GBP/JPY: Subject To Further Downside As Trade Deal Deadline Looms

The GBP/JPY currency pair, which expresses the value of the British pound sterling in terms of the Japanese yen, is a risk-on currency pair owing to the traditional safe-haven characteristics of the Japanese yen in addition to the increased volatility of the British pound sterling in recent times.

Japan is considered a safe haven due to its generally positive current account surpluses and domestic political stability, as well as the country's active investment sector which has traditionally sought higher rates of return elsewhere in the world (in light of Japan's low interest rates).

With Japan's short-term rate staying put at negative -0.10%, the collapse in global interest rates in 2020 has made international investments less attractive. Yet as risk sentiment has improved over recent weeks and months, reduced rates and heavy intervention from central banks has sent stocks higher on the back of reduced risk-free rates and a likely drop in equity risk premia (the excess return above risk-free rates that investors require to justify investing).

Therefore, while interest rate spreads have collapsed (thus decimating the appeal in the vast majority of FX carry trades), U.S. stocks remain popular internationally. As referenced in a previous article I wrote covering USD/JPY, published in June, Japanese investors have generated net inflows into U.S. equities through both March and April 2020.

The base case for GBP/JPY, a risk-on currency pair, might therefore be bullish. My last article covering this pair was however bearish; the chart below illustrates with a vertical line the publication of my previous article. The daily candlesticks depict recent price action, which shows that GBP/JPY began to fall before reverting to the upside; finally, GBP/JPY has fallen back to a similar level (with little net change from my last article).

(Chart created by the author using TradingView. The same applies to all subsequent candlestick charts presented hereafter.)

It appears that the pair has been consolidating, although this trading range is relatively wide, spanning from approximately 129 through 140 (over 1,000 pips). The updated chart below illustrates this range with the midpoint of approximately 134.50 being close to current market price.

The problem with viewing GBP/JPY as a risk-on pair is that GBP is exposed to idiosyncratic risks associated with the 2020 end-of-year deadline for a trade deal to be successfully negotiated with the European Union. A failure to negotiate this deal, and the fact that the June 2020 deadline has passed for the United Kingdom to request another extension of the transition period, means that risks remain on the horizon (and will continue for the rest of 2020).

It is true that GBP would likely rise significantly in a successful negotiation; however, it is fairly indisputable that negotiating a trade deal (an extremely complex and daunting task even without a firm deadline) amidst a pandemic, with less than half a year now to spare, is already highly ambitious. The chances of a deal being completed in, say, this next quarter (Q3 2020) is highly unlikely. Just as the value of a financial option tends to erode the closer it gets to its expiry date, I believe markets will continue to price risk into GBP in the short term.

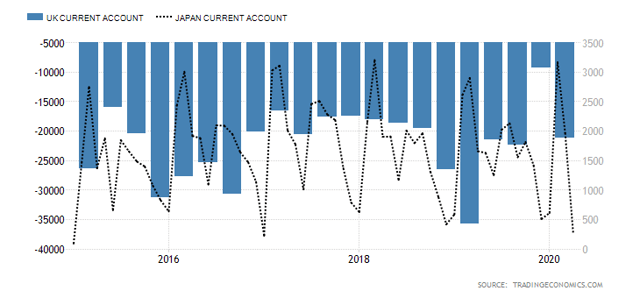

Therefore, regardless of the current risk sentiment, my personal view is remains bearish on the GBP in the near term. GBP is something like the opposite of a safe haven. While the United Kingdom might not be an emerging market, its currency is volatile due to the lack of political certainty (or confidence), and the country continues to maintain current account deficits (in contrast to Japan's generally positive current account).

The chart below illustrates the United Kingdom's quarterly current account deficits since the start of 2015; the dotted line, set against the far-right y-axis, shows the Japanese current account which has (in present times) remained in a positive position since May 2014.

(Source: Trading Economics)

The Bank of England's short-term rate of +0.10% is also only marginally distant from Japan's comparable (albeit negative) rate of -0.10%. The spread is tight enough for there to be practically no appeal in the differential from a carry-trade perspective. The implied spread of 20 basis points (the former rate minus Japan's short-term rate) has also been priced to perfection in bond markets; the chart below shows the one-year spread between U.K. gilts and Japanese bonds (the colored line, alongside our GBP/JPY chart).

As we can see, the recent run to the upside was not confirmed by the bond market, and as such GBP/JPY returned back to (the now midpoint of this range of) the 134.50 level. Going forward, I expect GBP FX crosses to trade primarily in accordance with political risk and economic uncertainty, which is heightened in the United Kingdom, and is likely to have international investors largely favoring investment platforms such as the United States instead.

More speculative international investors, counting on a potential spike in GBP on the back of the potential for positive trade-deal surprises, may continue to provide GBP with some support; this could prevent a hasty retreat to the downside. Nevertheless, I think that a gradual decline in GBP is still largely on the cards for the next quarter. GBP/JPY has potential to fall in both risk-on and risk-off regimes, and therefore not only will the pair likely serve as an attractive hedge against equity downside, but also as an attractive instrument for expressing a risk-off view in the short term (if the trader so desires).

In any case, in the short term, I think trade deal developments are likely to be limited, whereas the prospects of bond markets making any significant further re-pricings is unlikely at this juncture. A likely stable bond market, and with the clock ticking away, I believe it is probable that GBP/JPY will gravitate towards the bottom of its present trading range to retest the 129.30 level.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.