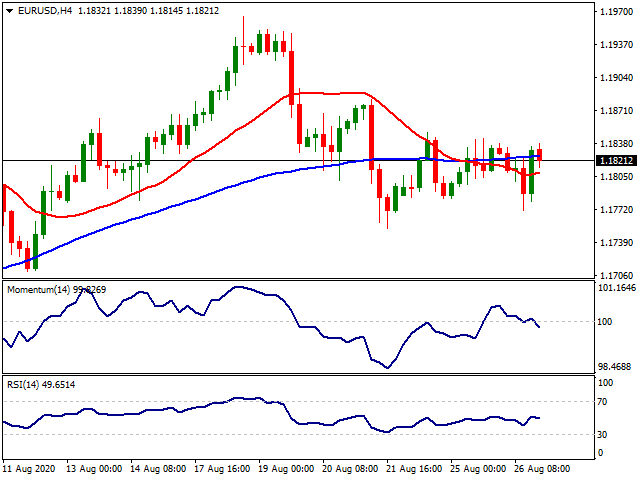

EURUSD

The EUR/USD pair held within familiar levels for a third consecutive day, finishing Wednesday little changed in the 1.1820 price zone. The dollar enjoyed some temporal demand at the beginning of the US session, helped by upbeat local data. Durable Goods Orders were up 11.2% in July, much better than the 4.3% expected, while Nondefence Capital Goods Orders ex-Aircraft met expectations at 1.9%. The pair fell to 1.1771 after the headline but recovered afterwards as the dollar was unable to retain gains.

Investors held a cautious stance throughout the day, ahead of US Federal Reserve Chief’s Powell appearance on Thursday, at the Jackson Hole Economic Policy Symposium. Market talks suggest that he is likely to stage a new monetary policy framework based around average inflation targeting (AIT). The US will also release the second estimate of Q2 GDP, foreseen at -32.5% from a previous estimate of -32.9%, and the usual weekly unemployment claims, seen at 1 million for the week ended August 21.

The EUR/USD pair has spent yet another day inside the range defined last Friday. The 4-hour chart offers a neutral stance, as the pair has been seesawing around its 20 and 100 SMA, which remain flat. Technical indicators, in the meantime, stand around their midlines, also lacking clear directional strength. Overall, the risk is skewed to the downside, although a firmer bearish extension will be likely on a break below 1.1750, where the pair met buyers by the end of last week.

Support levels: 1.1790 1.1750 1.1710

Resistance levels: 1.1840 1.1885 1.1920

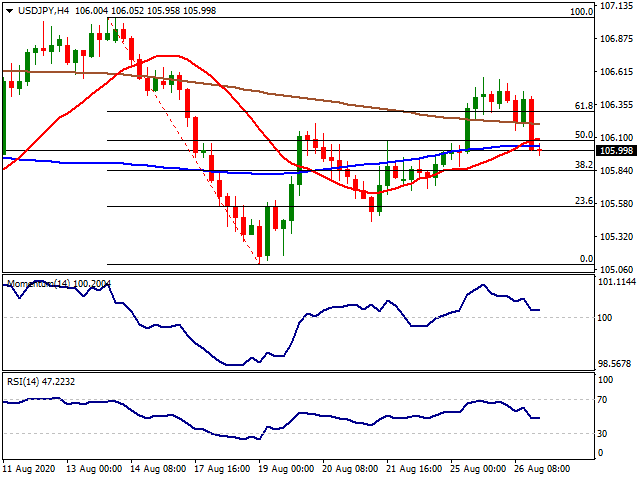

USDJPY

The USD/JPY pair gave up and settled around the 106.00 level, as speculative interest turned its back to the greenback, despite better-than-expected US data. Adding to the bearish case of USD/JPY, US Treasury yields retreated after failing to surpass weekly highs reached earlier this week.

Japanese data released at the beginning of the day was mixed, as the July Corporate Service Price Index printed at 1.2%, better than the previous 0.9%. However, the June Leading Economic Index was downwardly revised to 84.4 from 85. The Coincident Index, on the other hand, improved to 76.6 from the preliminary estimate of 76.4. The country has little to offer this Thursday behind a speech from BOJ’s member Suzuki.

The USD/JPY pair has lost its positive momentum and retreated below the 50% retracement of its latest daily decline. In the 4-hour chart, the pair is once again trading below all of its moving averages, which anyway remain directionless and inside quite a tight range. Technical indicators eased from their recent highs, with the Momentum now stable around its 100 level and the RSI at around 46, skewing the risk to the downside.

Support levels: 105.90 105.50 105.10

Resistance levels: 106.35 106.70 107.05

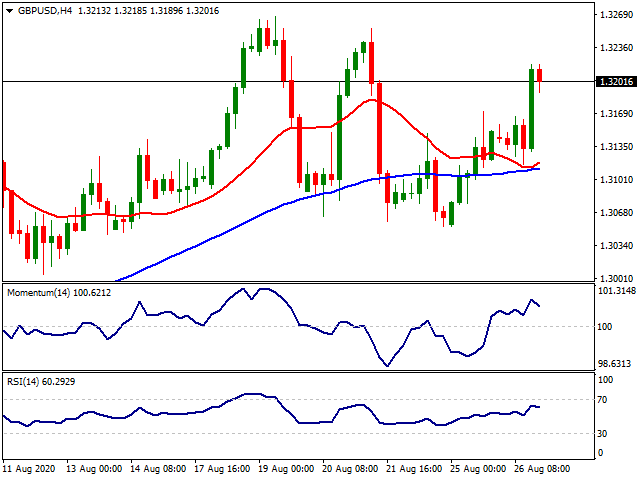

GBPUSD

The GBP/USD is up for a second consecutive day, trading around the 1.3200 level by the end of the US session. The pair surged from a daily low at 1.3116, reached after the release of encouraging US data, which anyway was not enough to support the dollar. The advance seems linked to investor’s cautious approach to the greenback ahead of Fed’s Powell speech on Thursday rather to resurgent demand for the sterling.

Meanwhile, EU´s chief negotiator set a final date for a UK-EU trade deal. "If we are to ensure the ratification of a new treaty in a secure way before the end of the year, we need to have an agreement by around October 31,” Barnier said. The news did not have an impact on the UK currency, yet for sure, is a negative factor that sooner or later will drag in. The UK’s macroeconomic calendar will remain empty on Thursday.

The GBP/USD pair is near the upper end of its latest range, yet still inside its monthly range. In the 4-hour chart, the pair has managed to advance above its moving averages, although the 20 and 100 SMA remain directionless and converging around 1.3120. Technical indicators advanced within positive levels but already lost their upward strength, indicating decreasing buying interest at the current levels.

Support levels: 1.3170 1.3120 1.3085

Resistance levels: 1.3250 1.3290 1.3330

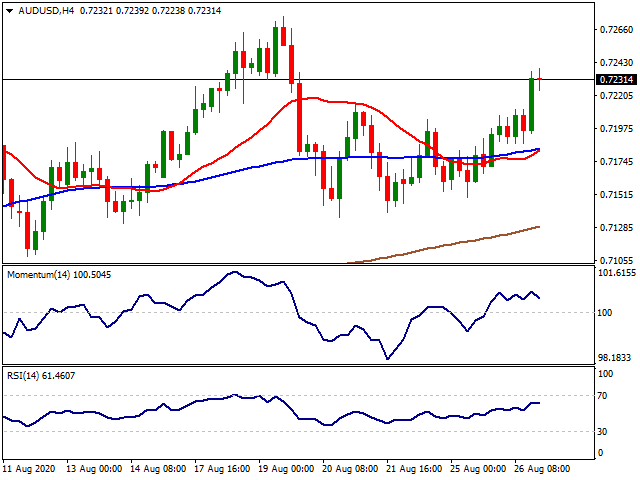

AUDUSD

Commodity-linked currencies were among the ones that benefited the most from the broad dollar’s weakness. The AUD/USD pair surged to 0.7239 and settled a handful of pips below the level. A modest advance in US equities helped to keep the pair afloat, as well as Australian data released at the beginning of the day. According to the official report, Construction Work Done resulted at -0.7% in Q2, beating expectations of -5.8%, and improving from -1% in Q1. During the upcoming Asian session, the country will publish Q2 Private Capital Expenditure.

The AUD/USD pair has an increased bullish potential, mainly considering that it´s trading near its yearly highs. Technical readings, however, fell short of confirming a bullish continuation. In the 4-hour chart, the pair has settled above all of its moving averages, with the 20 and 100 SMA still converging and without directional strength. Technical indicators hold within positive levels but turned lower ahead of the US close. Still, the pair has room to test its yearly high and even break above it during the upcoming sessions.

Support levels: 0.7195 0.7160 0.7120

Resistance levels: 0.7240 0.7275 0.7310

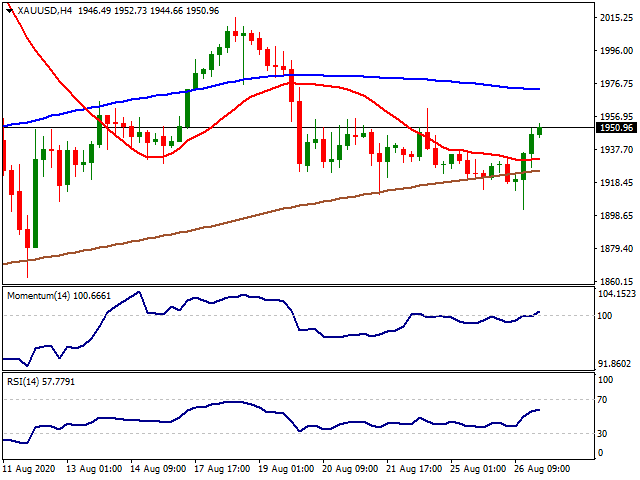

GOLD

Gold had a sharp reversal on Wednesday ahead of Jackson Hole symposium printing 50$ range intraday. The sudden move came in line with the USD index DXY slid a tick below 93.00 level while the US Durable Goods Orders report came better than expected. On the other hand, despite the move up in Gold, the US 10-year yield tested %0.70 intraday. All eyes will be on the keynote speech by Federal Reserve Chairman Jerome Powell at which he is expected to make a historic announcement about Fed monetary policy today.

As long as Gold stays over 1.950$, the targets upside can be followed at 1.980$ (previous all-time high), 2.000$ and 2.040$ levels. Below the 1.950$ the supports can be followed at 1.920$, 1.900$ and 1.825$ (2011 August close) levels.

Support Levels: 1.920$ 1.900$ 1.825$

Resistance Levels: 1.980$ 2.000$ 2.040$

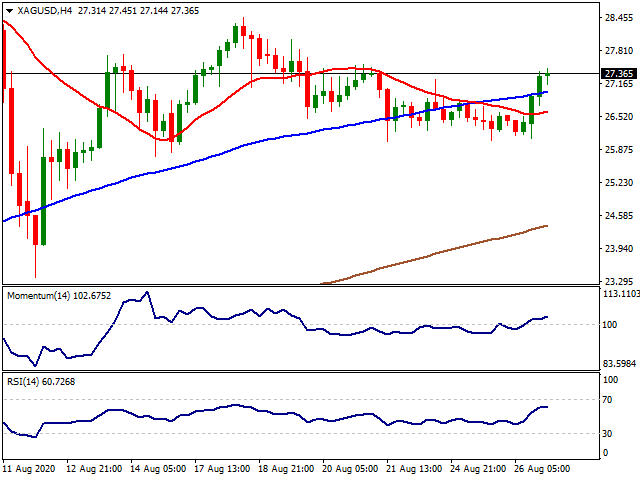

SILVER

Silver joined the rally of Gold on Wednesday surpassing 27.00$ level outperforming the yellow metal. The USD index DXY tried to move over 93.40 level during the day but slid below 93.00 level. Gold to Silver ratio retraced sharply to through 71.00 level indicating that Silver has more momentum upside than Gold. Today all the eyes will be at the Jackson Hole Symposium. In case of a dovish than expected statement from Powell, the USD will likely stay under more pressure and precious metals might extend their rallies.

If Silver manages to stay over 27.00$, next targets upside might be followed at 29.28$ (March 2013 resistance), 30.00$ and 32.00$ levels. Below the 27.00$ level, the supports might be followed at 25.00$ and 24.00$ levels.

Support Levels: 27.00$ 25.00$ 24.00$

Resistance Levels: 29.28$ 30.00$ 32.00$

CRUDE WTI

WTI is keeping its slow but steady move-up as Hurricane Laura turns into a category 3 hurricane. Hurricane Laura has maximum sustained winds of 115 miles (185km) per hour and currently located about 290 miles (465km) southeast of Galveston, Texas, the US National Hurricane Center (NHC) announced, as reported by Reuters. Meanwhile, oil producers in the US have already shut most of their output in the Gulf of Mexico. While fear of a disruption in oil production is supporting the prices, the situation in the coronavirus pandemic is getting worse on a global scale limiting the oil prices’s gains.

If WTI manages to hold over 42.00$, next targets upside can be followed at 44.00$ (February 2020 low), 48.64$ (March 2020 high) and 50.00$. Below the 42.00$ level, supports can be followed at 41.00$ and 40.00$ consolidation zone.

Support Levels: 42.00$ 41.00$ 40.00$

Resistance Levels: 44.00$ 48.64$ 50.00$

DOW JONES

Dow Jones made another attempt to break the resistance at 28.400 with the support of better than expected durable goods orders figures. Durable Goods Orders in the United States expanded by 11.2%, or $23.2 billion, monthly to $230.7 billion in July following June's increase of 7.7% (revised from 7.3%), the US Census Bureau reported on Wednesday. This reading beat the market expectation of 4.3% by a wide margin. On the other hand, while S&P and Nasdaq are printing fresh all-time highs almost each trading session, Dow Jones seems a bit reluctant to join the rally led mostly by tech shares. Following yesterday’s positive news about phase one deal between the US and China, on Wednesday, US Secretary of State Mike Pompeo said in a statement, President Donald Trump holds China accountable for covering up the COVID-19 pandemic. The statement did not have any effect on the markets as traders are focused on today’s Jackson Hole symposium. A more dovish statement from Powell will likely weigh on the USD and Wall Street.

From the technical point of view, over the physiological 28.000 level, 28.400 can be followed as next resistance while below 27.770 level the supports can be seen at 27.400, 27.000 and 26.757 (24.680-27.400 %23.60) levels.

Support Levels: 27.700 27.400 27.000

Resistance Levels: 28.400 29.000 29.500

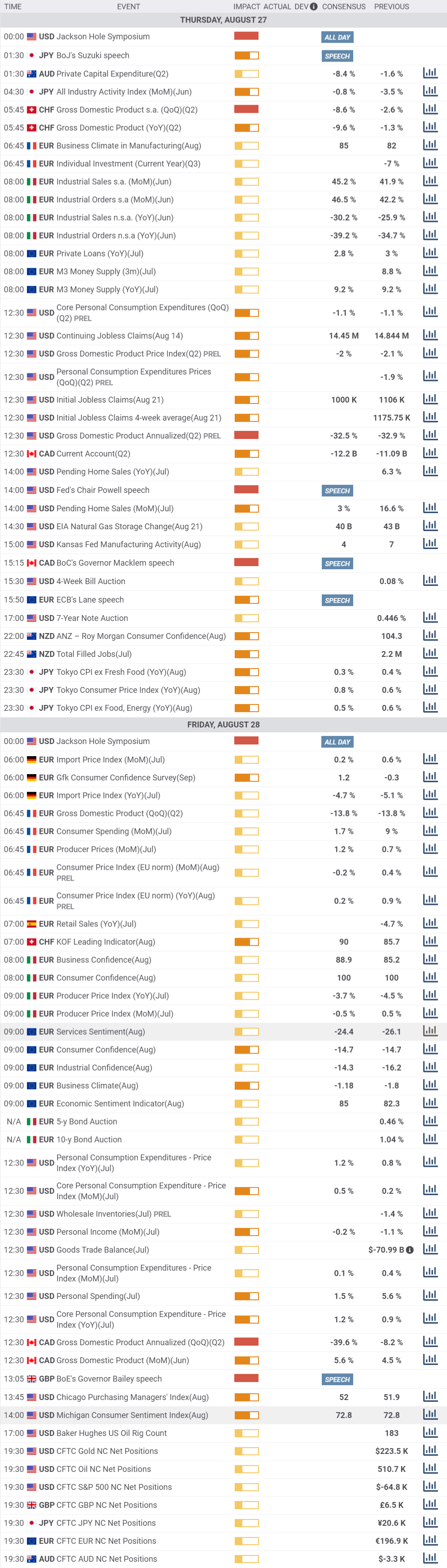

MACROECONOMIC EVENTS

* All the Moving Average support and resistance levels are dynamic by nature. Means when the price approaches the Moving averages, slight variation occurs in the forecasted Moving Average support and resistance levels. Previous few days’ intraday levels are also signicant while trading the current day as the price tend to hover around these levels for some time. Levels in red indicate strong, critical or vital.

Please remember that trading financial markets carry a high degree of risk to your capital. It is possible to lose more than your initial stake. Leveraged products may not be suitable for all investors, therefore please ensure you fully understand the risks involved and seek independent advice if necessary.

All Rights Reserved © Noor Al Mal

#黄金涨不动了吗##20%涨跌幅创业板来了##2020年美国大选##油价多空焦灼##澳美欧三大央行纪要来袭#

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.