Fed Meeting Preview: Gold, Dow, US Dollar Outlook as FOMC Looms

FED MEETING PREVIEW: GOLD PRICE, DOW JONES, US DOLLAR VOLATILITY ELEVATED AROUND FOMC ANNOUNCEMENTS

Traders are typically on high-alert whenever a FOMC decision is due. The Federal Reserve – now the biggest central bank by total assets held on its balance sheet – often sparks market volatility with periodically scheduled monetary policy updates. Evidence of above-average market activity around Fed meetings is indicated by measures of volatility, like the average-true-range (ATR), recently taken for gold, the Dow Jones, and US Dollar Index.

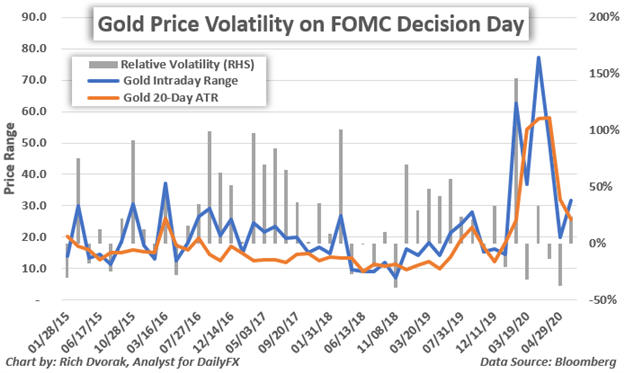

GOLD PRICE VOLATILITY ON FOMC DECISION DAY (CHART 1)

Gold price performance on FOMC decision days has a tendency to fluctuate drastically when compared average gold volatility. The intraday range notched by gold whenever a Fed announcement crosses the wires is generally greater than its respective 20-day ATR. This is highlighted by the predominantly positive ‘relative volatility’ series, which reflects the percentage that intraday volatility is above or below its average daily range over the preceding month.

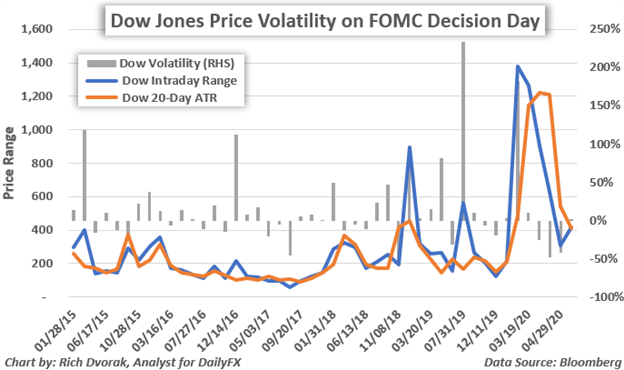

DOW JONES PRICE VOLATILITY ON FOMC DECISION DAY (CHART 2)

Likewise, stocks have historically experienced elevated market activity around Fed meetings. Intraday ranges recorded by the Dow Jones Industrial Average whenever a FOMC statement is released also suggest that, in general, the Federal Reserve can catalyze excess volatility.

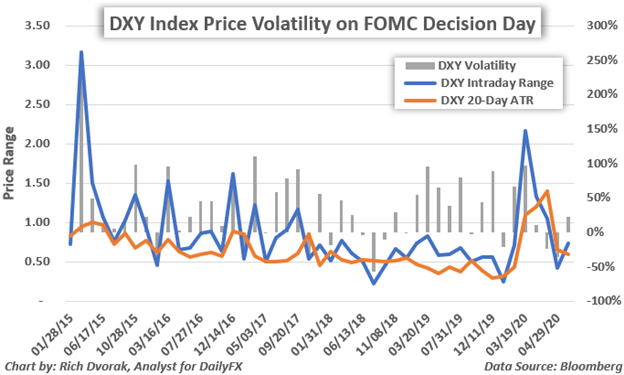

US DOLLAR INDEX PRICE VOLATILITY ON FOMC DECISION DAY (CHART 3)

USD price action in the wake of FOMC meetings also paints a narrative underscoring heightened volatility readings. This is indicated by US Dollar Index performance, which has a tendency to print larger-than-normal fluctuations around Fed interest rate decisions.

That said, prudent market participants may want to thoroughly consider adopting risk management techniques– like placing tighter stops or executing smaller position sizes – when trading gold, the Dow, and US Dollar around a Fed meeting.

Reprinted from dailyfx, the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-